Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 31 January 2020 00:05 - - {{hitsCtrl.values.hits}}

The KPMG Academy conducted a seminar on deferred tax, offering both an accounting and tax perspective, at the Ramada Hotel on 22 January.

The KPMG Academy conducted a seminar on deferred tax, offering both an accounting and tax perspective, at the Ramada Hotel on 22 January.

The seminar emphasised that the Inland Revenue Act No. 24 of 2017 (IRA 2017) had introduced a new dimension which required more focus in providing for deferred tax. As the Act prescribes a different treatment for transactions and events as opposed to accounting standards, companies are required to analyse each transaction in order to arrive at a conclusion on whether a different position is to be adopted for tax purposes.

Presentations were carried out by Accounting Advisory Services Partner Shameel Nayeem and Tax and Regulatory Director Hasna Hassan followed by a panel discussion.

The seminar commenced with KPMG Sri Lanka and Maldives Managing Partner and Chairman of Middle East and South Asia KPMG Board Reyaz Mihular delivering the welcome speech. Addressing the gathering to set the background to the seminar, Suresh R.I. Perera’s introductory comments pointed out that due to the new Inland Revenue Act, many incidents trigger deferred tax when compared to the old Inland Revenue Act.

Under the old Inland Revenue Act, Section 3 did not provide express rules with regard to the timing of recognition of the revenue Act but only identified the sources of Profits and Income. Based on the case law that “wherever the Act is silent, one must follow the principles and practices adopted by commercial accountants”, in most cases, the timing of recognition of revenue under the Accounting Standards were followed when computing taxable income. Therefore, the provisions of the old Inland Revenue Act and the Accounting Standards were aligned as far as computation of the taxable income was concerned. Thus, events that triggered deferred tax were restricted to incidences such as capital allowances, accounting depreciation, gratuity provision, debtor provisions and tax holidays.

Perera pointed out that the International Monetary Fund-based (IMF) new Inland Revenue Act is more comprehensive and addresses many aspects that were not addressed under the old Inland Revenue Act. The IRA 2017, while adopting the source doctrine and classifying and listing out the sources of income as Business, Investment, Employment and other Sources with comprehensive definitions, also sets out comprehensive rules for the basis of calculation of taxable income. Thus, the Act contains rules with regard to the timing of recognition of revenue, characterisation of revenue and allocation of revenue unlike those provided for in the repealed Inland Revenue Act.

Shameel Nayeem placed emphasis on the importance of a sound understanding of Income Tax as this is an area that requires significant judgment in the financial statements, especially with respect to the recognition and measurement of deferred tax assets. Nayeem elucidated on the principles and concepts of deferred tax. He stated that deferred tax is the amount of Income Tax payable (recoverable) in future periods as a result of past transactions or events. Sri Lanka Accounting Standards (LKAS) 12 prescribes that it is inherent in the recognition of an asset or a liability that the entity expects to recover or settle the carrying amount of that asset or liability. If it is probable that recovery or settlement of that carrying amount will make future tax payments larger (smaller) than they would be if such recovery or settlement were to have no tax consequences, then the entity must recognise a deferred tax liability (or deferred tax asset as the case may be), with certain limited exceptions.

Deferred tax is recognised for the estimated future tax effects of temporary differences, carrying forward of unused tax losses and carrying forward of unused tax credits. Adjustments to deferred taxes are accounted for retrospectively only if there is an indication that they are a result of an error. The following are the steps to account for deferred tax.

1.Determine the tax base of assets/liabilities.

2.Identify temporary differences.

3.Determine if an exemption applies.

4.Measure deferred taxes.

5.Recognise deferred taxes.

6.Determine where to recognise deferred tax.

1.Determining the tax base

The tax base of an asset is the amount that will be deductible for tax purposes against any taxable economic benefits that will flow to the entity when it recovers the carrying amount of the asset.

The tax base of a liability is its carrying amount, less than any amount that will be deductible for tax purposes in future periods.

2.Identify temporary differences

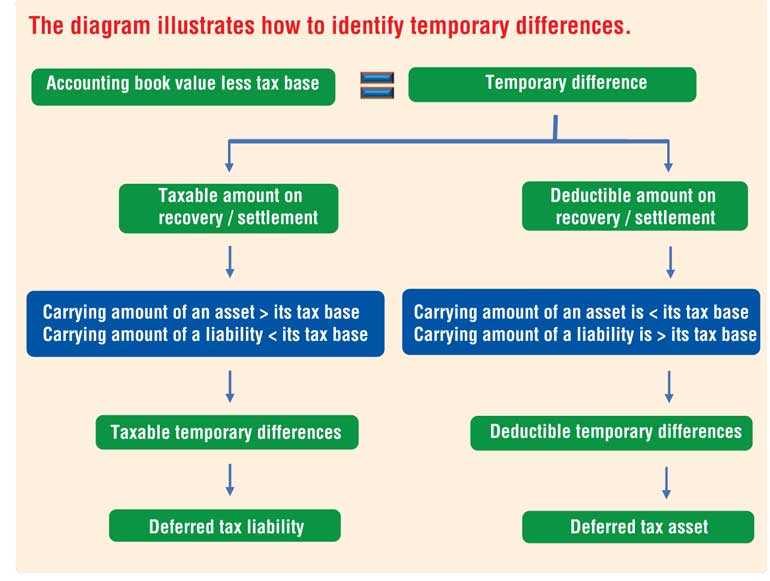

A temporary difference is the difference between the tax base of an asset or liability and the carrying amount reflected in the financial statements. Such a temporary difference will result in taxable or deductible amounts in future periods when the carrying amount is recovered or settled.

Temporary differences may be either:

3.Determine if an exemption applies

Deferred tax is not recognised for certain temporary differences that arise on the initial recognition of assets and liabilities. The initial recognition of an exemption is practical rather than conceptual in nature.

The exemption applies to:

_ Arises from the initial recognition of an asset or liability in a transaction that is not a business combination; and

_ Affects neither accounting profit nor taxable profit at the time of the transaction

4.Measurement of deferred tax

Deferred tax assets and liabilities are measured based on:

5.Recognition of deferred taxes

A deferred tax liability is recognised for all taxable temporary differences, unless the deferred tax liability arises from:

_ Is not a business combination

_ At the time of the transaction, affects neither accounting profit nor taxable profit.

A deferred tax asset is recognised for all deductible temporary differences, unused tax losses and tax credits to the extent that it is probable that future taxable profit will be available against which deductible temporary differences, unused tax losses and credits can be used. The recognition of deferred tax assets is not an ‘all-or-nothing’ test. An entity cannot choose not to recognise deferred tax assets as an accounting policy.

Under LKAS 12, the analysis for the recognition of a deferred tax asset is performed using a two-step approach.

Similar to deferred tax liabilities, no deferred tax asset is recognised if it arises from the initial recognition of an asset or liability in a transaction that:

However, specific requirements apply to taxable temporary differences related to investments in subsidiaries, branches and associates, and interests in joint arrangements.

6.Determine where to recognise deferred tax.

The general principle is that the accounting for the current and deferred tax effects of a transaction or other event is consistent with the accounting for the transaction or event itself.

Therefore, current and deferred tax is generally recognised in profit or loss, except to the extent that it arises from:

Hasna Hassan in her presentation briefed the audience on the principles of Income Tax, under the IRA 2017, which was introduced with effect from 1 April 2018. She explained the method of accounting in calculating Income Tax and expressed that it was vital to analyse the method of accounting of transactions under the IRA 2017 in order to identify the deferred tax implications stemming from the current tax law.

A reference to the “timing” of recognising the transaction in calculating the gains and profits is provided for in Section 21 of the IRA 2017. Thus, an understanding of Section 21 (1) of the IRA 2017 is important, to determine the point of recognition of transactions.

Section 21 (1) of IRA 2017 provides that “unless otherwise provided by this Act, the timing of inclusions and deductions in calculating a person’s income shall be made according to Generally Accepted Accounting Principles” (GAAP).

As per the section above, the timing of inclusions and deductions in calculating a person’s income shall be made according to generally accepted accounting principles unless a specific section referred to in the Act provides for the timing of inclusions and deductions. Therefore, one must analyse whether there are specific sections provided in the Act for the timing of inclusions and deductions in calculating a person’s income.

Nayeem and Hassan further elaborated on the individual elements of the financial statements and the corresponding provisions of the IRA 2017 Act vital to understanding the deferred tax impact of the timing of such elements. Furthermore, in order to provide more understanding and to grasp the complex tax treatments, practical case studies on revenue, other income, expenses and gains/loss on revaluation of assets and liabilities were analysed.

The IRA 2017 requires a company to calculate its business income on an accrual basis and defines the term ‘accrual basis of accounting’. Since the timing of revenue and expenses is provided for in the Act, the corresponding section related to the timing of revenue and expenses will apply in calculating the tax profits and income. Whenever the treatment of accrual basis of accounting for tax differs from the accounting recognition of revenue and expenses, there is a possibility of a deferred tax impact.

The IRA 2017 provides the company with the option of calculating its investment income either on an accrual or cash basis (the basis could be changed with the approval of the CGIR). Thus, the method of calculation of investment income by a company may lead to deferred tax implications.

The realisation of assets and liability is a new concept introduced in the IRA 2017. The gain on realisation is calculated based on the following formula:

Gain = Consideration less Cost

The gain could constitute either business income or investment income of the company, based on the type of asset. The gain should be calculated at the point of realisation. The IRA 2017 lists out realisation points, or in other words, the instance at which the gain should be calculated. According to Sri Lanka Accounting Standards, accounting for the gain or loss is computed every year for assets which are recognised at fair value. Thus the gain or loss on the revaluation of assets may require a deferred tax adjustment in the books.

Furthermore, Hassan in her presentation provided an in-depth analysis on the specific tax treatment in relation to tax losses, tax holiday, tax rate, leasing, debtors in addition to the impact of the tax policy changes introduced via public notices, etc.

The debtor provision cannot be deducted in calculating the business income. However, the IRA 2017 allows for the deduction of the write-off of bad debts for non-financial institutions. As the impairment of debtors for accounting and write-off of debtors for tax has its own method of accounting, most companies may record deferred tax on differential debt claim treatment.

The impact of deferred tax during the tax holiday period was analysed in detail with regard to the capital allowance claim and the tax losses incurred during the tax holiday period. Different practical scenarios to evaluate both tax and deferred tax impact under different captions were also covered in the presentation. This included instances where:

_ The tax holiday ceased prior to 1.4.2018

_ The tax holiday continued after 1.4.2018

The complexity of determining the applicable reduced rate for industries such as agriculture, education, tourism, information technology and exports and the ambiguity created in identifying the deferred tax for tax losses by such industries and new exemptions introduced by the Government were discussed with practical illustrations.

The presentation was followed by a lively and enlightening panel discussion. In addition to the presenters, the panel included Commercial Bank Chief Financial Officer Nandika Buddhipala and Royal Ceramics Lanka Plc Head of Finance Haresh Somashantha. The panel was moderated by KPMG Tax and Regulatory Principal Suresh R.I. Perera.

To start off the panel discussion, Perera directed a question at Somashantha on how his company and the industry as a whole identifies transactions which give rise to deferred tax where Accounting Standards are changing and both accounting and tax laws are becoming complex.

Somashantha mentioned that deferred tax was an area most organisations did not prioritise. Certain listed companies did not provide for deferred tax in their quarterly financial statements but provide for the same only in their year-end financial statements. The reason for the same is that these companies account for brought forward losses and therefore no entries have been made for deferred tax. He considers this a vital area overlooked by most of finance professionals.

Perera added that the process involved in identifying incidences triggering differed taxes is determined by the company without the aid of external experts.

Buddhipala briefed those in attendance on the difference in the recognition of deferred tax in the banking sector. He mentioned that a bank was required to evaluate its financial position quarterly and should also carry out biannual audits.

He stated that the industry faced many uncertainties such as those in relation to the revaluation of assets. For instance, the revaluation of properties by the bank every three years could result in an increase of Rs. 3-4 billion and this impact is reflected in capital assets rather that in profits.

If no such assessments were undertaken, banks would allocate Rs. 1-2 billion which will have a serious impact on the financials.

On the other hand, even if the value drop is identified, uncertainties in the regulations create difficulties. An impact assessment should be made before the Gazette for tax changes is issued. He added that globally banks carry out impact assessments or stress tests and emphasised that in Sri Lanka importance must be given to stress tests.

Nayeem, while concurring with the sentiments expressed by Buddhipala, stated that he too had observed that corporates did not pay much attention to deferred tax. He added that due to the changes stemming, there could be a requirement to maintain a separate income statement and balance sheet for tax purposes in addition to the income statement and the balance sheet prepared based on accounting principles. This will enable companies to identify the tax bases.

Furthermore, Nayeem pointed out that financials published quarterly may be different to the audited financials since the deferred tax adjustments were made only at the year-end.

Hassan pointed that though the IRA 2017 came into effect from 1 April 2018, the deferred tax adjustments were only carried out at year-end, i.e. 31 March 2019. Since companies have not carried out an impact assessment, they have realised that certain transaction have a deferred tax impact which could have been adjusted in the accounts properly.

She added that IRA 2017 is different to the old acts and that there were different criteria for the recognition of income and expenses. She pointed out that under the IRA 2017, tax computation is different and tax adjustments are not carried out according to the accounting profit before tax and there are certain occasions when even individual contracts could have an impact on the recognition of income and expenses. She mentioned that an impact assessment could have been carried out before IRA 2017 came into operation.

Perera pointed out that the Government has proposed a reduction in tax rates, for example, manufacturers will be taxed at 18%, and he requested Somashantha’s views on the impact of this rate reduction on the economy.

Somashantha welcomed the Government’s decision to reduce the tax rates for manufacturing companies. He pointed out that concessions were required for the expansion of businesses. He also mentioned that during 1995/96 Sri Lanka was in a position to produced half of India’s production but now India had the capacity to produce 100 times Sri Lanka’s production. He pointed out that countries like India had provided more concessions to their local industries. He also mentioned that the rate reduction would have an immediate triggering of deferred tax.

Buddhipala stated that the reduction of the Income Tax rate on the financial sector would have a positive impact when compounded with the measures taken by the Government to halt the recovery and repayment of loans obtained by persons in certain industries. The Government’s measure to grant concessions would strengthen the industry. If such support is not extended there could be a situation where the capital of banks is eroded.

He also stated that in addition to Income Tax rate reduction, the Government had also abolished the Debt Repayment Levy and the Nation Building Tax, which would also have a positive impact on the banking sector.

The seminar concluded with an interactive question and answer session during which the audience raised multiple questions with regard to the complexity and practical application of the deferred tax calculation. The session concluded successfully and the guest panellists were felicitated for their invaluable contribution.