Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 7 March 2018 00:00 - - {{hitsCtrl.values.hits}}

By Upali Wickramasinha

By Upali Wickramasinha

Gamini Wijesinghe F.C.A, I decided to address this letter to you because of the scare you gave us on the possibility of the average citizen of this country being made to bear the brunt of the expected “unprecedented drastic measures would be required to arrest the rapidly deteriorating situation”.

In other words you were warning the average citizen, who is subject to direct and indirect taxation, to be wary. Going by the information provided, based on the quantum of payment due on loans taken in the past, the repayment to be met in 2019, 2020 and 2021 will be Rs. 3 trillion per year. Needless to say that amount will be collected off the direct and indirect taxes to be collected from 90% of the population.

Life in the blessed island is not going to be rosy for the majority as the 10% that is not included can be traced and the whereabouts of the funds they possess can be found only with the next exposure by Panama Papers.

The situation is not bad, but it is of no use seeking the help of the legislators alone to avoid such a drastic situation. As Emil van der Poorten in an article on 1 March states: “What you are suggesting is common sense prevailing and that is not going to have any resonance with our politicians whose one and only question is – What is there for me?” re ‘Has the world been taken over by reactionary politicians?’

I have been peddling solutions enunciated in this document to all governments since 1988 and the only person who responded positively was late President Premadasa. LalithAthulathmudali and Champika Ranawaka did not reply the letters with the proposal that were sent. I do hope that the publication of this article will help to open the eyes of the public and thereby those of our politicians.

1. Sri Lanka has imported crude oil and refined products from 1998 through 2014 to the value of Rs. 3,903,013,480,000 – re the annual reports of the CPC. In 2015 the cost of imports was Rs. 100,578,000,000 and for 2016 the cost of imports was Rs. 86,969,000,000. (Information extracted from the Annual Reports of the Central Bank of Sri Lanka.)

2. This import can be easily substituted locally with ethyl alcohol and butyl alcohol. Ethyl alcohol is the drinking alcohol. Ethyl alcohol can be found in many forms. There are reports that ethyl alcohol of concentration at or slightly above 60% purity had been used as fuel. Work had been done on operating motor cycles with 60% pure alcohol. The alcohol that I am referring to is the one with 96% and 99% purity. Of these two, it is prudent to discuss only about the utilisation of the alcohol with 96% purity. 99% pure alcohol is expensive to make and to maintain at that purity. 96% pure alcohol has been used in vehicles as it is. Work was under taken in Sri Lanka in the mid 1970s by the then Distillery Manager at Hingurana K. Ganeshalingam. He was successful in the experiments conducted. He has since migrated to better climes. Brazil is reported to use 96% pure alcohol in vehicles. There were hitches, which they have overcome through the years. They call it H100 (Hydrous 100). This grade of alcohol is manufactured at Hingurana, Pelwatte and Sevenagala. The distillery at Wadduwa had the facility to manufacture 96% grade. 96% pure alcohol is also used mixed with petrol. The mixes being 10:90, 15:85, 20:80, 25:75. The lower figure represents the alcohol content in the alcohol/petrol mix. The 10:90 mix is popular in the US, South American countries, Canada, EU, India, China and even Australia. Ethyl alcohol is also mixed with diesel in compression ignition engines (diesel engines). Diesel which is a product from the distillation of crude oil can be replaced with plant-based oils – bio oils. Since the ethyl alcohol and diesel do not mix well, an emulsifier is used to marry them.

3.Brazil and the US faced many a technical problem in introducing 96% alcohol as a fuel in the aftermath of the oil crisis in 1973.Those problems were overcome and that information is available on the web. There are three faculties of engineering functioning at peak, at Moratuwa, at Peradeniya and at Labuduwa. I understand that there are two semi-developed faculties attached to the Jaffna and Eastern Universities. In addition there is a specialised unit on automobile technology near the New Kelani Bridge, and the ITI that could be collared to help to overcome any glitches. There is also the German-Ceylon Technical College.

4. Butyl alcohol is considered the best substitute for petrol. It is used as it is i.e. 100% butyl alcohol – no mixing with petrol. It is bit problematical to make because of the microbe that is required has to be identified and cultivated. If the GOSL is willing to finance research via the plethora of research organisations in the country, plethora of plant and animal science departments in our universities, the ITI, the Institute of Fundamental Studies and using the services of the GCE (AL) students and that of the undergrads, to identifying the microbe and cultivate it, there should be no problem in producing butyl alcohol. I know that the microbe is present in the country, unfortunately when I came across it, I did not realise the value of what I experienced. A student at the Post Graduate Institute of Agriculture at the Peradeniya University did identify one source of the microbe. There are problems in separating butyl alcohol from the fermenting mash. They could be overcome.

I made a mistake, it should not be. If the GOSL is willing to finance research, GOSL should finance the research. Research grants are made by all governments with a few exceptions. Identifying those exceptions is a stigma on our Government and our 2,500+ years old culture and history.

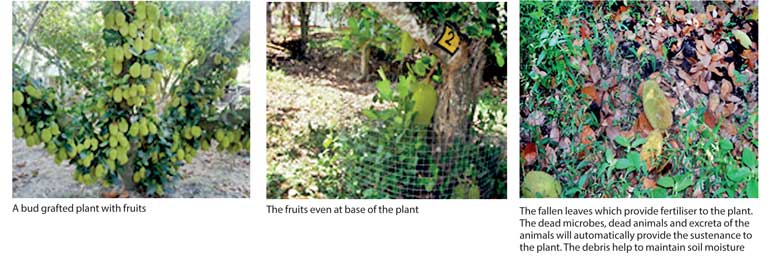

5. The next question to be solved is the source of raw material. I identify sugar cane, paddy (rice), corn (maize) and jackfruit as the sources easily available. Many of the yams, sweet potatoes, potatoes and manioc are also usable raw materials. While sugar cane paddy and maize are seasonal crops jack is not; once planted it will produce through at least 20 years. Jack has the advantage in that the capital and maintenance costs are minimal and the yield surpasses that of sugar cane, paddy and corn. What I mean is that once the plant takes off it will carry on, on its own i.e. no additional expenses are involved. Harvesting itself is not a problem as there are varieties of cultivated jack that are short (maximum height of about 20 ft) and fruits can be plucked easily. In addition jack provides a wide canopy that will prevent the dehydration of the soil and retain water for our use. Jack can be planted on deforested land, in one’s garden and also be the crop for the ‘Million Trees’ program of the National Savings Bank. Conversion of the material within fruit, called sachcharification, be it paddy, corn or jack, is not a problem as the technology is available in the country. The finer points can be easily polished up. The sachcharified raw material can be fermented into ethyl alcohol using yeast as the microbe. This technology is also known, even the home brewer cum distiller is aware of the technology. The raw material to be used without any lead times is paddy. One hectare of paddy should yield about 1,225 litres of ethyl alcohol. A hectare of jack – seed propagated – should yield about 1,400 litres of alcohol per hectare. What all this means is that the Government need not grovel at the feet of foreign governments to find employment for 1,000,000 people in Sri Lanka. Employment in the production of fuel alcohol will enhance the economy at the village and those trained in technical and humanities at the universities could find gainful and prestigious employment.

6. Today a distillery, when imported, buildings with machinery, will cost around $ 8,000,000/Sri Lankan Rs. 9,600,000,000 at Rs. 150=$ 1. This need not be so. A 2,000 gallons per day i.e. 2,000x360=720,000 gallons per year, distillery can be put up within Rs. 100,000,000, may be even less than that figure. This is based on work carried out in Sri Lanka. That type of money can be easily found by individuals, by companies, by the Government and by the provincial councils. With a project of this nature there are NGOs that can obtain the finances.

7. The consumption of fuel, which is one of the major costs at a distillery, can be brought down to less than 50% of the current costs. I would venture to a drop of about 90% of the current costs. This technology is available. The distillery at Kantale in the year 1968/69 consumed 266,400 gallons of furnace oil to produce 536,987.2 gallons of ethyl alcohol i.e. about 0.5 gallons of furnace oil to produce one gallon of alcohol. The oil consumption can be reduced by over 90% keeping 10% for sundry heating and electricity generation.

8. I project that a gallon of alcohol for use as fuel could be provided to the consumer at or around Rs. 60 per litre (the sale price at present is Rs. 250 to Rs. 350 per litre).

9. What are the short term, medium term and long term solutions proposed? As a short term measure I propose that the existing distilleries being used to manufacture food grade ethyl alcohol be converted to produce fuel alcohol. A study, with details, will help to design the changes required to upgrade the output. The cost of conversion will not be high and by adding about 5% petrol to the ethyl alcohol produced it can be made non potable – i.e. unable to drink. This is a tactic used all over the world.

10. What about the parties that purchase the produce of these distilleries for potable (drinking) and industrial purposes? How are their requirements to be met? Today ethyl alcohol from the existing distilleries cost the buyer anything between Rs. 250 to 350 per litres. Imported alcohol will cost much less. The mechanism is to get a reputed supplier – generally from South Africa – to import the alcohol at 96% purity in bulk and store it in custom bonded warehouses. This could be sold to the buyer, in the same manner as at present – i.e. with a permit from the Excise Department. This system has other advantages, less supervision, ability for the agencies of the GOSL re Customs Dept, Excise Dept and the Inland Revenue Dept, to monitor and collect the taxes due without much of a problem. This is because all transactions can be traced via the internet. This will also benefit the provincial councils that collect taxes on sales.

11. What about those that agitate against the sale of liquor? They should get their priorities right. The income from the sale of bottled liquor is a major contributor to the Government’s income. Those who agitate against the sale of liquor should part with that fraction of their income from the State, based on the fraction that comes from the sale of liquor and tobacco. Otherwise they can be identified as humbugs. Alcohol has been the carrier for all medicine from time immemorial both in the East and the West. This was so even up to mid-1950s, when the carrier for medicines in liquid form was ethyl alcohol. Some prominent examples of such medicines were Tinct Cardco (B.P.), which was a carminative, was a mix of cardamom, caraway and cinnamon oils and glycerine in ethyl alcohol and water (ethyl alcohol 96% reduced to 60% with water) which was coloured with cochineal for easy identity. This was dispensed as a solution to stomach problems. Waterbury’s Compound prescribed when one had a cough had ethyl alcohol, so did the Gripe Mixture. All these were prescribed even to small children. Ayurveda medicine, even today, uses ethyl alcohol as the carrier.

13. There is also the cost of importing coal. Coal is imported to generate electricity. Import cost of coal between the years 2007-2016 had been Rs. 116,857,000,000 (re CBSL). Some countries use fuel cells to generate electricity. Fuel cell energy – economy – is also called the hydrogen economy. In a fuel cell hydrogen reacts with oxygen from the air to generate electricity. There are cars running on fuel cells. Hydrogen is generated via the activity of specific microbes, the unicellular green algae, cyanobacteria and photosynthetic and dark fermentative bacteria. Hydrogen is also a by-product in the production of butyl alcohol. In the interest of the nation the Government should provide finances for such research. This article is published in the newspapers in order that the people of Sri Lanka will understand that everything is not lost and that they should ensure our politicians see the realities and not grovel in the presence of the Chinese, Japanese, Korean, the German, the British or the American Governments for cash. I would prefer if all comments both for and against the concepts and the abuse (there will be many) on this article is made via the newspaper – it is on the internet – so that any misapprehension could be smoothened. The idea is that this process is the only way through which we could lead a simple and peaceful life.

Dear Mr. Auditor General, this is only one way that the money required by the State could be harnessed. There are many other sources, which could be discussed, if anybody is interested.

(The writer has been involved in the ethyl alcohol distillation and blending trade since 1968 and has maintained his interest in the distillation trade though these 50 years. He formulated the recipes for over 20 bottled products in the Sri Lankan market and

formulated a dry gin and a grape brandy using ingredients available in Sri Lanka. He has had exposure to many distilleries in the world, including

some that have been operational since 1732 and some made out of wood.)