Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 12 May 2020 00:00 - - {{hitsCtrl.values.hits}}

Based on how businesses world over have responded to previous economic crisis and its own international experience (assignments in over 45 countries over 23 years), MTI Consulting has launched the latest version of ‘Trim & Fit’ – specifically to meet the post-COVID-19 challenges and opportunities.

MTI’s ‘Trim & Fit’ approach is a performance-driven consulting solution to help companies prevail (not just survive) the tough times and seize upside opportunities. It takes a ‘direct-2-bottomline’ route, thus ensuring sustainable results with the optimum level of resources. The entire process of change is lean and effective, which is further reinforced in the recommendations and outcomes.

Addressing international media on the launch of ‘Trim & Fit,’ MTI’s CEO Hilmy Cader said: “A common feature in all financial crises that the world has faced over since the Tulip Crisis in 1637 to the current COVID-19 crisis is the failure of some of the strongest companies that enjoyed meteoric rise in the good times. Research clearly shows that, how companies respond to the crisis, is what separates the ‘living’ from the ‘departed’.”

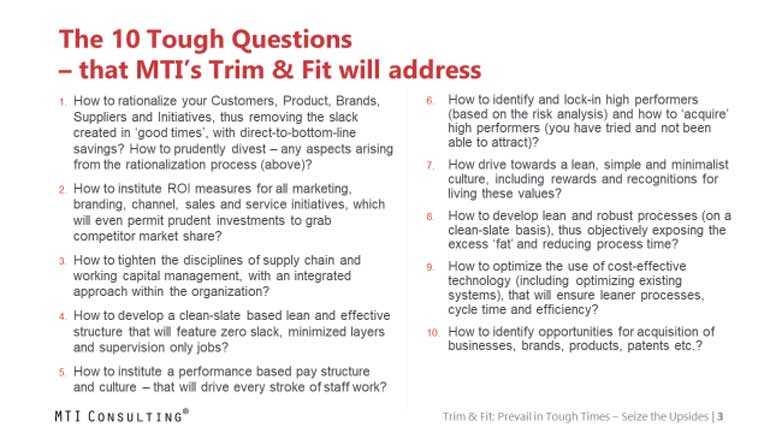

According to MTI, most organisations tend to cut costs indiscriminately, freeze all forms of developmental work and adopt a ‘wait & see’ approach. MTI calls them the ‘Chop & Cripple’ companies. By contrast, the smarter companies (MTI calls them ‘Trim & Fit’ companies), while being prudently cautious, use crisis periods as opportunities to critically evaluate every aspect of their strategy, structure, staff and systems, challenging every dollar and every stroke of work as to the value added. These companies also see the upside of acquiring low valued assets, strengthening their market position (given the lower level of competitive/marketing activity) and gear their organisations for the upturn.

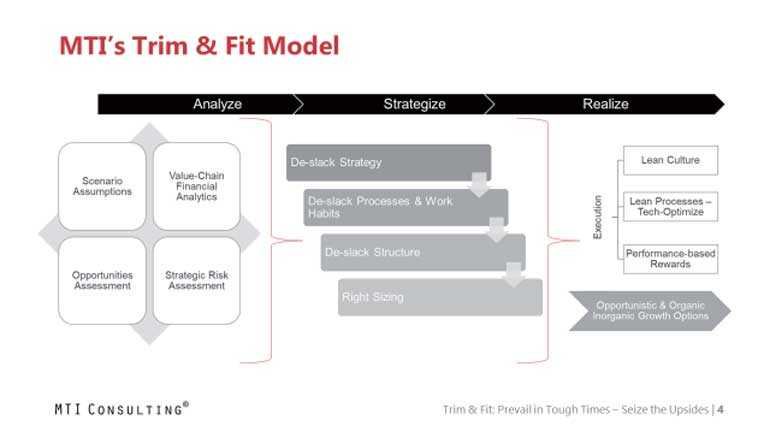

Phase 1: Analyse

The starting point of the ‘Trim & Fit’ process is to carry out a swift assessment of these four aspects – that could have a profound impact on the ‘Strategise’ process.

Scenario assumptions: Based on extrapolation and future macro possibilities, developing likely scenarios – based on which the business will respond

Value-chain financial analytics: Converting the traditional P&L to a value-chain P&L, thus exposing the real costs (and returns) of each element of the value chain and ‘unearthing’ the low-value addition functions

Opportunities assessment: Based on the adage “Never waste a crisis!” identifying the potential opportunities for the business

Strategic risk assessment: Identify and profiling the strategic risks – arising from the crisis and how this will impact the business

Phase 2: Strategise

As diagrammatically illustrated in the model, this is a sequential process of de-slacking the unproductive ‘fat’ that has been added in good time. By initially de-slacking the strategy, then the processes, work habits and structure, it helps to arrive at the optimal size of the organisation – as opposed to the knee-jerk reaction of head count reduction as a first resort in a crisis.

De-slack strategy: Via the analytics based rationalisation of business units, customers, products, brands, value proposition, channels, demand generating initiatives and the supply chain

De-slack processes and work habits: Based on the de-slacking of the strategy (above), the redundancy of some processes and work habits will become transparent and obvious. There would still be slack in the elements of strategy that have been identified as ones to continue with. By challenging the value delivered for each of these processes (and associated work habits), redundancies are identified here.

De-slack structure: Based on both the above de-slacking, the redundancies in the positions (not people at this stage), the layers, levels and latitudes in the structure will become transparent and obvious.

Right sizing: Arising from the sequential de-slacking process above, the optimal team size will be arrived. Based on this, the dual challenges of selecting the best-fit for remaining positions and dealing with the excesses – in a transparent, fair, responsible and humane manner.

Phase 3: Realise

Lean culture: The aftermath of a crisis is an opportune window to institutionalise a lean culture – in all actions of the organisation, challenging very action for the value it delivers. Not just cost, also use of resources and time – always asking the questions “Do we really need this?”, “What value will it deliver, when?” and “So what?”

Lean processes – tech-optimise: Going ‘ground zero’ and redefining the business critical processes, asking the questions above and importantly optimising technology. Thus ensuring that ‘humanware’ is not doing what ‘system ware’ can doing more cost-efficiently.

Performance-based bewards: This is also a good opportunity to introduce performance-based rewards, including attractive low-risk upside that will drive quantum performance leaps. This is also within a broader framework of cost agility and variable cost optimisation.

Opportunistic inorganic growth options: Identifying opportunities to ‘acquire’ businesses, products, brands, channels, people – making use of the low valuations in the aftermath of a crisis. Whilst, of course, divesting the excesses identified in the strategy de-slacking process.

MTI’s delivery of this consulting solution

Given the tough conditions we are in, the delivery of this ‘Trim & Fit’ approach will be based on the following principles:

An inclusive and interactive process that see key internal stakeholders being part of the analysis and solution development process, via consulting workshop and consulting clinic.

Based on strong analytics as the foundation of the solution.

Extremely lean and effective documentation, with the focus being on straction (converting strategy to action) and swiftly to implementation.

Given the above, ensuring rapid and condensed project timing.

Internal marketing and sensitivity appreciation to ensure smooth executions.

Implementation audits by to ensure it is being effectively implemented.

MTI Consulting is an internationally-networked boutique consultancy – with practices in strategy, go-to-market, operations, corporate finance, HRM and digital and analytics. In the last 23 years, MTI has carried projects in 47 countries – working with global and regional players, as could be seen from www.mtiworldwide.com.