Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 13 January 2022 01:37 - - {{hitsCtrl.values.hits}}

|

|

UNP Leader Ranil Wickremesinghe

|

The Leader of the United National Party and former Prime Minister Ranil Wickremesinghe stated that the International Monetary Fund (IMF) had never intervened in the economic affairs nor development activities of Sri Lanka during the time the UNP government was in power. He made this statement on the radio broadcasting program ‘Dasa Desin 7’ aired recently.

This is in fact a reality, as during the period 1977-1994 the World Bank, the Asian Development Bank and other world recognised monetary institutions actively engaged in the economic development activities of the country.

However, it must be stated that the Government needs to maintain economic activities within a certain framework, and must not seek to falsify data regarding any monetary agreements entered into. Thus, it is evident that Sri Lanka’s economic and development activities were carried out within a regulated framework with proper economic and monetary parameters during the time of the UNP government. It is thereby imperative to reiterate the facts stated by Ranil Wickremesinghe, in order to create public awareness of the true situation of resorting to the IMF to seek financial assistance, during the present economic crisis.

The IMF is an international organisation that promotes global economic growth and financial stability, encourages international trade and reduces poverty. It was founded in 1944 as part of the Bretton Woods Agreement along with the World Bank, along with 44 member states. It encouraged international financial cooperation by introducing a system of convertible currencies at fixed exchange rates. The Fund currently comprises 189 member states. The IMF started promoting floating exchange rates after the Bretton Woods system collapsed in the 1970’s and this system continues to date.

Among the main functions of the IMF are monitoring, capacity building and lending.

IMF loan facilities for low-income countries

IMF loan facilities for low-income countries

1. Extended credit facility – sustained medium- to long-term engagement.

2. Standby credit facility – financing for low-income countries with actual or potential balance of payment needs.

3. Rapid credit facility – a single upfront payment for countries that are facing urgent balance of payment needs.

The RCF carries a zero-interest rate from 2015, both ECF and SCF carry zero percent interest from June 2021 and a grace period of 5½ and 4 years respectively and final maturity period is 10 and 8 years respectively. The grace and maturity period of RCF is 5½ and 10 years respectively.

In addition, the Fund also provides relief to poor countries affected by the worst catastrophic natural disasters and also those battling public health crises, under the Catastrophe Containment and Relief Trust under which Guinea, Liberia and Sierra Leone received $ 100 million each in February-March 2015 to battle Ebola.

Sri Lanka and the IMF

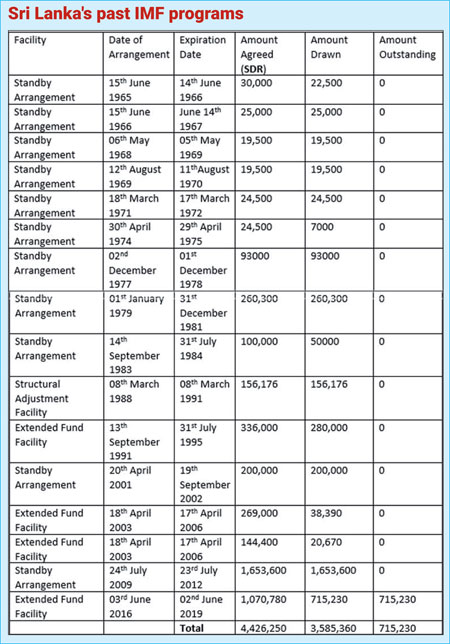

Sri Lanka obtained membership of the IMF on 29 August 1950 and has a quota of 578.8 million (SDR) and the amount of outstanding purchases and loans as of September 2021 is 922.26 million (SDR). Sri Lanka has had 16 arrangements for funding since obtaining membership.

Awareness of the same:

Before seeking the help of the IMF, the member state and the IMF must agree upon a programme of economic policies. The commitments by the member state to implement certain economic policies is an integral part of the system, and is known as ‘policy conditionality’.

This policy program is thereafter, presented to the Fund’s Executive Board by a Letter of Intent and further detailed in a Memorandum of Understanding.

Conditions imposed by the IMF on Sri Lanka in recent times

There happens to be an attempt to propagate misconceptions regarding the conditions imposed by the IMF on Sri Lanka, and it is therefore important to gain a clear understanding of the same.

The 2016 government under Prime Minister Ranil Wickremesinghe obtained an Extended Fund Facility of $ 1.5 billion for the period of 36 months, starting in June 2016. Upon granting the said facility the IMF imposed four grounds on which the government needed to abide by. These are as follows:

1. Covering up the country’s fiscal deficit by structurally building up the existing foreign reserves.

2. Reducing the dwindling of foreign reserves owned by the Central Bank.

3. Reducing the fiscal deficit in comparison to Sri Lanka’s GDP.

4. Effective management of State Owned Enterprises (SOE) through efficient management of public funds.

It is evident that all four of the above recommendations need to be implemented for the public benefit. I would like to emphatically state that it is a common characteristic of scheming politicians to create phantoms in the minds of the public, in order to achieve their petty means.

Sri Lanka agreed to the following six principles in order to obtain the said loan in 2016:

1. Advancing fiscal consolidation.

2. Mobilising state revenue.

3. Introducing reforms for the management of Public Finance.

4. Introducing reforms for the management of State Owned Enterprises (SOE).

5. Controlling inflation through a flexible exchange rate.

6. Introducing reforms to the trade and investment sectors of the country.

However, the toppling of our government in 2019 resulted in Sri Lanka losing the second quarter of the said loan payment, which was a massive loss in foreign exchange for the country. It is thus imperative that the public are made aware of this reality.

At present, the IMF provides financial assistance and debt service relief to member states which are experiencing economic crisis due to the pandemic. Overall, the IMF is making about $250 billion a quarter of its $ 1 trillion lending capacity. In total, the IMF is rendering financial assistance to 87 countries amounting to $ 167,729.14 million.

In the Asia Pacific region, countries such as Afghanistan, Bangladesh, Nepal and Myanmar are currently receiving monetary assistance under the Rapid Credit Facility and the Rapid Financing Instrument.

Further the IMF has requested China and other developed countries to suspend the collection of debt owed by poor countries during this period, which has been met with approval at the G-20 Summit. The G-7 Countries have also pledged an additional 100 billion worth of Special Drawing Rights, which is an internal currency of the IMF as funding to poverty-stricken nations in June 2021.

The most significant factor which needs to be kept in mind is that obtaining a loan from the IMF would result in developing nations building faith to invest in Sri Lanka. The reforms introduced by the IMF would help in reducing the country’s fiscal deficit, and therefore, it is unwarranted to create fear in the minds of the public on seeking IMF assistance.

It is light of the above circumstances that the Leader of the United National Party, Ranil Wickremesinghe has been reiterating the fact that it is the incumbent government’s responsibility to seek the assistance of the IMF, for over a year to date. It is the safest route which will prevent the country from going to the ruins.

It is onus on the public to decide the proper fate of those who spread falsities regarding the IMF; as such factions are prejudiced against the creation of proper financial and economic reforms, which will stabilise the country and rule out the possibility of corruption and unjust enrichment.

|

It is evident that upon reviewing the instances where Sri Lanka has sought the assistance of the IMF, the public have been free of scarcity and the need to stand in long queues in order to obtain basic essentials. Political parties who are against the requesting of such assistance from world renowned sources such as the IMF, have wrecked the economy, creating increased financial stress and further burdening the public with surplus debt.

Most people question the role of the United National Party in stabilising the economy. It is the UNP which introduced discipline to both the economy and fiscal expenditure. This may have caused added stress to certain parties who were seeking to meet their own ends through deceitful means. However, it is only the United National Party which has always endeavoured to safeguard the interests of the public. This is apparent when one studies the 2001-2004 era during which Prime Minister Ranil Wickremesinghe’s timely measures enabled the public to be debt free.

Ranil Wickremesinghe proved the fact that it is indeed a possible task to steer the economy in the correct direction, and manage the increased pressure on the economy, when the UNP took over the country’s reigns on 8 January 2015. I thereby request the public to make use of the knowledge of such a visionary leader during the New Year of 2022.

UNP Chairman Wajira Abeywardana shows off a cut pumpkin at yesterday’s media briefing to drive home the soaring cost of living in the country