Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 30 July 2019 00:00 - - {{hitsCtrl.values.hits}}

By Kasun Thanthrimudalige

and Ruwani Kapuge

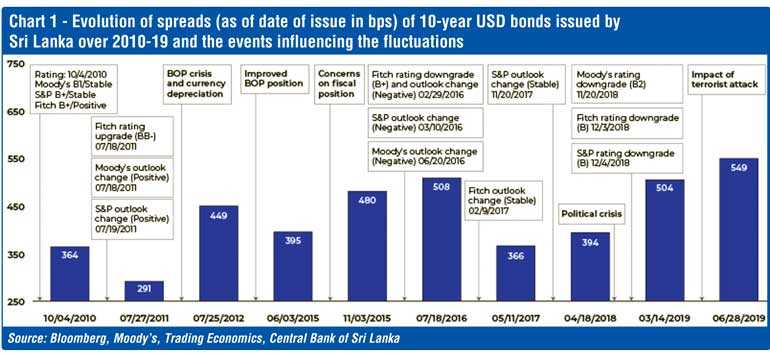

With Sri Lanka successfully completing its 14thinternational sovereign bond (ISB) issuance yesterday (3x oversubscribed), we take a look at how the country’s bond spreads (vs. US Treasury bonds of similar maturity) have evolved (Chart 1). While one may wonder about the timeliness of the latest issuance, given heightened risk consequent to the Easter Sunday bombings, the urgency is most likely to negate the impact of an anticipated reduction in tourism-related fund flows following the attack, as well as to refinance maturing foreign debt.

The inflow of $ 2 billion from the ISB issuanceboosted the country’sofficialreserve position to$ 8.9 billion at end-June (import cover of 5.1 months)relative to $ 6.7 billion at end-May (import cover of 3.9 months).

Predictably, the spread of the 28 June issuance widened slightly to 549bps (+45bps compared to the ISB issued on 14 March). However, the 7.55% yield achieved can be considered a success against the challenging backdrop. What assisted this issuance is increased appetite for emerging-market (EM) bonds from investors looking for higher yields in the context of a decreasing US Federal Reserve Board (Fed) rate forecast. The performance of this bond in the secondary market has been encouraging so far, with the yield and spreadcontracting to 7.31% and 526bps, respectively, (as of 24 July),likely due to the spill-over effects of strong investor demand seen for this ISB issuance.

Looking ahead, the country’s overall ISB spreads are likely to shrinkin the near to medium term, with most market participants expecting the Fedto cut interest rates in the USas early as July, increasing fund flows to EMs.The main risks to this view are fiscal slippage and political uncertainty as we approach the next election cycle, with the presidential election likely to be held in December, followed by the General Election in 2020.

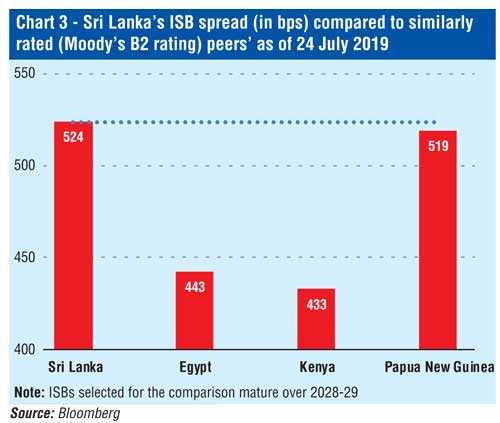

If the elections result in the forming of a strong government able to demonstrate policy stability over a period of time, the spreads are likely to narrow as investor confidence improves. Currently, Sri Lanka’s ISBs are trading at a premium to similarly rated peers’ (Chart 3), and as such, an improvement in underlying conditions could potentially be the catalyst for reducing the risk premium. Conversely, if the elections result in an uncertain political climate, spreads are likely to widen.

Sri Lanka appeared to be geared for an unparalleled positive phase of economic growth following the end of the 30-year war, reflected in the lowest spread recorded at the 27 July 2011 issuance. The lowest spread of 291bps at the issuance on 27 July 2011 reflected the most conducive investment environment in Sri Lanka, supported by positive economic momentum and investor sentiment following the end of the 30-year war.

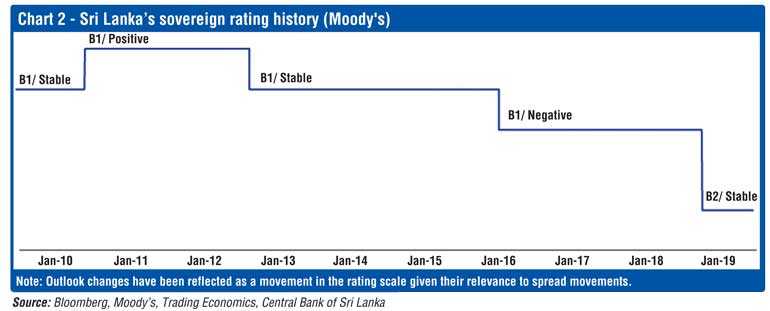

Positive rating actions followed, with the rating agencies upgrading their outlook on the country. Benign external borrowing conditions for EMs on the back of a low interest rate environment in the US also supported lower spreads. However, the momentum was short-lived, owing to sub-par fiscal performance, a rising external debt position, and lingering concerns on the country’s balance of payments (BOP), combined with monetary policy tightening in the US, driving spreads up.

Sri Lanka’srisk profile has taken a turn for the worse since 2011, evident in the rising trend in credit spreads on bond issuances, barring a few periods that saw temporary declines (June 2015, owing to reduced concerns on BOP relative to 2012, and May 2017, owing to positive rating action and favourable external funding conditions).

A number of factors influenced the rise in spreads, such as a BOP crisis and pressure on foreign-currency reserves (2012), concerns on a widening fiscal deficit (2015), increasing external debt, and unfavourable rating actions (1H 2016 and 4Q 2018). In addition, the impact of the monetary policy tightening cycle in the US (which began with the Fed’s announcement to taper the quantitative easing programme in mid-2013, followed by the start of the Fed rate hikes in December 2015) on EM fund flows has exerted upward pressure on the country’s spreads, except during 2017, when the pace of Fed rate hikes was scaled back, and in 2019, when the Fed indicated a dovish policy stance.

In 1H 2016, all three rating agencies changed their rating outlook to Negative from Stable, while Fitch downgraded the rating to B+ from BB-, mainly owing to weaker fiscal and external balances and subdued economic growth. However, S&P and Fitch reversed their rating outlook to Stable in 2017, based on improving fiscal performance, policy credibility, and a reform drive.

These positive developments were short-lived; in 4Q 2018, all three rating agencies downgraded their ratings by one notch, driven by the impact of the political crisis (a surprise replacement of the Prime Minister in October 2018 by the President) on fiscal reforms, tightening financing conditions, refinancing risk, and pressure on foreign-currency reserves. More recently, the terror attacks in April contributed toward rising country risk and spreads, despite a relatively better political environment in the country.

Nevertheless, spreads are likely to narrow in the near to medium term, benefiting primarily from increased investor appetite for high-yielding Ems.With the Fed expected to reduce interest rates to circumvent a slowdown in the US economy, we expect more fund flows to EMs as investors look for higher yields.

This is likely to drive Sri Lanka’s spreads down in the near to medium term. We, however, note the substantial risk to Sri Lanka’s credit profile due to the presidential and parliamentary elections expected in the latter part of 2019 and in 2020, respectively, which could derail ongoing fiscal consolidation efforts.Beyond the elections, a stable and strong government could go a long way in reducing the country’s credit risk premium and lowering its cost of funds.

Moody’s Analytics Knowledge Services Assistant Director Kasun Thanthrimudalige

Kasun Thanthrimudalige has close to nine years of work experience covering investment research, credit ratings, and corporate finance. Currently, he works in the Fixed Income and Credit Research team supporting a European buy-side client. He is a CFA charter holder and a CIMA (UK) associate member.

Moody’s Analytics Knowledge Services Assistant Director Ruwani Kapuge

Ruwani Kapuge has over 14 years of work experience in financial planning and investment research. Currently, she works in the Fixed Income and Credit Research team, supporting a European sell-side client. She holds a Bachelor in Business Administration (Finance) and Master in Business Administration, and is a CIMA (UK) associate member.