Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 27 November 2017 00:00 - - {{hitsCtrl.values.hits}}

Port of Colombo with Colombo International Container Terminal

By Rehan Fernando

Following the launch of Vision 25 which outlines the Government’s economic development program, there were many thoughts and discussions over making Sri Lanka a maritime hub. Sri Lanka is in an enviable location where the busy East-West shipping route passes just six to ten nautical miles south of the island. More than 60,000 ships ply this route annually, carrying two-thirds of the world’s oil and half of all container shipments. It is no secret that Asia is bound to emerge as the economic powerhouse of the world, if the current trends of development continue for the next couple of decades.

It is inevitable that Sri Lanka should capitalise on the location specific advantages and position itself as a hub. Therefore it is important to probe what constitutes a maritime hub and what are the immediate investments required to get there. This article mainly highlights few of those crucial investments required urgent attention

Port related infrastructure

With shipping lines looking at taking advantage of economies of scale, more and more companies have added larger container ships to their fleet in recent times. This has led to berthing issues in existing ports with their inability to accommodate the new age ships which require ‘deep water terminals’.

At the moment Colombo International Container Terminal (CICT), with an 18m berth depth is the only existing deep water terminal in Sri Lanka. Such terminals are in high demand due to the increase in size of container vessels over the years. The CICT reported a throughput of 2 million TEUs for the 12 months ending 31st December 2016, achieving impressive YOY growth of 28% in volume. It’s already operating at 80% capacity and will soon exceed capacity creating the need for another deep water terminal in the country.

With Sri Lanka working hard towards establishing itself as a maritime hub, terminals of this nature are increasingly becoming a basic need. With Sri Lanka’s central location and ability to cater to the East-West route with such ease, more and more shipping lines will find it beneficial to call Colombo as opposed to other ports in the region. However Sri Lanka will only be able to take advantage of this opportunity if we can cater to the requirements of the large container ships these shipping lines are adding to their fleet. The East Container Terminal (ECT) therefore plays an important role in Sri Lanka’s journey of becoming the maritime hub in Asia.

It would be prudent for the SLPA to plan not only to equip the present 440m of the ECT by expediting the installation of cranes, but at the same time commence the rest of the construction of the ECT. At present only two vessels with a length of 360m can be accommodated in the port of Colombo at any given point of time. This should at least increase to four vessels if we are to attract multiple east-west services to the port of Colombo. If we are unable to attract these services, we may see a decline in the share of transshipment that is attracted by the port of Colombo. Hence building the required port capacity is paramount in developing Colombo as a growing transshipment hub for the region which is capable of handling a much larger volume of deep draught vessels. This is paramount since the port of Colombo is already operating at near full capacity.

Furthermore Port of Colombo also needs to upgrade facilities for handling break bulk and non-container vessels and also invest in the required equipment for these types of discharging operations such as a grain, wheat and steel bulk cargoes.

Other ancillary services

Apart from port infrastructure there are many other areas which need attention to develop this eco system. Without these ancillary services, a concept of a hub is just a dream. A successful hub port requires the full range of ancillary port and marine services at competitive prices in order to be attractive to mainline and feeder operators, casual callers and attracting vessels specifically for services even without cargo operations. The Government should promote maritime related ancillary services by creating a climate that would encourage investors by offering incentives and non-bureaucratic regulatory infrastructure for these services to be offered at world class standards and regionally competitive rates.

The ancillary services include the following: Bunkering, marine lubricants and freshwater supply, off shore supplies and ship chandelling, slop disposal facility, salvage and towage, ship repair and ship building, ship layup, services to cruise ships and yachts, and maritime security services.

The bunkering industry provides the shipping industry with the fuel oil that the vessels consume. The quality of the fuel oil provided will ensure the safe operation of vessels. Ship bunkering is a key support service that a maritime hub can provide for the global shipping industry. If a ship can carry less bunker on a voyage it can accommodate more cargo, which means it can take in less bunker at turnaround ports and re fuel whilst on voyage at a strategic location.

Sri Lanka is located at such strategic location in the Indian Ocean, and can provide bunkering and other services to thousands of ships plying along the south coast connecting east west global trade. This is where Hambantota Port is situated, and it can provide both inshore and off shore bunkering and ship services as a profitable business. For this purpose the private sector should play a greater role and should be allowed to set up operations for distribution and market development.

The turnover and the revenue generated by this activity would contribute significantly to the Sri Lankan economy.

For the bunkering industry to succeed, it is necessary that the industry has access to good supply vessels, storage facilities and a competitive product. At present there is limited land based storage capacity to store bunkers and supply from pipeline from JCT OIL bank. Enhancing this storage capacity is key in enabling bunker operators to buy larger volumes and leverage on lower prices to supply a competitive price in the region. Currently there are many restrictions to operate Floating storages and other bureaucratic restrictions which inhibit the growth of bunker volume from Sri Lankan ports. Another major requirement is to have refinery capacity which can supply excess product for bunkering industry. Sri Lanka urgently needs to expand its refinery output/ capacity to fuel the bunker supply.

Salvage operations is also an important aspect in the maritime industry, with high revenue potential, not only to the salvors, but also to the ports, transporters, insurance surveyors and everyone involved in the chain. The Government shall encourage the practitioners to handle vessels in distress in Sri Lankan waters and ports.

Salvage services are also essential to ensure that maritime casualties in Sri Lankan waters do not cause damage to the environment, fauna and flora, as well as the coast. Search and rescue facilities have to be maintained by the Government as well. The Government should encourage the development and promotion of the business of salvage and towage and encourage Sri Lankan entrepreneurs to invest in this industry with necessary incentives. The Government also shall ensure that minimum salvage and search and rescue facilities are maintained in and around the Sri Lankan waters. The Government should encourage the development and promotion of ship Chandelling and offshore supplies to ships. The present facilities available in bonded stores are only for liquor and cigarettes. As a result, a large range of ship supplies normally requisitioned by vessels have to be purchased by chandlers in the open market at rates which include import duties and other local levies. This makes supplies from Sri Lankan chandlers uncompetitive for ships calling at Sri Lankan ports. The existing bonding facilities need improvement and enhancement to accommodate all products.

Development of the national merchant shipping fleet and making Sri Lanka flag attractive

The national policy should be to encourage organisations on ship ownership, ship operation, ship management of national tonnage and registration/flagging in Sri Lanka. Therefore the government will have to promote fiscal and other support measures that will encourage and promote the establishment and expansion of the National Merchant fleet. In the above context it is best that the Maritime Administration to be made a commercially oriented and an efficient entity which promotes the national interest whilst creating an investor friendly framework. Establishing smooth and efficient processes for ship owning, and establishing a unit dedicated for the purpose of promoting ship owning and flagging is very important. Promoting the Sri Lankan flag as a flag of convenience and attracting ship owners to register their fleet using Sri Lankan flag is a direct method of gaining foreign exchange revenue. However the regulations and conditions of the Sri Lanka flag continue to be unattractive and bureaucratic to be attractive to foreign ship owners or investors.

Improve ease of doing business and digitalisation

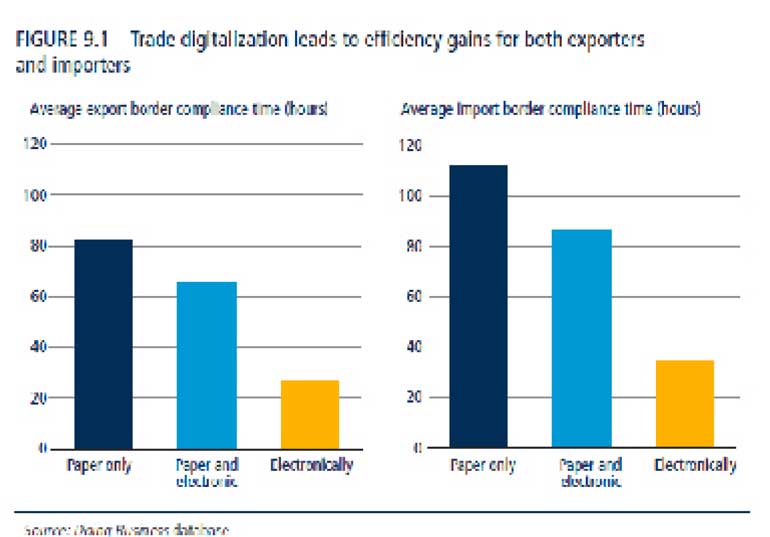

The World Bank has come up with a number of performance indices used to benchmark performance of countries on key dimensions such as the Logistics Performance Index (LPI) and Ease of Doing Business to name a few. They measure, among others, time taken for documentary and border compliance as well as cost to export and import. Sri Lanka has achieved an overall ranking of 111 on ease of doing business and is ranked 86 on trading across borders whereas Singapore has been successful in achieving an overall rank of 2.

It is common to note that Customs administrations become the focus when the subject of trade facilitation is discussed. Although the functions and activities of Customs administration is an essential component towards facilitation, a view from a supply chain perspective helps to understand the various dependencies among other players, procedures and processes as well as linkages between these parties such as private sector traders, transport providers, service intermediaries and other regulatory bodies in the public sector. This has resulted in many countries making efforts to exploit digitalisation in order to drive efficiencies through automation, paperless trade, electronic data interchange, cashless transactions, etc.

According to the report titled ‘Review of Maritime Transport 2016’ published by the United Nations Conference on Trade and Development (UNCTAD), the fourth industrial revolution, through digitalisation and the leveraging of innovation, technology, data and the Internet of Things is set to revolutionise the service industry. This will shift established modes of production and consumption generating welfare and productivity gains and offering new opportunities. Therefore it is imperative for us to consider whether we are ready as a nation to face this revolution and the demands that come with it.

However, in driving towards this, following should be in place:

Cruise tourism and passenger terminal

The cruise market is one of the fastest growing segments in the travel and tourism industry and can make a significant contribution to a destination’s economy. As cruise lines are increasingly looking for new destinations, cruise tourism can offer opportunities to developing countries with harbour facilities and an interesting hinterland.

However, with the increasing number of tourists, Sri Lanka is compelled to improve its infrastructure facilities in order to entertain and facilitate the large number of tourists expected. There are many concerns raised over the lack of a suitable terminal and berth to handle large passenger vessels. It is important for Sri Lanka to develop the ports around the country if it was to develop the leisure industry. The current passenger terminal is not suitable for modern ocean liners which carry a large number of passengers and crew. The harbour does not have facilities to provide water, dispose garbage, and refuel the vessel. The terminal should be revamped in order to accommodate such large vessels.

Capacity building

Responsiveness to the demands of the labour market is an essential requirement when developing an internal logistics hub. Capacity building from secondary and tertiary levels as well as vocational training would be of paramount importance to the growth of the industry. Vocational training especially would be a key area of development in order to address the gaps and oversupply in the labour market.

In order to develop requisite skills for capacity building, it would be necessary to;

Conclusion

It is important that the Government initiates discussion with all stakeholders and working on these main investment areas which is required to achieve the hub status. This process has already been initiated by the Sri Lankan Ports Authority through the compilation of the Maritime Policy Framework. However more importantly, an implementation body with legal mandate needs to be put in place to ensure that policy is executed without any delay. The main point to stress that a maritime hub consists of several elements primarily ‘capacity’ and physical infrastructure, quality ancillary services, and ease of doing business all which need to be addressed simultaneously to attract more vessels and more revenue and more investment to this country.

Advocates of liberalisation first need to understand the elements that make up a maritime hub and what are the key features required for this without blindly subscribing to liberalisation as a concept that can be just applied to every sector of the economy without addressing the pressing issues that affect that industry. The shipping and logistics industries are fully liberalised in Sri Lanka and any foreign investor is free to come and set up in any of the above mentioned areas which make up a maritime hub. The shipping agency function is the only area which the majority is reserved for locals primarily because there’s little capital investment required for shipping agency and to ensure earnings are retained within the country.

The arguments that state that allowing foreign shipping lines to set up their own agency offices in Sri Lanka will lead to more volume is completely destroyed by the fact that Colombo port doesn’t have any port capacity to handle more volume. Further the contention that shipping lines having their own offices in Sri Lanka will lead to lower freight rates holds no ground. What determines freight rates in the shipping lines include main cost elements such as vessel operating costs, bunkers, crew, insurance and port costs. The agents costs are inconsiderable when compared to the above main cost elements. Further freight rates are determined by the forces of supply and demand for cargo between destination and the tonnage deployed on those routes. Proponents who think that exporters will benefit from this move with lower freight rates will be in for a surprise when lines will then increase rates and additional charges to cover their costs and maximise their profits.

Policy makers should look at the bigger picture, develop Sri Lanka to a maritime hub, develop our ports, develop the ease of doing business, rest will follow.

The write is a Senior Maritime Consultant.