Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 30 December 2022 00:00 - - {{hitsCtrl.values.hits}}

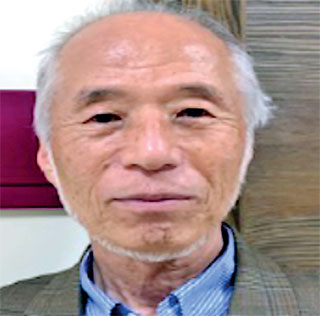

Japan Futures Research Center Director and former Professor of Economics Dr. Kaoru Yamaguchi (Presenter)

University of Colombo Professor of Economics Prof. Sirimal Abeyratne (Moderator)

University of Colombo Ph.D. candidate in Economics Hema Senanayake (Discussant)

By Nihal Rodrigo

The article is based on a presentation made on 5 November at the Monthly Seminar of the Sri Lankan Economic Association (SLEA), via Zoom platform. Dr. Kaoru Yamaguchi, who is a director at Japan Futures Research Center and former professor of Economics, at several universities in the USA and other countries, made a presentation on ‘Debt Money System is a Design Failure – 30-year Loss for Japan and Lessons for Sri Lanka’. The discussant was Hema Senanayake, a Ph.D. candidate in Economics at the University of Colombo and author of two books on economic-related matters. The session was moderated by Prof. Sirimal Abeyratne of the University of Colombo. The views expressed in the article are those of the presenters and do not reflect the views of SLEA.

Public money, money stock, and total debt

Issuance of debt money by commercial banks and central banks commenced after about 1840 when the Bank of England was established. The distinction between public money and debt money is that public money is issued free of interest while debt money is always issued at a rate of interest. Three statistically significant relationships have been found by based on his analysis of money stock and total debt of Japan during the period from 1980 to 2019

First, the money stock in Japan has been almost equal to the total debt of the country consisting of government debt and private debt. This highlights the fact that one’s money is someone’s debt. Secondly, private debt has a very close relationship with time deposits. The private sector consisting of households and producers borrows money for housing purposes and for meeting capital expenditures respectively, and then the excess of their income is deposited in banks as deposits. Therefore, the debt comes first, and saving is an outcome of their debt.

This finding is opposed to the standard Keynesian macroeconomic theory where money is first exogenously printed by a central bank; debt is created by commercial banks using such money and savings are leakages from the system; and, banks use such savings to grant loans for investments as intermediaries. Accordingly, a recession occurs as and when investments are smaller than savings. The third finding is that government debt is highly correlated with narrow money supply (M1) or currency and demand deposits. A similar relationship between the money stock and total debt is evident in the USA, too from 1945 up to now.

Failure of mainstream economic theories in Japan

Until around 1990 Japanese economy was booming and growing faster. However, since 1990, Japan has been in a recessionary state, despite implementing a number of fiscal and monetary policies. Both fiscal and monetary policies have failed to stimulate GDP growth in Japan for the last 30-year period, and statistically, the multiplier effect of fiscal policy is almost negligible. Hence, there is no economic theory to explain the situation in Japan.

Debt money is a design failure

The presenter identified debt money as the main cause of Japan’s recession and explained several negative effects caused by the debt money system. These include the creation of bubbles and busts, inflation and unemployment, accumulation of government debt income inequality in society, and environmental degradation.

The answer to debt money system is public money system

Under the public money system, there will not be debt money created by banks out of nothing and all money will be legal tender issued free of interest. All government debts will be paid out by about 2019 under the proposed system. Further, the proponents propose converting all existing currencies into digital currency and issuing them as Electronic Public Money (EPM) using cryptocurrency technology.

Modern Monetary Theory (MMT) and the public money system

When questioned on whether the proposed public money system is another version of Modern Monetary Theory (MMT), the presenter explained that the proposed system differs from the MMT in at least two ways. First, MMT is based on debt money and it wishes to continue the existing debt money system, and secondly, MMT is not against money created by banks.

The simulation result of the proposed model would eliminate all the evils of debt money referred to above. Details of the system can freely be accessed freely at http://www.muratopia.org/Yamaguchi/MacroBook-j.html.

Hema Senanayake, the moderator, briefly summarised the presentation and said that Dr. Yamaguchi proposes converting the existing debt money system to a public money system based on 100 percent reserve banking. While saying that this proposal is completely different from Modern Monetary Theory (MMT), he disclosed that Dr. Yamaguchi was instrumental in drafting an Act in 2010, after the global financial crisis, for converting US debt money system into a public money system with the help of some congressmen, though it did not get approved.

The IMF too did a similar study (WP/12/202/2012) in 2012 aimed at converting the US money system to a full reserve system and arrived at similar conclusions. He showed a very high debt-to-GDP ratios in several developed countries and observed that the proposed public money system could be a solution for the high debt problem faced by developing countries and developed countries too.

Lessons for Sri Lanka

As per Dr. Yamaguchi, the orthodox macroeconomic theories and policies have failed to find answers to the 30-year-old recession in Japan. Therefore, policymakers should break out of these orthodoxies and explore innovative models and remedies for economic issues in countries like Sri Lanka.

Another takeaway from the presentation for Sri Lanka is to research into the relationship between debt and various components of the money stock and the effectiveness of fiscal and monetary policies. This is of special significance to Sri Lanka as it too is undergoing a crisis brought about by the non-sustainable level of public debt.

(The writer is Vice President, SLEA, and former Director of the CBSL.)