Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 30 January 2023 00:08 - - {{hitsCtrl.values.hits}}

MTI’s Thought Leadership team comprising:

Senior Consultant Darshan Singh

Director – Asia Pacific Dr. Jason Cordier

Senior Business Analyst Rivisarani Karunanyake

Project Lead Saarankan Kusalakumaran

Director – Sri Lanka Malithi Herath

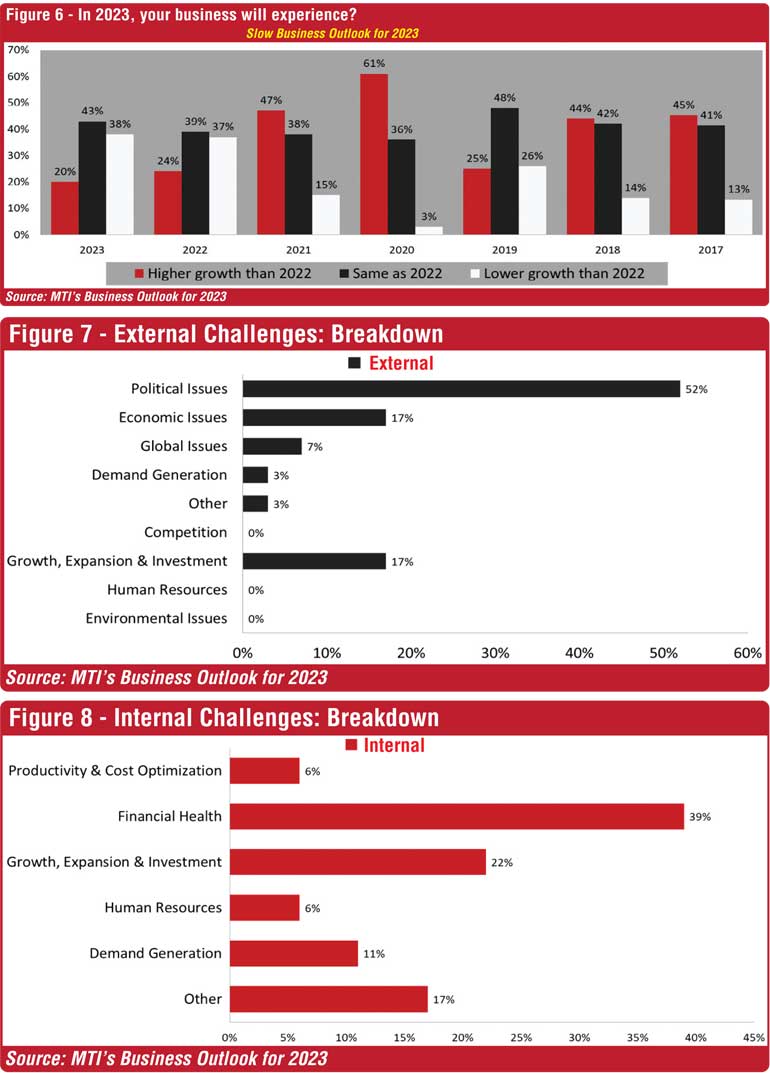

In 2022, businesses continue to perform below expectations

69% of the surveyed Chief Executives indicated that their businesses performed below expectations in 2022. This indicates an increase in this sentiment since 2021 – a change that can be due to the economic crisis Sri Lanka is still emerging from.

However, it is notable that 11% of the surveyed CEOs have seen their businesses perform above expectations – an indication that, despite the local economic crisis, some businesses have performed well.

World in 2023

IMF has predicted that the global growth will be 2.7% in 2023, while Emerging and Developing Economies are expected to remain at 3.7%, like in 2022. Advanced Economies are expecting a declining growth of 1.1% with downgrades concentrated in the US and European economies.

China is expected to have a growth rate of 4.4% in 2023. However, China is a major trading partner of the Association of Southeast Asian Nations (ASEAN) region. According to the IMF, ASEAN 5 economies’ projected growth is downgraded. One of the expectations underpinning this downgrade is slower growth in major trading partners.

As per the IMF, world trade volume (Goods and Services) is forecasted to grow by 2.5% in 2023. However, the World Bank expects it to grow by 1.6% which is well below the historical average of 4.6% for the period of 2000 to 2022. This will be triggered by the global output growth decline, supply chain constraints and the dollar’s appreciation in 2022.

According to the World Bank, oil price is projected as $ 88/bbl in 2023. This is a decline of 4.0% compared to the 2022 projections. This is subject to slower global growth and weakening oil demand, particularly in Europe in 2023. It is expected that Russian oil exports will fall due to the European Union (EU) sanctions on crude oil.

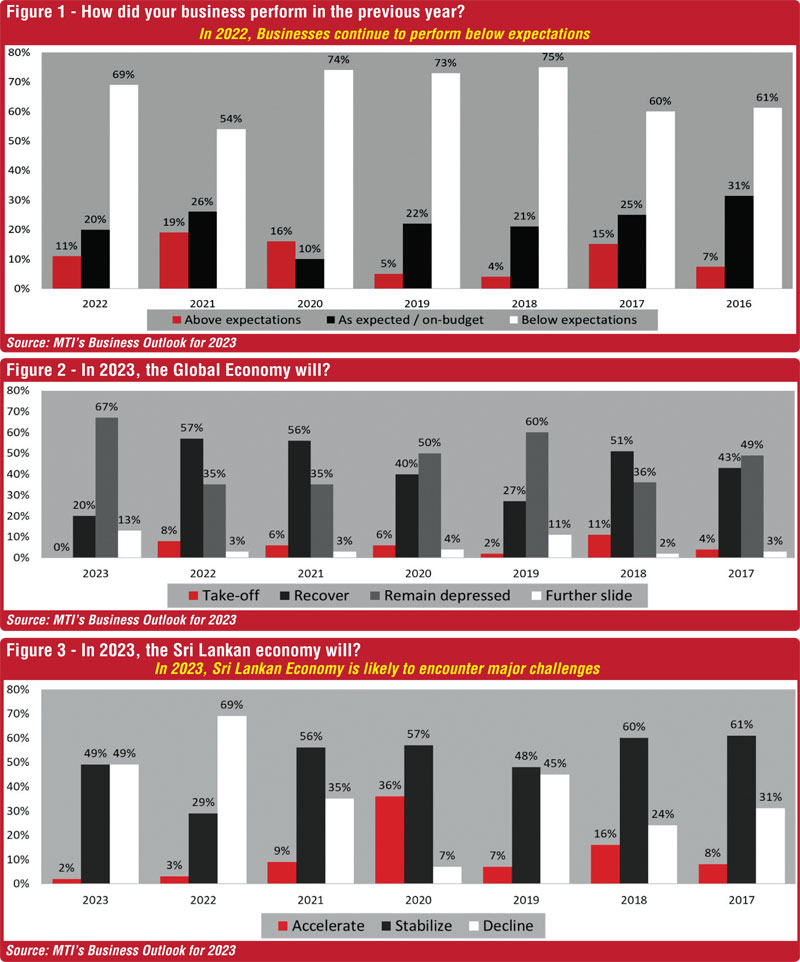

20% of the surveyed CEOs expecting the global economy to recover in 2023 while 80% of the surveyed CEOs are of the view that the global economy will continue to see a depression state or worsen in 2023, in light of the Ukraine-Russia conflict and increasing global inflation pressures.

In 2023, Sri Lankan economy is likely to encounter major challenges

49% of the CEOs surveyed were of the opinion that the local economy will decline in 2023, which is a notable drop in comparison to the 69% from last year. An equal percentage is hopeful that the economy will stabilise, which is also a significant increase compared to the 29% from the survey responses last year.

However, only 2% of the CEOs were of the opinion that the economy will accelerate, which is even lower than the responses from last year – a declining trend that has been continuing in the most recent years.

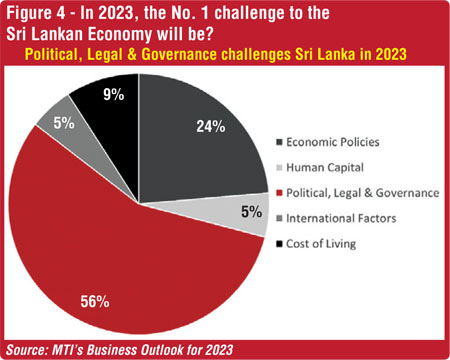

Political, legal and governance challenges Sri Lanka in 2023

56% of the surveyed CEOs have identified Political, Legal and Governance issues as the number one challenge to the Sri Lankan economy this year, followed by Economic Policies (24%). The concerns over these two challenges show that Political, Legal & Governance has become a bigger concern compared to Economic Policies, in contrast to the previous years’ survey, which leads to the assumption that CEOs have not witnessed major improvements in areas related to these issues.

Political stability is the main concern

Further analysis of Political, Legal and Governance issues reveals that notably 58% of the surveyed CEOs expressed alarms over Political Stability in the country which is slightly lower than that of last year (63%). There has been a considerable increase in concerns over Corruption and Good Governance for 2023 (17%) compared to that of last year, which was 6%.

Some of the key issues that were highlighted as part of Political Stability was worries of securing IMF support successfully and loss of confidence in the leadership and government of Sri Lanka.

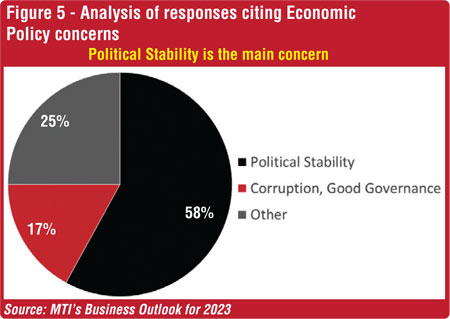

Slow business outlook for 2023

Despite the rough economic conditions, 20% of the CEOs are optimistic of higher growth than 2023. This is a slight drop in CEO confidence when compared to the 24% in the previous year.

Moreover, 43% of the CEOs anticipate that their business will achieve same level of growth this year compared to that of 2022 followed by 38% of respondents expecting lower growth than 2022.

Overall, a bleak outlook is apparent in terms of business performance with expectations of local and global economic recovery.

External challenges dominate

According to the surveyed chief executives, 53% are certain, that challenges they will face in 2023 will be factors that are external to their businesses while 47% believe they will take the form of controllable (internal) factors – unlike last year, where 85% of the surveyed CEOS believed that the challenges to the business would be external.

The key external challenge that concerns CEOs this year is Political issues (52%). Some of the main political issues that were frequently highlighted included regulatory concerns with regards to imports, policy inconsistencies, and interest rates.

17% of CEOs cited Economic issues and Growth, Expansion, and Investment as the 2nd biggest external challenge where issues surrounding inflation, exchange rate, taxation, and interest rates were stressed.

This was followed by Global Issues and Demand Generation which are believed to be the top external challenges by 7% and 3% of the respondents, respectively, with underlying themes being global economic conditions and expenditure on budgets.

Internal challenges

Internal challenges

39% of CEOs have identified Financial Health as the key internal challenge for the year, expressing concerns over maintaining the profitability during this rough economic crisis.

Ensuring Growth, Expansion and Investment was cited as the 2nd biggest internal challenge with 22% of the CEOs expressing concerns over imports and global economic outlook.

Furthermore, Demand Generation was pointed out by 11% of the CEOs respectively with a smaller percentage highlighting concerns over Human Resources and Productivity and Cost Optimisation.

Conclusion

Conclusion

With Sri Lanka still facing the lingering effects of the COVID-19 pandemic and expecting to encounter more challenges with regard to the economic crisis, the expectation for the business environment to perform below expectations is continuing – identical to previous years. Issues with the shortage of foreign exchange leading to a shortage of raw materials, increase of prices of inputs, and continuation of electricity cuts, are expected to continue. These will negatively affect production, leading to the risk of losing jobs and income.

CEOs attribute the Political Instability to be the main factor that could have an impact on their business’s performance and external challenges were perceived to be the biggest obstacle for CEOs in operating their businesses in 2023.

Further, the global economy is also expected to continue facing challenges such as the Russian invasion of Ukraine, high cost of living, increasing inflation pressures and the economic slowdown in China. Therefore, it is essential that CEOs take the initiative to work with the Government of Sri Lanka to make positive progress.

Demand for Sri Lankan exports as well as tourist arrivals in Sri Lanka are expected to be affected by the recession predicted for most countries in 2023 so measures have to be taken to value added exports and maintain the recent pickup in tourist arrivals.

Sri Lanka plans to promote Sri Lankan tourism in major cities in India in 2023. These actions as well as improving facilities for tourists and taking measures to ensure their safety during their stay in Sri Lanka will go a long way in boosting Sri Lankan tourism.