Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 2 July 2018 00:00 - - {{hitsCtrl.values.hits}}

Ministry of Finance and Planning Secretary to the Treasury Dr. R.H.S Samaratunga

The attention of the General Treasury has been drawn to an article published recently under the title The Government’s “Growth Scam” written by Mr. Ajith Nivard Cabraal, the former Governor of the Central Bank of Sri Lanka, where he has tried to present a different and manipulated viewpoint on the Central Government’s financial statement.

The said article published on 26 June 2018 in some English newspapers claimed that there was some discrepancy in published statistics on Gross Domestic Product (GDP) and the Government’s Debt to GDP ratio. While leaving for the relevant institution to clarify matters relating to the compilation of GDP statistics, the General Treasury would like to place the following on record on the outstanding Debt to GDP ratio of the Government.

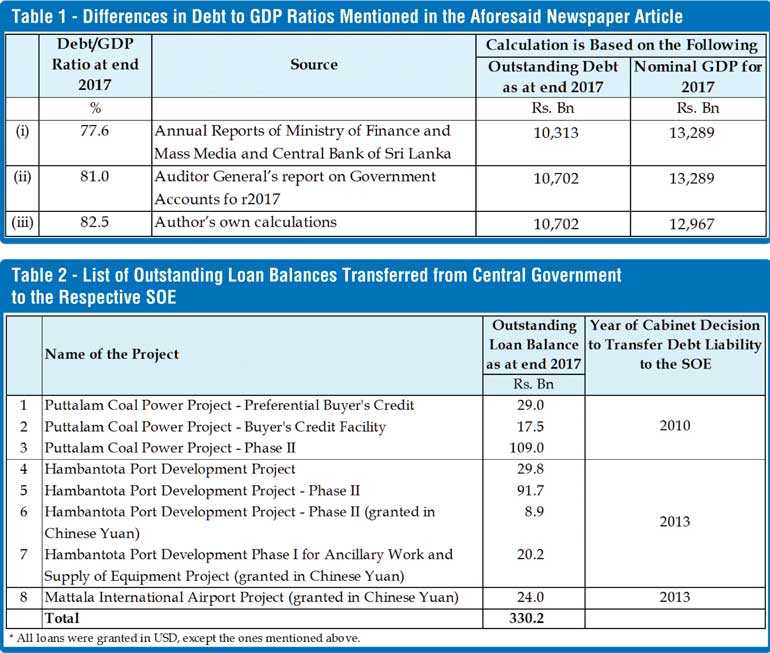

The writer in his article had mentioned three Debt to GDP ratios to be applicable as at the end of 2017, while arriving subjectively at his own GDP value as Rs. 12,967 billion whereas the official figure is Rs. 13,289 billion.

As shown in the table above, the officially published ratio of Debt to GDP in 2017 is 77.6%. Mr. Ajith Nivard Cabraal, for reasons best known to him, has endeavoured to manipulate this official figure of the debt to GDP ratio as 82.5%.

As per the decisions taken by the then Cabinet of Ministers during the period from 2010-2013, the loans obtained by certain State-Owned-Enterprises (SOEs) were not included in the government’s financial statements.

Accordingly, the previous government had transferred the loan balances of the Puttalam Coal Power Project, Hambantota Port Project and Mattala Airport respectively to the Ceylon Electricity Board, Sri Lanka Port Authority and Airport and Aviation Services Authority from the central government’s financial statements on the assumption that these debts could be repaid by the respective SOEs.

It is a pity that Mr. Cabraal as the then Governor of the Central Bank who was privy to this decision is now trying to manipulate the debt to GDP ratio by citing the public policy of non-inclusion of debt, held by SOEs in the government’s balance sheet. This was a decision taken by the then government in which he was a prominent stakeholder in handling the government’s debt management.

The General Treasury has nothing to hide about the debt to GDP ratio or the large debt obligations to be met, particularly during 2019-2022. The Government is on record to make the highest debt servicing of about Rs. 2.4 trillion in 2019 of which 77% is on the maturity of loans obtained prior to 2015.

The changing of GDP estimates by the author concerned based on his own assumptions and then reporting a different Debt/GDP ratio is of no significance to the General Treasury. Because the General Treasury relies on the independent GDP compiling authority, namely the Department of Census and Statistics, when it comes to computing ratios of government statistics vis-a-vis GDP. Hence, the so-called Debt/GDP ratio of 82.5% as reported in the newspaper article is a hypothetical figure for which the General Treasury would not need to comment on.

However, the General Treasury would like to explain the difference between officially published government debt of Rs. 10,313 billion at end 2017 and the Auditor General’s calculations of Rs. 10,702 billion, which led to the increase of Debt/GDP ratio from 77.6% to 81.0% as at end 2017. It is important to note at the outset that such a difference is entirely due to classification differences of certain debt obligations as reported in the Government’s accounts and Auditor General’s report. Such classification differences are explained below.

A majority of such classification difference is due to the transfer of debt liability relating to eight loan agreements from the Central Government to the respective State-Owned-Enterprises (SOEs) by Cabinet decisions taken during 2010 and 2013.

According to the Auditor General’s report on Government Accounts for 2017, “The debt balance of Rs. 330,221 million remained as at 31 December 2017 relating to eight loan agreements entered into by the Government under the contractual agreements had not been included in these financial statements.” (Page 2 of Auditor General’s Report).(Source: http://www.treasury.gov.lk/documents/10181/12870/2017.pdf/2bce4f3d-ebde-4409-b2b5-c8a0801b3edc)

The details of those eight loan agreements referred to in the Auditor General’s Report are given in Table 2.

The remaining difference between officially published outstanding debt balance of Rs. 10,313 billion and the Auditor General’s calculations of Rs. 10,702 billion as at end 2017 is mainly due to the exclusion of Treasury bonds issued to two State-Owned-Enterprises, namely the Ceylon Petroleum Corporation (CPC) and SriLankan Airlines.

As reported in the Annual Report of Central Bank of Sri Lanka for 2017 (Statistical Appendix, Table 118), the outstanding debt balance of Rs. 10,313 billion excludes treasury bonds issued to the CPC in January 2012 to settle dues; and to SriLankan Airlines in March 2013 for capitalisation purposes, which in total amounts to an outstanding balance of Rs. 69.8 billion as at end 2017. Any remaining marginal difference if it exists, can be attributable to the net credit to government from banking sector operations.

Thus, the classification differences in government debt statistics as highlighted date back to debt management measures implemented during 2010 through 2013. This has caused confusion among the general public, hence corrective measures would be taken in due course. Nonetheless, any attempt to discredit the official statistics on government debt at present deems to call into question the debt management measures taken then, while serving no other purpose in the interest of the economy.

The current government is determined to consolidate the outstanding government debt over the medium term, supported by a credible fiscal consolidation framework. The envisaged path for primary surplus and current account surplus in fiscal operations would ensure a steady fall in the Debt/GDP ratio in the coming years.

Having recognised the Government’s fiscal consolidation plan, international organisations such as the International Monetary Fund (IMF) and World Bank project a lower Debt/GDP ratio for Sri Lanka over the medium term.

For instance, the IMF Staff Report on Sri Lanka published in June 2018 projects Sri Lanka’s Debt/GDP ratio at 66.7% by 2023 (Source: https://www.imf.org/en/Publications/CR/Issues/2018/06/19/Sri-Lanka-2018-Article-IV-Consultation-and-the-Fourth-Review-Under-the-Extended-Arrangement-45997).

Such projections would necessarily inform the international rating agencies in their review of Sri Lanka’s debt sustainability and overall economic stability over the medium term.