Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 28 February 2022 00:00 - - {{hitsCtrl.values.hits}}

By The Research Intelligence Unit

Progressing on previous work on tax revenue leakage and illicit markets, the Research Intelligence Unit (RIU) launched its latest report on the economics of tobacco taxation providing a macro-level overview of the tobacco industry in Sri Lanka, including the illicit market. The report is aided with preliminary results of an ongoing tobacco consumer and retailer primary survey. Understanding the nature of the overall tobacco market with special focus on the illicit segment is pivotal to comprehending the impact it has on the local economy, including particularly the erosion of revenue of the Treasury.

Progressing on previous work on tax revenue leakage and illicit markets, the Research Intelligence Unit (RIU) launched its latest report on the economics of tobacco taxation providing a macro-level overview of the tobacco industry in Sri Lanka, including the illicit market. The report is aided with preliminary results of an ongoing tobacco consumer and retailer primary survey. Understanding the nature of the overall tobacco market with special focus on the illicit segment is pivotal to comprehending the impact it has on the local economy, including particularly the erosion of revenue of the Treasury.

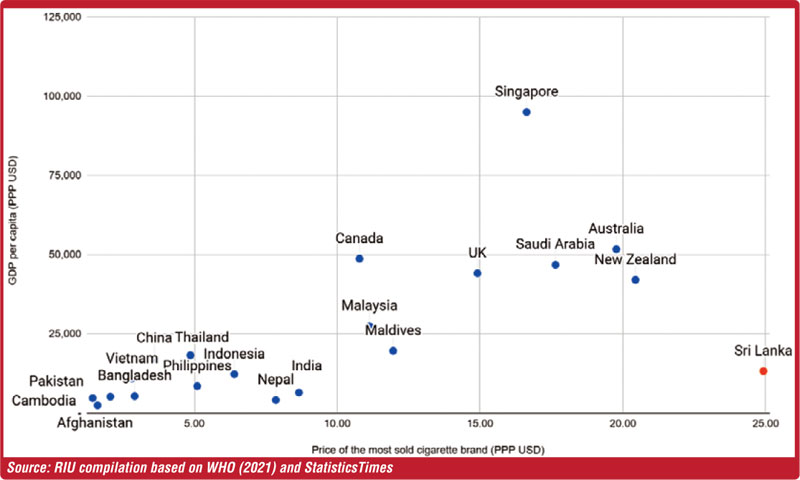

The World Health Organisation (WHO) has revealed that Sri Lanka is the most expensive country in the world to purchase cigarettes in 2020, based on Purchasing Power Parity (PPP), making the country a “high price hot spot” and a prime target for the global illicit tobacco trade.

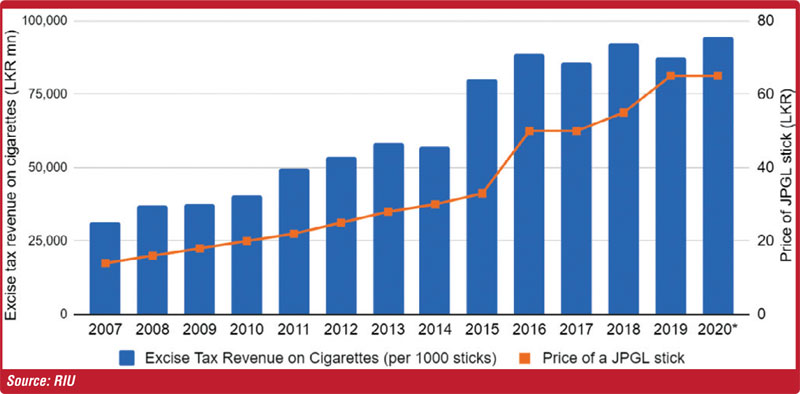

As illustrated below, the price of the most consumed cigarette brand in Sri Lanka, John Player Gold Leaf has increased gradually but considerably over the past decade.

Concurrent to the above has been the rise of illicit cigarette trade, more specifically illicit importation – cigarettes produced/bought in one, low cost, jurisdiction then illegally transported to another, high profit jurisdiction, to avoid applicable taxes. In addition to the high prices for legal cigarettes in Sri Lanka, other factors such as weak border control and the low risk-high reward nature of penalties in the illicit cigarette industry result in making Sri Lanka a smuggler’s paradise. Based on primary research findings, RIU’s latest report estimates that 21% of cigarettes consumed in Sri Lanka in 2021 were illicit.

The illicit share has gradually increased over the last decade from less than 10% in 2012 to 21% in 2021. A market share of 21% means a fiscal revenue loss of approximately Rs. 27 billion for the year 2021. If avoided, these resources could be realigned towards funding productive economic, environmental and social development activities, as well as further investments in illicit trade mitigating measures such as increasing customs and law enforcement personnel and modernising equipment for detections. To put things into perspective, the Rs. 27 billion amount could have for instance funded brand new laptops for over 300,000 students.

A common term in the illicit market is ‘bootlegging’, which is the purchase of cigarettes from low or no tax jurisdictions for resale in higher tax jurisdictions without appropriate taxes being paid. This can include direct smuggling where smugglers use illegal entry points to avoid customs inspection and directly introduce tobacco products via sea or land from neighbouring countries. These operations implement deceptive methods such as concealing cigarettes in secret compartments aboard ships, food, vehicles or vehicle parts, wood, luggage, furniture, toys, boats, tires, textiles. Smuggled cigarettes avoid various restrictions and health regulations, such as requirements for Graphic Health Warning labels (GHWs) in the local language. They can pose serious health risks for its users as quality standards are not verified.

Aside from health and economic implications, illicit cigarettes also pose risks from a criminal activity and national security perspective. Cigarettes are one of the most smuggled ‘legal’ products in the world and cigarette smuggling is considered a form of transnational organised crime. As such, this activity poses significant and increasing threats to national security and public safety. Evidence shows that many high-profile terrorist organisations such as Al-Qaeda and ISIS operate smuggling rings due to higher profit margins and the relatively lower risk.

The street value of a container of illicit cigarettes can be worth approximately Rs. 700 million. However, the maximum fine in Sri Lanka for smuggling a large container load of cigarettes is only Rs. 1 million. Consequently, smugglers make substantial profits by exploiting the system which is lenient on punishment and lucrative in terms of the market. Criminal networks are able to expand through the trafficking of illicit tobacco products, facilitating and providing funding for other criminal activities. These include money laundering, bulk cash smuggling and trafficking in humans, weapons, drugs, antiquities, diamonds and counterfeit goods.

The notorious drug dealer ’Makandure Madush’ publicly admitted to using cigarette smuggling from Dubai as the profitable gateway to smuggling drugs, a clear indication that illicit cigarette smuggling lays the foundation for other undesirable criminal activities in the country. In his last press interview, he stated, “Riskon’s primary operation was smuggling illicit cigarettes from Dubai to Sri Lanka. We loaded containers full of cigarettes to Sri Lanka. It was only later that we got involved in the heroin trade” (Sinhala Sunday Island, November 2020).

Listed below are some recent examples of noteworthy, smuggled cigarette seizures in Sri Lanka.

•A container containing 150,000 smuggled Chinese cigarettes, worth Rs. 9 million was seized in March 2021. These cigarettes were hidden in iron pipes.

•In May 2021, over 200 million cigarette sticks were attempted to be illegally imported into the country from the Jebel Ali Port in Dubai. This stock was fortunately seized by Sri Lanka Customs thereby protecting the country from a fiscal revenue loss of ~Rs. 9 billion.

•The Police Narcotic Bureau arrested three persons and recovered 212,000 sticks of smuggled cigarettes worth over Rs. 10 million in May 2021.

•In June 2021, Sri Lanka Customs found a shipment of 276,000 cigarettes worth over Rs. 24.8 million. These illegally imported Chinese-made cigarettes were hidden in small chair-like boxes.

According to RIU’s primary research, a substantial number of illicit cigarettes is found to be sold through family/friends/work colleagues, street sellers and known re-sellers. Illicit cigarette smokers have also reported illicit cigarette purchases through hotels, restaurants, and cafes (HoReCa). Alarmingly, illicit cigarettes are also reported to have been purchased through small retail shops/supermarkets/grocery stores. Illicit traders have pivoted to the online arena during the pandemic. As a result, online dealings through well-known platforms have seen a spike in sales and distribution.

Therefore, it is imperative that the Government adopts a more comprehensive, but pragmatic tobacco policy to achieve national health objectives, maximise revenue and curb the growth of the illicit tobacco market. The RIU report highlights policies that the Sri Lankan Government can take on board to address the growing illicit tobacco market more directly.

The RIU has continuously been an organisation that has addressed issues of national interest, advocating the pursuance of prudent and pragmatic policies that avoid spurring the growth of illicit markets. In addition to tobacco, Sri Lanka is affected by illicit markets that exist in other sectors such as agriculture, alcohol and pharmaceutical products, which all result in fiscal revenue leakage for the country. In a 2021 report, the RIU estimated the fiscal revenue loss due to illicit glyphosate was estimated to be Rs. 295 million for the year 2020.

For more information on RIU’s research and to access freely accessible research reports, visit www.riunit.com.