Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 2 October 2019 00:00 - - {{hitsCtrl.values.hits}}

By D.L.P.M. Rathnasingha and Madusha Sivanathan

1. Introduction

The stock market is an important part of any country’s economy that plays a pivotal role in the industrial growth by providing an optimum channelisation of funds between the users and suppliers of funds. The performance of any stock market is influenced by economic, non-economic and political events in the country (Ismail and Suhardjo, 2001).

Political events have been well known to be one of the main factors that affect the stock market. If the political system of a country is more stable, a business operating in that country will face less risk. Stable political situation has a low systematic investment risk, encourages growth, capital investment and improves overall economy’s performance (Betchel, 2009).

The development and stable performance of the stock market attracts investments from both domestic and foreign investors (Levine and Zervos, 1998). Undoubtedly, their influence is followed by the price changes in the stocks which are traded in the stock exchange (Volodin and Kuranov and Yakubov 2017).

Further, Bailey et al. (2005) and Frey and Waldenstrom (2004) also stated that political events have a strong effect on the returns and trading volume of the financial markets. Literatures on Stock market volatility to political events, were mainly based on the elections or civil war that took place in the country.

For example, study by Karunarathna and Wijayanayake (2015) focused on the anomalies in the CSE due to presidential and general elections whilst, Kumara, Upananda and Rajib (2014) focused on the impact of ethnic war on the dynamic properties of stock return in the CSE. Therefore, the present study would provide coverage to Presidential Election events than what is available in the existing literature.

Ismail and Suhardjo (2001) argue that mean adjusted returns model is superior to market model or market adjusted returns model in analyzing the movements of sector indices. Mean adjusted returns are actual returns minus a constant; the constant being the average return for that industry during its estimation period.

The expected return is calculated using equation 1:

where T is the number of days in the pre-determined estimation window, and t is the market index return on day t of the estimation window. Abnormal returns for each day of the event is calculated using equation 2:

where ARt is the abnormal return in the market index in day t in the event window, Rt the return of the market index on day t of the event window, and R* is the mean return of the market over the number of days within the estimation period. The standard deviation of the returns is calculated using equation 4:

The significance of the abnormal returns during the event period is calculated using equation

ASPI which is the value weighted price index of the entire share listed in the CSE is used to measure the movement of stock prices as an indicator to identify the stock market’s reaction in whole. Further, individual sector indices of BFI, BFT, CE, HT, DIV, MFG, MTR and PLT, etc., are used to measure the movement of stock prices under each sector in the CSE. Sectors are chosen based on their contribution to the market capitalisation of the CSE and depending on the availability of data.

2. Discussion on seventh Presidential Election

The seventh Presidential Election of Sri Lanka was held on 8 January 2015 which was two years ahead of schedule. The incumbent President was the United People’s Freedom Alliance’s (UPFA) candidate, who contested for a third term in office.

The United National Party (UNP) which led the Opposition Coalition chose to field the former Minister of Health and the General Secretary of the Sri Lanka Freedom Party (SLFP) as its common candidate. The Opposition Coalition candidate was declared the winner after receiving 51.28% of all votes casted compared to 47.58% of votes received by the UPFA candidate and was sworn in as the sixth executive president of Sri Lanka. Further, the UNP Leader was sworn in as Sri Lanka’s new Prime Minister.

Calculations illustrate that the market generated significant positive AR well prior to the Election Day (-2 day) and continued to generate positive AR throughout the window (-2 to +2 day) with large AR of 4.52% being generated on +1 day. Further, a similar trend in reaction is observed in BFI, HT, DIV and MFG sectors, with significant positive AR of 7.00%, 7.8%, 2.95%, and 8.17% generated on +1 day respectively while, BFT sector started generating significant positive AR after the event day with significant positive returns of 1.71% generated on +1day and +2 day and MTR sector generated 2.79% significant return on +2 day.

However, CE is only generated significant negative AR after the election with significant and large AR of -7.30% generated on +2 day. As AR generated by the market as a whole remained positive throughout the event window (-5 days to +5 days) with large positive abnormal returns generated on +1 day following the election. The positive AR indicated a growing trend from -5 day to +1 day and reached the highest positive AR of 4.93% on +1 day and thereafter showed a declining trend, while BFI sector started generating significant positive AR on days prior to the event -3 day and followed the market trend thereafter. BFT sector generated negative AR in the pre-event window (-5 day to 0 days), whereas positive AR are generated in the post window event window (+1day to +5 day). However, CE sector generated significant negative abnormal returns throughout the event window (-5 day to +5 day).

Further, AR are positive throughout the event window in MFG, DIV and PLT, whilst large significant positive AR are generated in the MFG sector with 9% AR on +3 day.

The market started generating significant positive AR on -7 day, and continued to generate significant positive AR throughout the window (-7 to +10 day) while, large abnormal returns are observed closer to the event day (-2 to +4 day) with the highest AR of 5.15% being generated on +1 day. Similar trend is observed in BFI, MFG, HT, PLT and MTR segments while MFG sector generated large positive AR of 9.56% in +1 day. In the interim, BFT sector generated insignificant negative AR in the pre-event window (-10 to 0 day), whilst significant positive AR are generated in the post event window. Further, CE sector generated significant negative AR throughout the window with larger negative AR being generated in the post event window.

2.1 Summary on seventh Presidential Election

When analysing the stock market reaction to the seventh Presidential Election using 5, 11 and 21-day windows, the results indicate that the market as a whole generated positive AR throughout the event window, with large positive AR being generated closer to the event day and highest positive AR generated in +1 day of the event.

Meanwhile, similar trend is observed in BFI, HT, DIV, MFG and PLT sector, with large positive AR are generated in MFG. Further, BFT sector generated negative abnormal returns in the pre-event window and generated positive AR in the post event window. CE is the only sector that generated negative AR throughout or on most of the days in the event window.

3. Discussion on sixth Presidential Election

The sixth Presidential Election of Sri Lanka was held on 26 January 2010. The President decided to seek a fresh mandate prior to the expiration of his term in 2011. President at that time who was elected as the President for a 6-year term in November 2005, was the candidate of the ruling UPFA.

The former Commander of the Sri Lankan Army was his main opponent in the election. He had been endorsed by a number of main Opposition parties, including the UNP and the Janatha Vimukthi Peramuna (JVP). President in office proceeded to win the re-election, over 57% of all votes casted, whilst UNP leaded common candidate received over 40%.

As per the calculations, the market started generating significant positive AR on -1 day and continued to generate positive AR generate throughout the window, with large positive AR being generated on +2 day. Similar trend was observed in MTR segment. BFT, HT and CE sector generated significant positive AR through the event window (-2 to +2 day), with large AR being generated on +2 day. CE sector generated the large positive AR of 10.01% on +2 day.

Similarly, BFI and DIV generated negative AR in the pre – event window and started generating positive AR from the event day (0 day). Although, MFG and PLT sectors generated positive AR throughout the event window, the AR are significant only in the post event window (0 to +2 day).

The market started generating significant positive AR from -1 day and continued to generate positive AR throughout the event window with large positive AR generated on +3 day. BFT sector followed somewhat similar trend to the market. Further, CE, HT, MTR and PLT generated significant positive AR throughout the event window with large AR of 24.11% generated on +3 day by PLT sector and 12.95% by the CE sector respectively. Meanwhile, BFI and DIV sectors generated negative AR in the pre – event window and started generating positive AR in the post –event window, starting from +1 day.

According to the market generated positive AR throughout the event window (-10 to +10 day) with large positive AR generated in the post event window (0 to +10 day) and the highest being generated in the +6 day. All the sectors generated significant positive AR in almost all the days in the event window. CE sector generated the large positive AR of ~10-20% throughout the event window, with very large AR of 25.63% generated in +3 day. PLT sector generated very large AR in the post – event window in the range of ~20-27% during +2 to +10 days.

3.1 Summary on sixth Presidential Election

When analysing the stock market reaction to the sixth Presidential Election using 5, 11- and 21- day window, the results indicate that the market as a whole generated positive AR throughout the event window, with large positive AR being generated in the post event window, and highest positive AR generated in +2-day, +3 day and +6 days in the of 5, 11- and 21-day event windows respectively. CE sector generated large positive AR in all three windows, whilst PLT sector generated large positive AR in the post event window. BFI and DIV generated significant negative AR in the pre-event window in both 5 day and 11-day window.

4. Discussion on fifth Presidential Election

The fifth Presidential Election of Sri Lanka was held on 17 November 2005. Prime Minister at that time emerged as the candidate of SLFP and the leader of UNP as the candidate for UNP. Both candidates tried to round up the support of minor parties. SLFP was endorsed by both JVP and Jathika Hela Urumaya, after he agreed to reject federalism and renegotiate the ceasefire with the Liberation Tigers of Tamil Eelam (LTTE). Prime Minister of the governing UPFA was elected, receiving 50.3% of all votes casted, whilst the opposition secured 48.43% of the votes.

As shown by outcomes, the market generated significant negative AR in the post event window (+1 to +2 day), with large negative AR generated in +2 day. BFI, BFT, HT, MFG and DIV followed the market trend. Meanwhile, PLT, MTR and CE started generating significant negative AR from the event day and continued to generate significant negative AR on +1 and +2 day. Further, CE sector generated large negative AR of -16.95% and MTR sector generated -16.22% on +2 day.

As indicated by calculations, the market generated negative AR in almost all the days of the event window with significant negative AR being generated in the post event window (+1 to +5 day). The large negative AR of -13% generated in +2 day while, the market generated positive AR in -1 day. BFI, HT and DIV sectors followed similar trend of the market. BFT, MFG and PLT sector generated significant negative AR throughout the event window, whilst CE sector generated large negative of AR -18.08% in +5 day.

It was found that the market generated significant negative AR in the post event window and large negative AR being generated in +2 day, whilst the market generated significant positive AR well prior to the event (-10 to -7 day). Further, BFI, BFT, HT and MFG broadly followed the market trend, whilst PLT sector generated significant negative throughout the event window (-9 to +10 day) with very large AR being generated in the post event window but MTR and DIV sector generated significant positive AR in the pre-event window (-9 to 0 day) and generated significant negative AR in the post event window (+1 to +10 day).

4.1 Summary on fifth Presidential Election

When analysing the stock market reaction to the fifth Presidential Election using 5, 11- and 21-day window, the results indicate that the market as a whole generated negative AR in the post event window. Almost all the sectors followed the similar trend to the market with significant negative AR being generated in the post event window. Large negative AR are generated on +2 day in all three windows. Further, CE sector generated large negative AR among the sectors under consideration in all three windows. Meanwhile, PLT sector generated significant negative AR in both pre and post event window in all three estimation windows.

5. Discussion on fourth Presidential Election

The fourth Presidential Election of Sri Lanka was held on 16 November 1999. Incumbent President of the governing People’s Alliance was re-elected for a second term, receiving 51% of all votes casted. The main opponent representing the UNP received 42.7% of the total casted votes.

President at that time called the election one year ahead of the schedule, with previous election being held in 1994 and the Presidential term being 6 years. UPFA candidate campaigned to continue the actions against the LTTE, while the main opponent called for the commencement of direct negotiations with the LTTE. UPFA candidate was injured in an assassination attempt at the final rally, three days before the election.

It indicates that the market generated significant positive AR before the election (-2 to 0), with very large positive AR generated in -2 day. BFI, CE, DIV and MFG sectors also generated returns similar to the market trend with large AR’s of 2.48%, 5.38%, 3.74% and 2.17% respectively. Meanwhile, BFI and BFT sector generated significant positive AR in the post event window in +1 day (-2 to +1 day). Further, PLT sector generated significant negative AR on -1day, +2 day.

The market generated significant positive AR in most of the days in the event window, with large AR generated in the pre-event window indicated. The market generated very large AR 5 days prior (-5 day) to the election and remained positive and significant till +2 day. BFI, DIV sector followed, similar to the market with very large AR of +10.71% generated in the BFI sector. Further, BFT, CE and MFG sectors generated significant positive AR returns from -5 day until +1 day. Parallelly, HT and MTR sector generated significant positive and small AR of less than 1% in almost all the days in the AR.

As indicated the market started generating significant positive AR well prior to the election starting from -10 day and continued to generate positive AR till +8 day after the election. Large AR are generated in the days prior and closer to the election (-7 to +1 day). BFI, BFT, CE, MTR and HT sectors generated similar returns to that of the market. Similarly, PLT sector generated significant positive AR in all the days of the event window, whilst MFG sector generated significant positive AR until +2 day.

5.1. Summary on fourth Presidential Election

When analysing the stock market reaction to the fourth Presidential Election using 5, 11, and 21-day windows, the results indicate that the market as a whole generated positive AR in most of the days in the event window, with very large AR generated in the pre-event window. The market started reacting positively well prior to the event and very large AR are generated closer to the event. The positive AR indicated a declining trend thereafter. Almost all the sectors generated similar returns to that of the market.

Meanwhile, PLT sector reacted negatively to the elections in the short term with significant negative AR generated in the post event window, whilst reacted positively in the longer term. Further, BFI sector generated significant large positive AR in all three windows, out of all the sectors under consideration.

6. All Presidential Elections

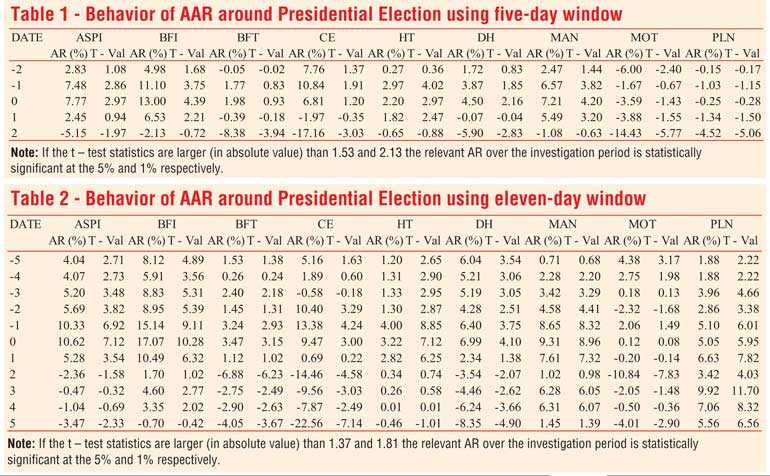

As a summary all Presidential Elections using five-day window taken are shown in the table.

When analysing the average abnormal returns of all four Presidential Elections held in the period of 1994 June 2018 in the 5-day window using Table 1, the results indicate that the market started generating significant positive AR in the pre-event window and continued until the event day (-2 to 0 day) and very large AR was generated on the event day. Further, the market generated significant negative AR in +2 day. DIV and CE sector indicated similar reaction to that of the market, whilst CE sector generated large AR on -1 day. At the same time, HT sector significant positive reaction on -1 to +1 day. BFI and MFG sector generated significant positive AR in -2 to +1 day of the window, whilst BFT and PLT generated significant negative AR only in +2 day, with no significant reactions observed in the other days.

When analysing the stock market reaction to Presidential Elections as a whole, using Table 2, in 10-day window, the results indicate that the market started generating significant positive AR well prior to the event and remained positive for a shorter time period following the event (-5 to +1 day). The market generated large positive AR closer to the event with the 10.62% AR generated on the event day itself. BFT, HT and DIV generated similar returns to that of the market. Meanwhile, BFI sector generated significant positive AR throughout the event window with the exception of -5 day, with very large AR generated in the event day, whilst MFG and PLT also generated significant positive AR throughout the window. CE sector reacted positively from -2 to 0 day, whilst very large negative AR are generated subsequent to the event in the post event window.

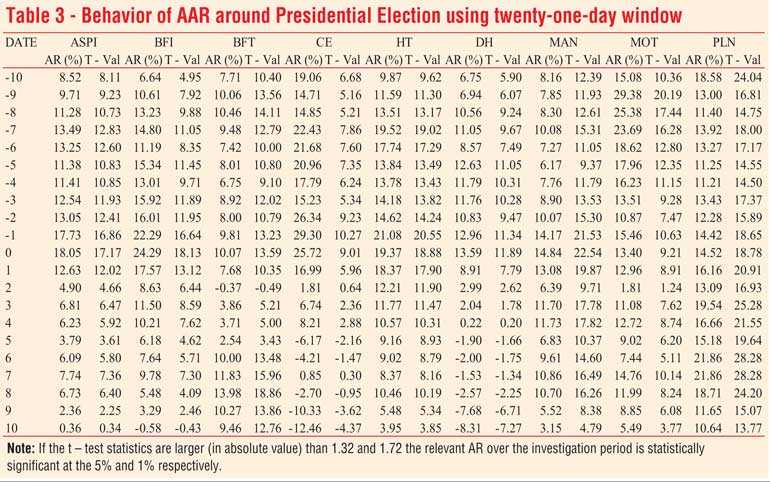

When analysing the stock market reaction to Presidential Elections as a whole, using table 3, in 21-day window, the results indicate that the market started generating significant positive AR well prior to the event starting from -10 day itself and remained positive throughout the window.

The market generated large positive AR prior and closer to the event and AR of 18.05% is generated on the event day itself. BFI sector generated similar returns to that of the market, whilst MFG, MTR, HT and PLT generated significant positive AR throughout the window and, CE and DIV sectors generated significant positive AR from -10 to +4 days of the window, the sectors generated significant negative AR from +6 to +10 days, with large negative AR being generated in the later part of the window. Further, BFT sector generated significant positive AR throughout the window, with the exception of +2 day.

6.1. Summary of all Presidential Elections

When analysing the CSE’s reaction to Presidential Elections as using three window periods, the results indicate that the market as a whole, reacted positively to the Presidential Elections before and during the elections and negatively after the election in the short term. This is evident from significant positive ARs being generated in the pre-event window and the event day and significant negative AR being generated in the post event window in both 5 day and 11 days window under consideration. Almost all the sectors followed the similar trend with the exception of MTR in both the windows and PLT in the 5-day window.

When considering the long-term reaction using the 21- day window, the market reacted positively to the Presidential Election with significant AR generated in most of the days in the window, large AR being generated prior to the event and largest AR being generated on the event day. Almost all the sectors generated similar returns with the exception of DIV, CE sector that generated significant negative AR in the post event window.

7. Conclusion

The CSE reacted positively before and after the election for three out of four Presidential Elections considered while negatively before and after the elections for the fifth Presidential Election. Investors have had negative expectations about the outcome of the fifth Presidential Election and the negative returns increased further, after the results.

In terms of the returns, larger returns are generated closer to the election, specifically after the elections. This indicates that market participants have priced their expectations about effects of political change into stock prices prior to the Presidential Election and adjusted their opinion according to the actual voting results and the political decision making after the election and inauguration took place.

This is also consistent with the work of Oehler, Walker and Wendt (2013) that stated that an increasing likelihood of a candidate’s victory and expected changes in policy should be reflected in stock prices already prior to the election. Largest reactions are observed within +1 day or +2 day in the shorter window and within +1 to +3 day for longer window period, whilst AR diminishes thereafter. Therefore, it can be concluded that CSE is very reactive in the short term for presidential elections and the market starts normalising within a short period.

In terms of the sectors, most of the sectors generated reaction to that is somewhat similar to the market for the elections with the exception of CE sector remained very reactive to two Presidential Elections with very larger negative returns towards the latter part of the window. BFI, BFT, HT, DIV, MFG, MTR and PLT sector did not react significantly before the elections and reacted only after the elections in the short term. This indicates the investors adjusted their price estimates only after the election and only the results of election had significant impact on those sectors.

(Dr. Rathnasingha is Senior Lecturer, Department of Finance, Faculty of Management and Finance University of Colombo. Madusha Sivanathan is a graduate from department of finance, Faculty of Management and Finance of University of Colombo)