Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 13 September 2017 00:00 - - {{hitsCtrl.values.hits}}

By Piyumi Kapugeekiyana, Ph.D., STAX

By Piyumi Kapugeekiyana, Ph.D., STAX

On 2 August, global strategy consulting firm STAX and Sri Lanka Institute of Directors unveiled the results from the first-ever survey of Sri Lankan family businesses and convened a stimulating panel discussion with some of Sri Lanka’s finest family business leaders across generations. In embarking on this exercise, we wanted to uncover the unique opportunities and challenges confronting family business leaders. This article offers a quick spin through the highlights of our research.

What is it that makes a family business unique? An astute observer might speculate about everything from the trust inherent in familial relationships to the availability of pooled resources. The reasons may vary but there is no denying the socioeconomic influence and philanthropic reach of these firms. Family businesses account for two-thirds of all firms around the world and contribute to an estimated 70%-90% of global GDP annually. These institutions serve as engines for employment creation, contributing 50%-80% of jobs worldwide. Family firms also tend to be amongst the biggest givers—often supporting philanthropic activities in their respective communities.

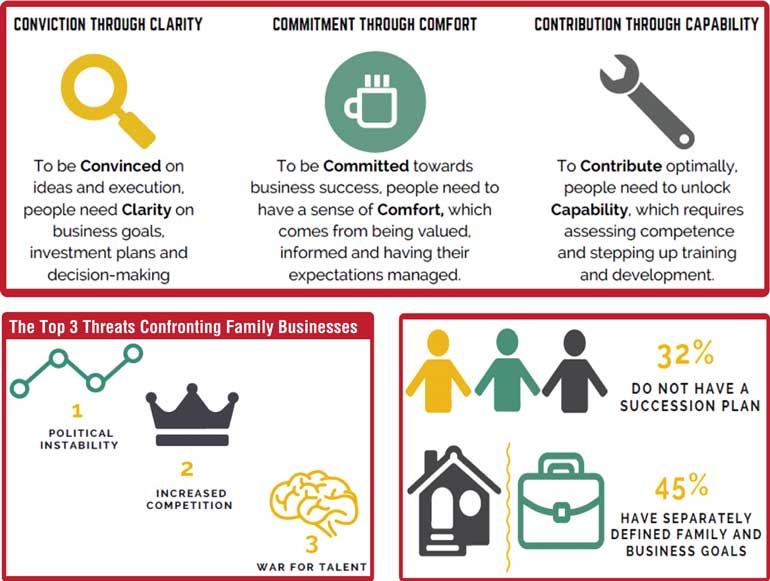

On the flip side, these firms also encounter their own set of challenges around longevity and conflict resolution. In 2016, 43% of global family firms did not have a succession plan in place, with only 12% making it to a third generation.

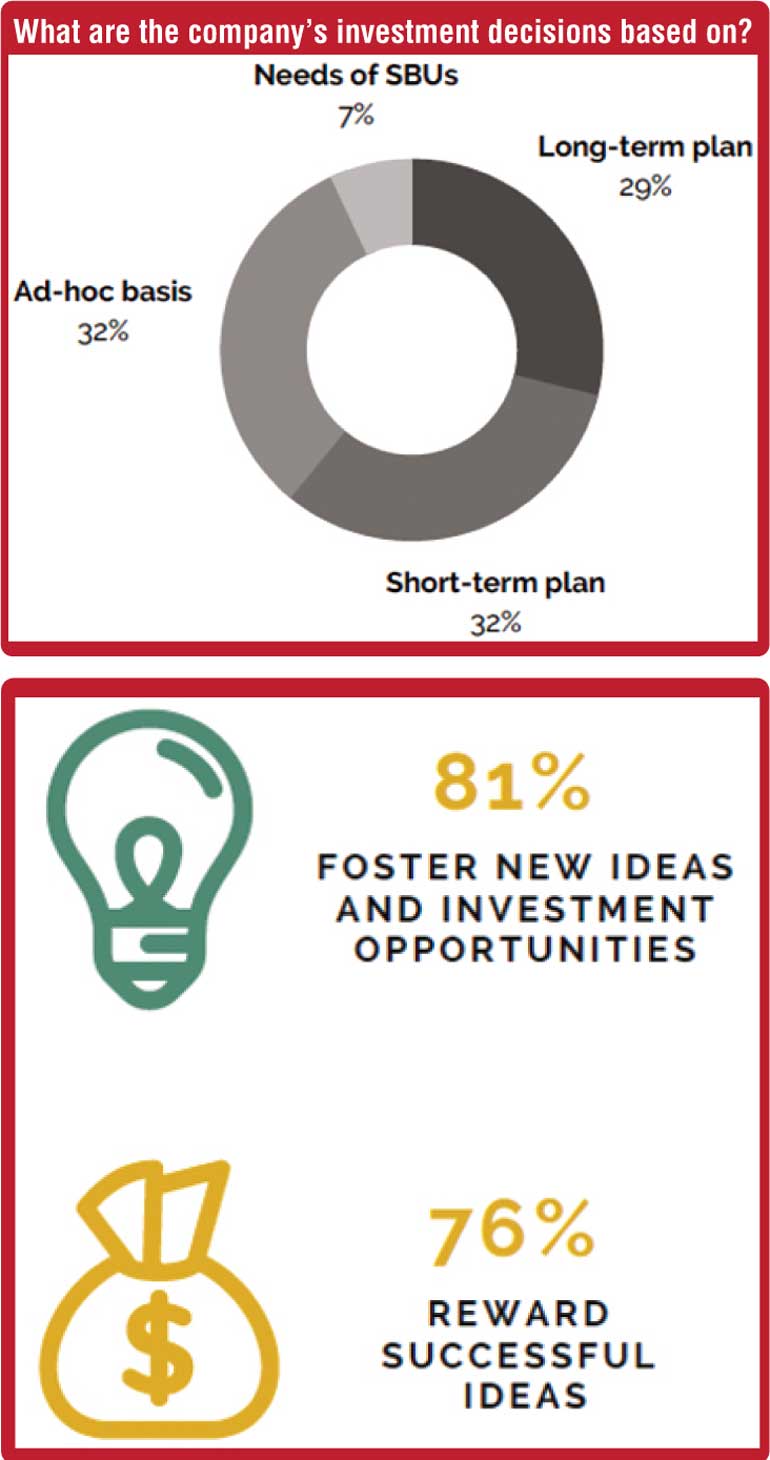

STAX’s survey of 31 local family business leaders reveals both strengths and challenges. Nearly 77% of these firms can lay claim to a well-defined vision while 61% of firms have crafted a five to 10 year strategic roadmap. While such strengths bode well for the collective success of these firms, certain problems still loom on the horizon. Amongst those surveyed, 32% of firms reported that they did not have a succession plan while 65% shared that they make their investment decisions on a short-term or ad-hoc basis. At least 74% of firms reported that they did not have risk management strategies in place. Additionally, these firms also perceive other threats on the horizon.Based on STAX experience and best practice, there are four key areas that leaders need to consider if they want their family businesses to persevere to the next generation.

“The people who started the business know exactly why they did it. In the second generation onward, the vision is not as clear as in the first” — 2nd Gen Electronic Components Supplier.

Strategic thinking is crucial for family firms, where the tendency towards myopic decision-making can be heightened by competing family interests. As most leaders soon discover, a clear vision is the cornerstone of any strategic roadmap.

While the majority of businesses claim to have a well-defined vision, 42% only have a verbally agreed vision. This failure to articulate the vision of the business in writing can be especially problematic as a company transitions from the 1st Generation to the 2nd because the underlying goals are no longer as clear as they once were. During our in-depth interviews, some companies attributed the delay in formulating strategy to a perceived lack of need—especially where there was a long history of close-knit, family-run operations with little or no external professional involvement.

In particular, small companies that had long been managed by only family members tended to hold the view that a formal strategic roadmap was only necessary when the company expanded and took on board new external hires. Until then, these firms were content to operate on the basis of a shared understanding between family members.

Even where family businesses acknowledged the importance of strategic planning, leaders lacked clarity around when to embark on such an exercise, whom to include, and how to resolve the conflicts that arise as a result of competing interests. As an extension of this issue, our survey also picked up mismatches in the alignment between the long-term strategic plans of family firms and their investment decisions.

“In order to run a family business, you’ve got to understand how it works and where it’s headed. For that, you need some external experience. Otherwise, you’ll have ownership of the asset and won’t know what to do with it. It’s like having a gold mine but not knowing how to dig for gold. What’s the value in that?” — Beyond 3rd Gen, Diversified Conglomerate.

Globally, this is an important focus area—if handled the wrong way, issues pertaining to succession are the likeliest to bring both personal and professional domains into conflict, placing both the firm and the family at risk.

While the majority of Sri Lankan family businesses reported that they had a succession plan that satisfied their aspirations, 65% of firms are yet to develop a sense of clarity and comfort regarding the extent to which the next-generation will contribute towards the business. Given the challenges, family businesses see value in working with independent consultants to refine their succession plans and ensure continuity of the business and the family name.

“As the second generation gets involved, it’s important to go through a structured process” — 2nd Gen Consumer Products Firm.

The act of professionalising involves achieving a separation between family ownership and business management; often by hiring senior managers from outside the family and providing them with clear performance indicators, lines of responsibility and guidelines for daily operations. While family businesses can be slow to embark on this process, professionalising can free up valuable time and space for family members to think and plan more strategically; paving the way for a healthier business environment in the long run. Interestingly, 94% of family firms reported that they want to bring in senior expertise from outside the family.

While Lankan firms fare well on their openness to professionalisation, they are still some way from realisation. Currently, only a fraction of firms have separately defined business and family goals.

Positively, ~71% of these firms agree that business goals should nonetheless take precedence over family goals in the event of a conflict. Firms are also increasingly seeing value in structured processes such as the implementation of family employment policies.

“Technology is the way forward” – Beyond 3rd Gen, Diversified Conglomerate

The willingness of family businesses to innovate and invest in technology differentiates them from the competition. Sri Lankan family businesses reportedly perform well in this area.

The majority of firms (~87%) also leverage technology for operational improvement and product development. However, leaders have also sounded an important caveat: Any plans for innovation need to be considered against potential limitations in resources and the broader business environment.

When interacting with family businesses across generations, STAX has discovered that it is essential to understand the needs of multiple, interdependent groups in order to avoid conflicts and ensure long-term success. In the process of dealing with various stakeholders, family business leaders need to consider the following questions periodically:

In our experience, businesses under-perform when there is a lack of Conviction, Commitment and Contribution from key stakeholders. To address this issue in family businesses, STAX has developed the 6C Framework aimed at bolstering Clarity, Comfort and Capability.

As family business leaders think about the future, our goal is to drive leaders at all levels to capitalise on exciting opportunities while mitigating the threats that confront them.