Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 1 February 2021 00:00 - - {{hitsCtrl.values.hits}}

It is estimated that the total heroin smuggled into Sri Lanka during a year is 3.2 tons

By Ajith Perera

Sri Lanka has upped its ante to attract foreign investment. Despite the clutches of COVID-19, the incentives unveiled in the Government budget viewed in tandem with the global geo-political sphere augurs well for interest and investments into Sri Lanka.

Sri Lanka has upped its ante to attract foreign investment. Despite the clutches of COVID-19, the incentives unveiled in the Government budget viewed in tandem with the global geo-political sphere augurs well for interest and investments into Sri Lanka.

The expansion of air and sea ports around the country is paving the way for new industrial zones, as both foreign and local investors show renewed interest to take advantage of the infrastructure and relaxed management and duty structures proffered by these zones. The latest Chinese investment of $ 300 million into the Hambantota Port Industrial Zone stands ample testimony.

Investments and Free Trade Zones (FTZ) alongside Free Trade Agreements must be encouraged, as they are imperative for our development ambitions. Notwithstanding that authorities must be conscious to the challenges these pose to our socio-economic balance, and be equally decisive and earnest with any efforts to control them.

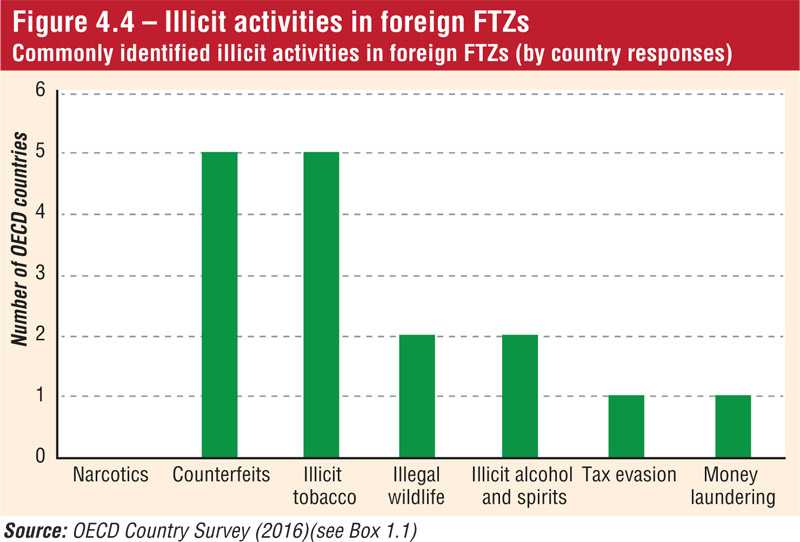

Environmental conservation is naturally one such key concern, but the focus herein falls on the issue of smuggling. FTZs are renowned hotspots for illegal activities, and a few prominent global examples include Jebel Ali in Dubai, Shanghai and Fujian in China. Over the years, smugglers have skilfully infiltrated administrative networks in FTZs and engage in numerous illegal trade destroying billions of dollars in revenue and resources.

Infiltrating authority

It is critical to note that smugglers are a well-entrenched network, and have bought their way into departments and offices to ensure safety and ease of passage. Identifying and closing the loop on such operatives is a key component of anti-smuggling operations, and perhaps a bigger role for our state intelligence services.

The International Chamber of Commerce recently pointed to an incident where 16 containers containing counterfeit products were imported to Jebel Ali, and Dubai Customs intercepted eight of these containers following complaints. Intelligence sources of brand owners discovered that smugglers in Dubai and China had become aware these containers were to be detained in Dubai for examination, revealing that a high-ranking official in Dubai had provided support and information.

Previously, UK Customs had seized pharmaceuticals in transit from a company within the Sharjah FTZ to an organisation established in the Freeport FTZ in the Bahamas. The Bahamas FTZ was raided based on intelligence and the very next day products in the Sharjah FTZ were moved to Jebel Ali FTZ.

Disquieting signs for Sri Lanka

In addition to traffic emanating from Sri Lanka’s industrial zones, 70% of volumes at the Colombo port are transshipment cargo and early signs are evident the country is increasingly targeted by large-scale racketeers.

The United Nations Office on Drugs and Crime in its country report found that Sri Lanka has been used as a transshipment hub for heroin from South West Asia and India to other destinations. It adds that using a rule of thumb for seizures commonplace for law enforcement agencies, it is estimated that the total heroin smuggled into Sri Lanka during a year is 3.2 tons. However, there is little definitive information on the final destination of the excess heroin. The Indian Directorate of Revenue Intelligence has identified Sri Lanka as a transit point for smuggling other narcotics in containerised cargo. This view seems to be confirmed by reports that 2.5 million amphetamine tablets and 31 kg of heroin seized in Djibouti and Southampton respectively were reported to have transited through Sri Lanka, the UNODC report adds.

Very recently, a Sinhala daily quoted the now deceased drug kingpin, Makandure Madush, pointing to an accomplice named Riskaan whom he revealed was shipping entire containers of cigarettes to Sri Lanka from Dubai. In September this year, Sri Lanka Customs detected Rs. 122 million worth of tendu leaves being imported into the Katunayake Export Processing Zone, listed as raw material for a BOI company.

Tobacco is just one part of the problem, but in Sri Lanka this is a highly popular product for smugglers due to the high returns they bring due to price. Pharmaceutical products, cosmetics, electronics, lifestyle and agricultural products all fall within the fold.

Origin laundering

The International Chamber of Commerce also reveals that in 2011, in Greece over 70% of custom seizures of smuggled cigarettes were illicit white brands. The majority of such cigarettes are manufactured in duty-free zones. Smuggling of illicit white cigarettes is reportedly rampant in the Colon Free Zone (CFZ), Panama. The main countries of origin for these cigarettes are China, India, the United Arab Emirates and Paraguay. From CFZ, some cigarettes go direct to their destination like Colombia, Dominican Republic, Ecuador and Costa Rica and are also shipped into other FTZs. Cigarettes and many other forms of illicit trade, pass through several zones to alter their certificate of origin – a practice often referred to as ‘origin laundering’, the Chamber reports.

Illicit tobacco, particularly trade in illicit ‘cheap whites’, is considered a relatively safe area of operation by organised crime compared with other forms of illegal activity such as narcotics, reports the Organisation for Economic Cooperation and Development (OECD) discussing Enforcement Challenges in Countering Illicit Trade in Free Trade Zones.

“Contrary to popular perceptions, the risk/reward structure of illicit tobacco makes the market for such products highly lucrative and attractive, particularly when there are significant taxes that increase the relative price differential between taxed and untaxed products,” the report states. A recent report published by the International Tax and Investment Center (ITIC) also provides evidence on the exploitation of FTZs by criminal networks specialising in illicit tobacco trade, particularly for unlicensed and duty-unpaid cigarettes (illicit whites). The research said FTZs are exploited to hide origin and destination as transshipment hubs, and serve as manufacturing bases for illicit goods and are also a cause of ‘leakage’ for undeclared and illicit products into local and international economy.

In addition to altering the source of counterfeit products, payments for these goods also end up in third-party accounts in different countries. For instance, payments for counterfeit pharmaceuticals from China, which came through the Middle East and on to Africa were realised in Panama, and went on to fund other illegal activity thereon. There is a need for greater cooperation between governments and enforcement agencies to unravel and dismantle these global criminal networks.

Funding criminals globally

It is of concern that few people accept black markets are a key source of revenue for organised crime. These links have been established globally, and is also reflected in the comments made by Madush with respect to Sri Lanka. In addition to funding criminality, illicit trade erodes government revenue and heaps further burden in terms of costs and measures to combat counterfeits and their fallout on the socio-economic system. These are losses Sri Lanka can ill afford at this juncture; at the cusp of a concerted effort to change our pace of development.

The OECD’s Governance Frameworks to Counter Illicit Trade report of 2018 states: “There are presently no wide-reaching international frameworks that set out a series of rules or governing regulations for FTZs (including what activities may or may not take place and with what information or data sharing). Further domestic and international regulation is required in many FTZs. The absence of effective controls not only leads to diminished oversight, but also a misunderstanding among law enforcement of the risks of certain FTZs and the activities that take place therein.”

Sri Lanka has listed several game changing initiatives in its 2021 budget, including some regional firsts. The country could also do better and take the lead with stronger governance and monitoring within industrial zones, whilst sustaining the incentives provided within. This will prove beneficial to Sri Lanka to safeguard revenue, whilst building confidence amongst prospective investors with respect to protecting their intellectual property. This entails a stringent process of checks and balances on those already operating within Sri Lanka’s FTZs, and also who we welcome into the country under the banner of investors and traders. Such measures will strengthen brand Sri Lanka on the global stage.

(The writer is a retired Administration, Shipping and Maritime Security Consultant with extensive experience in anti-smuggling operations in Sri Lanka and the Middle East.)