Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 4 October 2021 01:58 - - {{hitsCtrl.values.hits}}

|

| Dr. Nadeem Ul Haque |

|

| Dr. Indrajit Coomaraswamy

|

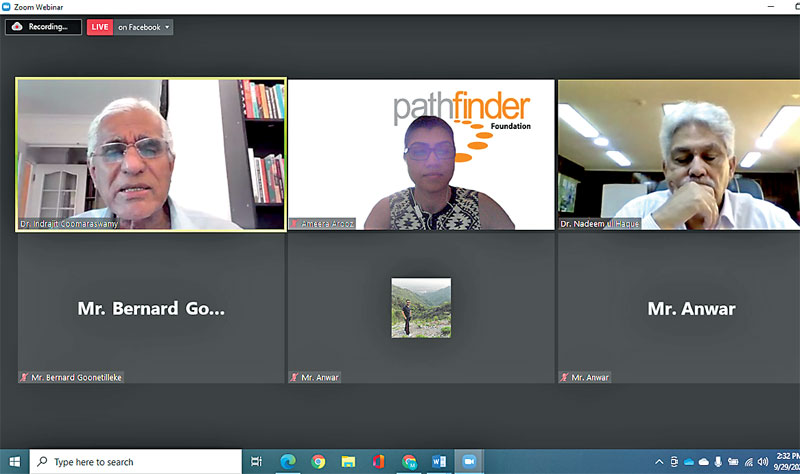

The Pathfinder Foundation and Daily FT co-hosted the ‘In Conversation’ webinar last week featuring former International Monetary Fund (IMF) Country Director Dr. Nadeem ul Haque on the question of ‘Should Sri Lanka be afraid of going to the IMF?’.

Former Central Bank Governor Dr. Indrajit Coomaraswamy, who is also a Distinguished Fellow of the Pathfinder Foundation, conducted a discussion with Dr. Haque, who served as the IMF’s Resident Representative from 2000 to 2003.

The ‘In Conversation’ webinar was structured into three segments: Dr. Haque’s take on the global economy on its challenges and prospects; his views on the Pakistani economy in order to understand similarities with that of Sri Lanka, if there are any lessons to be learnt; and thereafter a discussion with regard to the current context in Sri Lanka and what Dr. Haque believes are priorities for the country at this juncture.

Haque in his remarks focused on the state of the global economy in the context of the pandemic; the increasing role of technology and how it needs to be factored into thoughts and policy; the situation with regard to global resources with ever increasing commodity prices and governments not taking such issues into consideration; the transformation of the growth engine of the world. China and the slowing down of its economy and how it will impact countries such as Sri Lanka and Pakistan, which are heavily dependent on China’s economy was also highlighted.

One of the most significant problems according Dr. Haque was inequality, with middle-class incomes not seeing growth. He highlighted China’s knowledge policy of having invested in research with 3% of the country’s GDP as the research budget that has enabled China to compete with research domains of the US and Europe.

Sri Lanka’s relations with the IMF at this particular juncture, being the main thrust of the discussion, was addressed at the webinar as well.

Dr. Coomaraswamy, made note of the fact that Pakistan is currently in an IMF program, whereas Sri Lanka is not, and raised the questions as to whether the program has helped Pakistan, if so how; and if the IMF is a viable option for Sri Lanka.

Dr. Haque noted that there have been 23 IMF programs in Pakistan’s history and was rather critical of the country either not being able or unwilling to independently formulate its own policies. He made an important point that countries, although obtaining support of the IMF, in the long-term, have to make their own policy changes to suit the economy, and in the absence of such, stability of the economy will not be sustainable. A key question he pointed out was why countries keep going back to the IMF and why the IMF too was willing to continue its funding cycles. Dr. Coomaraswamy supported this critique and stated that there was no point in seeking IMF support, if the underlying problems are not addressed by the country as is the case with Sri Lanka and Pakistan being twin-deficit countries.

Whether Sri Lanka needs such a temporary solution due to its dollar illiquidity, excessive debt repayment obligation, and extremely low foreign reserves, was a question posed by Dr. Coomaraswamy. He pointed out that options were bilateral borrowings, increased non-debt creating flows such as FDI or by import capital and forex controls, [which is a sub-optimal situation/option] and asked whether Sri Lanka should seek IMF support, albeit a temporary palliative that has to be supported by reforms.

Dr. Haque affirmed that the situation Sri Lanka faced does require support of the IMF. Whilst restructuring existing debt, engaging in reforms such as restructuring the regulatory state, expanding the market allowing investment opportunities and allowing the economy to transform as a long-term measure are imperative steps, failing which, seeking ‘emergency’ IMF support would continue – in a cyclical manner.

Dr Haque mentioned that a country with a weak economy does not always have the luxury of making choices, and Sri Lanka, he believed, would have to turn to the IMF in the current context. In terms of conditionalities, he mentioned that the Fund program will require measures for ‘tightening the belt’ and managing reserves among others, but his advocacy on the key question would be why not undertake structural reforms such as deregulating the market and creating investment space. He stressed that protectionism with too many controls and regulations with too little focus on markets and flexibility comes at a cost.

A pressing concern is whether the Fund has evolved over the years, as there is a widely held perception in Sri Lanka that we are still in the midst of the Washington Consensus with the Reagan-Thatcher era ideology of the Bretton Woods institutions. Whether the Fund takes into account distributional issues as one of the biggest problems is increasing disparity, which has been a concern over the years.

Dr. Coomaraswamy queried as to whether the IMF now shows flexibility to accommodate the impact of the pandemic in Pakistan; if it is a more flexible Fund that has moved away from the ‘one size fits all’ approach, and if there is space to negotiate.

Dr. Haque’s response was that there is always space to negotiate and the Fund has changed, whereas what has not changed are the policies of countries seeking its support. He clarified that each country needs to have a program in-hand when negotiating with the IMF, inclusive of reasonable requests, which would in the long-term serve the interests of the country. The key problem as he saw was that governments did not wish to make fundamental changes on their own. The Fund, he said, will ensure a social safety-net, although providing subsidies instead of opportunities to people creates a negative impact on the labour force.

Therefore, restructuring a country’s own economy to suit itself, which is clean, efficient and practical, is what is needed. In this regard, it is important to be ready with a holistic and coherent program to be able to negotiate with the Fund, and plan well ahead, so that repeated support of the IMF will not be necessary. To that end, the strategy would be to be equipped with a plan to restructure and reform the economy.

Following the discussion, several questions raised by the virtual audience were responded to by the speakers. In response to a question on Pakistan’s experience of negotiating with China on the China-Pakistan Economic Corridor (CPEC), Dr. Haque stressed on the importance of being smart and well-informed, when negotiating with an investor or donor. Whether FDI or loan, it is the responsibility of the government to engage intellectual capacity to build a case, which is well-researched, practical and best suited for the country.

Dr. Nadeem ul Haque is currently the Vice Chancellor of Pakistan Institute of Development Economics and served as the Deputy Chairman of the Planning Commission of Pakistan. Dr. Haque has served in the International Monetary Fund for 24 years and has implemented Public Structure Reform in Sri Lanka.

Previous Pathfinder webinars of the ‘In Conversation’ series have featured Faris Hadad-Zervos, World Bank Country Director for Maldives, Nepal and Sri Lanka; Dr. Shanta Devarajan, Professor of the Practice of Development at Georgetown University’s Edmund A. Walsh School of Foreign Service; Ambassador Shyam Saran, former Foreign Secretary of the Government of India; Ambassador Shivshankar Menon, former Foreign Secretary and National Security Advisor to the Prime Minister of India; Professor Carole Mundell, Chief International Science Envoy, Foreign, Commonwealth and Development Office of the UK; and The Rt. Hon. The Lord Michael Nasby PC.

The recording could be viewed on the Pathfinder Foundation’s Facebook page https://www.facebook.com/Pathfinderfoundaton/videos/1188627651620920.