Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 28 November 2017 00:00 - - {{hitsCtrl.values.hits}}

By Kanchana Wickramasinghe

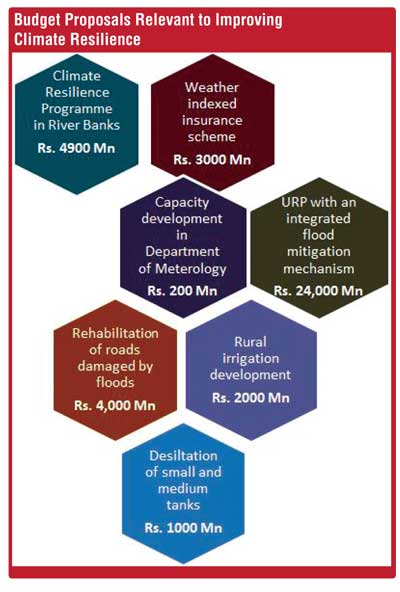

Sri Lanka’s Budget proposals for 2018 explicitly identify that changing weather patterns and the increased frequency and severity of natural disasters (droughts, floods, and landslides) had posed a substantial challenge to the country’s economic performance in 2017. The cost of such disasters is calculated to be 1% of GDP in 2017. The 2018 Budget proposals take a pioneering nature, as it pays due attention to enhancing climate resilience of the country through short, medium, and long term interventions.

The proposals mainly focus on increasing resilience in rural agricultural areas, mitigating urban floods, and bolstering the technical and human resource capacities of the Department of Meteorology. Among those, the proposal to design an index-based insurance scheme to enhance farmers’ resilience towards weather shocks is a commendable step.

Why is index-based insurance important?

A weather indexed insurance scheme is proposed in the Budget, as a partially subsidised insurance, with a premium contribution from the farmers. The crop insurance programs provided by the government in the past have been indemnity-based by nature. It requires farm level assessments of crop damages before making the pay-outs to the farmers. As such, there are many inefficiencies associated with indemnity-based insurance.

The need for an index-based insurance program, and its technical feasibility, was assessed by an IPS study, with financial and technical support from the Global Development Network (GDN). The study findings, which were presented to major stakeholders in January 2017, mainly highlighted the necessity for improved data availability of the weather index – rainfall. At present, the number of rain gauge stations in Sri Lanka are not adequate to carry out an index-based insurance program. In the case of index-based insurance, the pay-outs to the farmers are calculated based on the rainfall levels. Therefore, the accuracy and the timely availability of rainfall data is a must for processing the pay-outs in an efficient manner. This is also helps in maintaining the farmers’ trust.

One of the major obstacles to popularising insurance among vulnerable farmers is the lack of knowledge and understanding about crop insurance. Index-based insurance is a further novel concept for the majority of the farmer population in Sri Lanka – except in the case of a small number of farmers, who were targeted by the previous index-based insurance scheme, carried out by a private insurance company. Therefore, the proposed index-based insurance should certainly have a component to provide education and awareness programs to all stakeholders involved, especially to the farmers.

Experience from other countries reveal that insurance should bring in tangible benefits to farmers to ensure the viability and popularity of such insurance schemes. It is vital to consult farmers to identify specific needs that should be covered through the insurance scheme. Further, studies in other countries’ experience suggest that the insurance has to be integrated with other climate resilience programs or developmental programs. The close coordination with agencies providing rainfall data is also much important in this regard.

The Budget proposals for improving the technical and human resource capacities of the Department of Meteorology is a significant step forward when it comes to achieving climate resilience. Improved climate information is an essential requirement for improved climate resilience of any country. It will undoubtedly help the successful implementation of the proposed index-based insurance, as the availability of data is likely to be enhanced, with the capacity development of the Department of Meteorology. This will also boost the Meteorology Department’s ability to provide climate and weather forecasts with improved accuracy to all users, including the vulnerable communities. Improved climate data is also vital in other development planning activities.

The IPS’ action research study, funded by the Think Tank Initiative (TTI) of the International Development Research Centre, which aims at overcoming the information and communication gaps in providing climate information to farmers, will make a useful contribution towards the budget proposal objectives. This project aims at assessing farmers’ climate information needs and bridging the existing information communication gap with the support of the Department of Meteorology, thereby ensuring improved availability of climate information, including short-medium term weather forecasts and seasonal climate outlooks.

The index-based insurance programs in Sri Lanka will undoubtedly benefit through this initiative. The proposed Budget also has allocations to scale up the existing climate resilience program in the Kelani river basin, with the aim of mitigating urban floods, as well as extending such programs to other important river basins. In addition, under the Urban Rehabilitation Project (URP), a specific component is included for an integrated flood mitigation mechanism within the Colombo city limits and its suburbs. This is expected to extend to other important cities in the country in the future. Allocations are proposed to rehabilitate the roads, which were affected by floods and landslides.

There are several other Budget proposals which can address issues such as water scarcity in Sri Lanka. Support to develop rural irrigation, drip irrigation, and rainwater harvesting can help farmers find solutions for the increasing water scarcity in dry areas. The Budget proposals also aim at continuing the initiative to de-silt small and medium tanks in a systematic manner for rainwater harvesting.

It is commendable that climate resilience is given considerable attention in several Budget proposals. However, climate resilience can only be achieved if the proposals are strategically translated into programs and actions in a timely manner.

[Kanchana Wickramasinghe is a Research Economist at the Institute of Policy Studies of Sri Lanka (IPS). To share your comments with the author, please write to [email protected]. For more articles, visit our blog http://www.ips.lk/talkingeconomics/.]