Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 22 July 2019 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka Team taking part in the ICC Cricket World Cup 2019

As part of their Thought Leadership Initiative on Strategy, MTI Consulting has applied a strategic analytical approach to cricket in Sri Lanka and also recommended a strategic framework for a country’s cricket eco-system.

Start with candid ground reality

Yes, we would like to see Sri Lanka winning and do get excited even by the faintest hope of winning a match, natural it is. When we lose matches (which should not come as a surprise anymore!), we blame the current players and feel the guys who were dropped should be brought back. Reality is, like our politicians, there is hardly a difference between the current and dropped guys!

It is time that we get our head around some simple, logical facts:

Yes we have won an ODI World Cup (23 years ago) and been to a couple of T20 finals and won one (more recently). Occasionally, we win test matches. However, it is natural that we remember only our highs!

The best way, in my opinion, to measure the consistency of a team’s performance is to look at the ICC team rankings

We have never been ODI No. 1 team ever, neither have been No. 2. We have been No. 3 for a short period and since then it has been downhill. In test, the best we had ever got was around No. 5. In T20 we held No. 1 and then had the dubious record soon being at the bottom of the table

So, at best we have been mid-to-top performing team (for short period of history, like 96, 2007-12), inconsistent during other times, with the ability to spring surprises, which we remember very well and forget the downs.

Now the question is, why has our performance (as measured by the ICC rankings) significantly deteriorated over the last five years or so? We would like to draw an analogy to teak plantation, where growing teak takes a very long period of time, before it is ready for harvesting. Most of the saplings that we planted in our nurseries in the ’80s and ’90s, started maturing in the early 2000s (think of Sanga, Mahela, et al). While we were enjoying ‘harvesting’ them, we did not plant enough good quality saplings.

What we have now is mostly a nursery and half grown trees, with few close to harvesting (at least it seems so!) So, let the trees grow, manage your expectations. If you want a repeat of those glory days, then make sure there is a lot of focus on the management of the nursery and the grooming process.

As a nation we need more logical analysis of our performance, be it the economy or sports. We need to critique our own performance and be very candid about it. Doing that does not mean you are not patriotic to your country. In fact, if your critique is sincere and your intent is to see improvement, that really is patriotism.

Look beyond rhetoric blaming politics for all ills – on and off the pitch!

Whenever we lose in cricket and lose badly at that, we blame the politics in the cricket administration. There could be some justification in doing so, but may not be entirely. Why so? Consider the following:

Why cricket’s eco-system needs strategising

While recognising that industry (cricket in this case) appreciation and experience is essential, MTI is of the professional opinion that, given the multi-faceted nature of this industry (with the game at the core) it also requires strong strategic and managerial competencies which can benefit from non-cricketing brains as well.

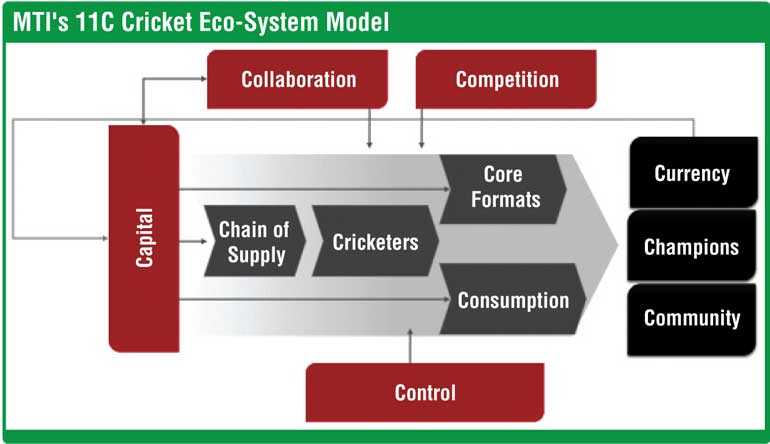

Based on a pioneering research and thought leadership assignment, MTI had developed ‘MTI’s 11 Cricket Model’, which can be an effective framework for the newly elected body to shape their direction and strategies.

The business of cricket is a multi-billion dollar industry and could be easily classified as a ‘FMCG’ (fast moving consumer good). Not only does it touch the hearts and minds of over two billion consumers worldwide, it accounts for a significant proportion of the consumers’ television and web surfing time, not discounting the enormous amount of casual consumer chat!

It is argued that this form of unscripted entertainment is capturing share from other forms of leisure and entertainment. It is now opening up new frontiers, from Afghanistan to Argentina, from Canada to China and from Namibia to Netherlands.

The innovation curve now in high growth mode, with multiple International T20 tournaments, and it is expected to capture an increased % of the consumers and the advertisers’ wallet. Many in the industry still see it as a competitive sport, consumers see it as a form of entertainment, cricketers see it a viable career, above all it is among the most competitive and dynamic industries, that rivals many conventional industries.

Given the many facets of the cricket industry (players, spectators, TV viewers, sponsors, advertisers, boards etc.), it requires a holistic business strategy framework, that can benefit from proven strategy formulation models, yet captures the very essence of cricket. MTI’s 11C Cricket Business Model has been developed as a framework (with relevant tools) to help Cricket Authorities to analyse, strategise and realise greater heights for the cricket as a business.

The strategy formulation process starts by analysing cricket’s performance (in a given country or territory) – based on the end results by which the success of the industry must be measured. In the case of cricket, this includes three equally important success criteria i.e.:

Currency

How much funds has cricket been able to attract from consumers via ticket sales, television viewing, sponsorships and endorsements and converging segments like memorabilia, coaching etc. The argument being that the more satisfied the consumers are, the more time they will spend ‘consuming’ cricket and this in turn means a greater share of their wallet towards cricket.

Champions

How has the country performed in this globally competitive industry, as measured by the team and individual performances, which influenced the ‘Currency’? There is a direct co-relation between a country’s performance at sports and the ‘currency factor’ it attracts.

Community

Unlike some conventional industries, cricket (and most sports for that matter) has a strong social aspect that is interwoven into it. Therefore, it needs to play a role in linking citizens and different cultures and promote healthy values.

Competition and collaboration

The consumer has a finite amount of time, discretionary income (and passion) that different types of leisure activities compete for. Some of these could be between Sports and some from other forms of entertainment. For instance, TV ratings and tickets sales of Bollywood movies dropped during the IPL. It could also be between different types of sports, for instance the decline of cricket in the Caribbean attributed to the intensified marketing of Baseball and Basket Ball in the Americas. Cricket as a product needs to be constantly researched and evaluated if it is providing value to consumers and if competitive activities and sports are making inroads.

Based on these findings, like in conventional industries, the product (in some cases the brand) needs to be fine-tuned, this is an on-going process. As in the case of West Indies Cricket, it may take many years to see the consumer impact on the game, however once this happens it will take as many more years to reverse the trend. So the key is on-going research and feeling the pulse of the consumer who consumes this product on a daily basis.

Given that a significant part of cricket consumed is still between countries, the ‘production’ of cricket requires the collaboration of two or more countries, hence this calls for the need to factor in all the bi-lateral and multilateral negotiations between boards at this stage of the process. Like in soccer, with the advent of the likes of IPL, the type of collaborations will change, and this needs to be monitored and factored into the strategy formulation process. There is bound to be competition within different formats of cricket – competing for the consumer’s cricket dollar.

Core formats and competition

This effectively is the way in which cricket is ‘consumed’ and equates to product development in the conventional sense. It includes everything from 6-a-Side to Tests and all forms of experimentation with the core product, from referring umpiring decisions to day-night test matches.

The findings from the competitive scan (above) and the expert opinions (effectively the R&D/Innovation lab) will be the basis on which existing products are fine-tuned and new products developed. If this is carried out on a continuous process, it will signal the challenges well in advance – well before it hits the bottom-line of cricket. For instance, the alarming low level of in-stadium spectators for test cricket could have been signalled by such timely research and analysis.

The module on consumption will focus on how cricket is ‘consumed’, beyond just in-stadium spectators and television viewing. Potentially, it can cover a diverse range of applications, from web applications to degrees in cricket management to a cricket version of an American Idol, where raw talent can emerge outside the formal school and clubs. Put it another way, ‘Slumdog Cricketers’ (no insult meant) – in the words of Steve Waugh.

Cricketers and chain of Supply

The modules on Core Formats and Consumption will help determine the demand for cricketers – based on the demand for cricket – very much like a typical manpower planning exercise in a business. Like in the movie industry, the stars (the cricketers) hold the key to ‘cricket-entertaining’ audiences, which determines the financial health of the industry.

The module on Cricketers will intensively focus on the total development and welfare of the cricketers, applying relevant human resources management principles. The appearance of your favourite and successful cricket star on ‘stage’ is the end of a long supply chain process, that starts with identifying talent as early as toddler and grooming them through the process and ensuring their welfare through to retirement.

The module on Chain of Supply will cover all the aspects that support the total development of the cricketers and will include aspects relating to coaching, education, infrastructure and even a cricket culture in the society.

Capital and control

(MTI Consulting is an internationally-networked boutique management consultancy, offering advisory services ranging from strategic planning, corporate re-structuring, process re-engineering, performance management, international market entry, feasibility studies, due diligence, corporate finance, M&A, HR, executive search/head hunting, marketing strategy, branding to market research. Since its inception in 1997, MTI has worked on over 660 assignments in 43 countries, covering a diverse range of industries, clients and business challenges.)