Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 30 January 2018 00:00 - - {{hitsCtrl.values.hits}}

Ravi Abeysuriya, CFA

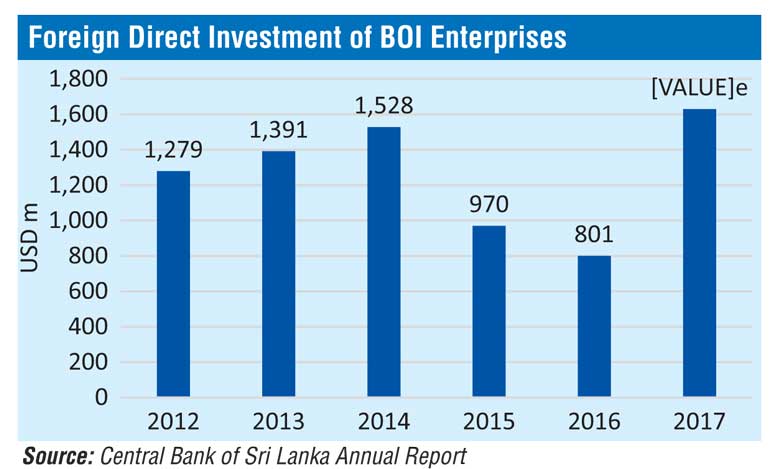

Inflows of Foreign Direct Investment (FDI) to companies registered in Sri Lanka under the Board of Investment (BOI), including loans, is estimated to be $ 1.63 billion in 2017 as compared to $ 801 million in 2016, reflecting a year-on-year increase of 103%. This is the highest ever FDI received by Sri Lanka surpassing the $ 1.5 billion in 2014, a key milestone for Sri Lanka and will be a turning point in FDI inflows.

This is a remarkable achievement, when global FDIs have reduced by 16% in 2017, to an estimated $ 1.52 trillion, from $ 1.81 trillion in 2016. However, FDIs to developing economies have remained stable at an estimated $ 653 billion, 2% more than the previous year, according to the ‘Investment Trends Monitor’ released by the United Nations Conference on Trade and Development (UNCTAD).

The increase in FDI to Sri Lanka in 2017 can be largely attributed the commencement of the Hambantota industrial zone and the continuation of the Colombo Port City project. These two projects together with other infrastructure projects planned is expected to bring significant FDI flows from 2018 onwards to Sri Lanka in the tune of $ 2 to 3 billion. The current Government policy is to attract more on non-debt creating financial flows to the country to generate increasing growth, employment and incomes. Sri Lanka need to leverage its strengths such as strategic geographical location, Free Trade Agreements, excellent international relations, including with capital surplus countries in East and South East Asia, and proximity to India, the fastest growing large economy in the world, and China’s maritime silk route to generate FDI.

Increased non-debt creating foreign inflows is imperative for the country to fill the savings-investment gap, which amounts to about 5% of GDP ($4 b). FDI also brings in technology, markets, branding and knowhow. Sri Lanka is attracting less than 1.5% of GDP as FDI, even seven years after the end of the conflict. Countries like Malaysia, Thailand and Vietnam have attracted three or four times that.

A business friendly legal and regulatory environment along with political stability, security, and macroeconomic conditions are key factors for multinational companies making investment decisions in developing countries. FDI usually have a multiplier effect in economies with good governance, well-functioning institutions, and transparent and predictable legal environments. Regulatory simplification, removing barriers to investment entry and addressing infrastructure constraints rank among the important confidence building signals for investors to respond with more FDI to a country.

The key challenge will be effective implementation. It is important to build a national consensus and involve all stakeholders. Sri Lanka was second to Japan in Asia on most indicators at the time of independence. Today, it has slipped behind several other countries. Many opportunities have been lost during the last 68 years. The current historical conjuncture holds considerable promise. The opportunities need to be seized, which is the challenge for all Sri Lankans.