Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 27 November 2018 00:00 - - {{hitsCtrl.values.hits}}

The IMF’s continuous advice over the last few years was the need for Sri Lanka to reform Government revenue through increase in tax rates and widening the tax base to increase tax revenue, with the objective of reducing the budget deficit. The Government on its part has mostly executed these instructions, in the form of the new Inland Revenue Act which was implemented last April.

The IMF’s continuous advice over the last few years was the need for Sri Lanka to reform Government revenue through increase in tax rates and widening the tax base to increase tax revenue, with the objective of reducing the budget deficit. The Government on its part has mostly executed these instructions, in the form of the new Inland Revenue Act which was implemented last April.

Anaemic growth in tax revenue

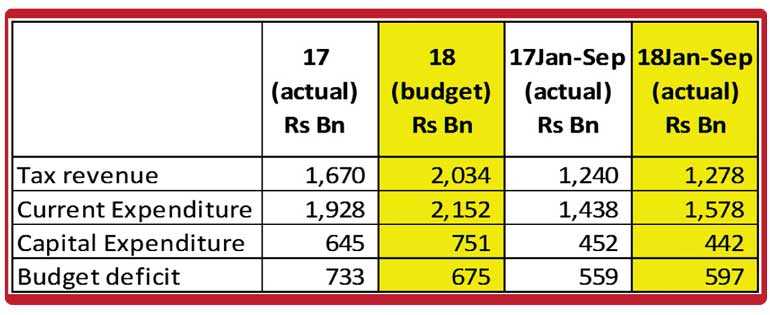

However the latest Central Bank data shows that the increase in tax revenue is a mere 3% in 2018 third quarter (Jul-Sep). We have previously highlighted in this column that despite higher tax rates, a slowing economy would rake in lower tax revenues. The data seem to show just that.

From Jan-Sep in 2018, tax revenue has increased by just 3% or Rs. 38 b in rupee terms. The Budget for 2018 has estimated a spectacular 22% rise in tax revenue, which works out to an increase of Rs. 364 b. With just three months to go, there is no doubt that the tax revenue would be nowhere near what was estimated at the beginning of the year.

As weather has improved and the Agriculture sector has revived, there is nowhere to hide for authorities. They can no longer point at poor weather (drought or floods) as the reason for failing to achieve targets.

Fiscal consolidation not happening

With recurrent expenditure up to September broadly in line with the budget, the Government has reduced public investments (capital expenditure) below the budgeted figures to prevent the budget deficit from expanding significantly. Capital expenditure up to September is actually lower than that of last year. Clearly a cut down in public investments affects the long term growth prospects of the country.

As a result, the budget deficit has increased by 7% or Rs. 38 b in rupee terms up to September, compared to 2017. The estimate at the beginning of the year was to reduce budget deficit by Rs. 58 b, which reflects how poor the actual performance is in comparison to the target. Therefore while the budget deficit was targeted to reduce to 4.8% of GDP in 2018 (from 5.5% in 2017), it is likely to remain around 5.5%.

In other words, the fiscal consolidation target of IMF has not been met, despite the Government faithfully implementing the measures stipulated by IMF.

Faulty fiscal policy affecting economy

On the other hand, the faithful adherence to IMF advice has firmly applied brakes on the economy. Official GDP growth numbers are shown as slightly over 3% so far in 2018, but thanks mainly to revision of the previous year numbers lower. Growth would have been less than 3% if the previous year numbers were not adjusted.

The GDP growth for the third quarter of 2018 (Jul-Sep) will be released in a few weeks, and it is likely to continue around 3%, unless the previous year numbers are revised lower, yet again. Even the official growth rate of around 3.5% is grossly insufficient to improve the quality of life of the public.

The fiscal consolidation target of IMF has not been met, despite the Government faithfully implementing the measures stipulated by IMF. The faithful adherence to IMF advice has firmly applied brakes on the economy

Private sector profit underlines slowing economy

If one needs more data to justify whether the economy is sliding or not, one need not look any further than how the listed private sector entities have performed in the recent past. The 2018 third quarter (Jul-Sep) profitability data for the larger private sector entities show the decline in profits, apart from a handful of exceptional cases.

The banking sector which has remained relatively unscathed so far is also expected to join the wounded list from the coming quarter as loan defaults have started to escalate from mid 2018. The poor profitability trend which has started from mid 2018, is likely to continue in the coming 12 months, in line with the severe weakness in the economy.

If one needs more data to justify whether the economy is sliding or not, one need not look any further than how the listed private sector entities have performed in the recent past. The 2018 third quarter (Jul-Sep) profitability data for the larger private sector entities show the decline in profits, apart from a handful of exceptional cases. The banking sector which has remained relatively unscathed so far is also expected to join the wounded list

Outcome of IMF prescription

The IMF’s prescription has been to increase taxes and boost Government revenue to reduce the budget deficit. However as data clearly shows (especially since the new Inland Revenue Act was implemented since last April), the economy has slowed down sharply while as a result, the tax revenue has remained mostly stagnant and may even fall in the coming quarters. As a result, no improvement is seen in reducing the budget deficit – in other words, the so called “fiscal consolidation” is not materialising. It would be hilarious if the IMF finds the Government responsible for not achieving fiscal consolidation objectives. The faulty strategy was recommended by the IMF itself!

Importantly, the slowing economy is creating greater problems in social, political and even constitutional domains as of now.

The IMF’s prescription has been to increase taxes and boost Government revenue to reduce the budget deficit. However as data clearly shows the economy has slowed down sharply. It would be hilarious if the IMF finds the Government responsible for not achieving fiscal consolidation objectives. The faulty strategy was recommended by the IMF itself!

Time to act on data

The data cannot be clearer. The verdict on the success of current fiscal consolidation strategy cannot be clearer. As this column has repeatedly pointed out, the economy should be revived based on sustainable policies – led by focused and decisive Government public investments and focused tax incentives and reliefs. The resultant revival in economy would boost tax revenue although reducing budget deficit should not be the country’s priority. Setting on a path of sustainable economic development should be the priority.

Strategic, decisive policies are the need of the hour. Hence, a new president and a Parliament with a five-year clear mandate is the need of the hour. The alliances and coalitions formed to obtain power, sans strong economic policies and a practical implementation methodology should be rejected by the people even before such unproductive alliances are formed.

(The writers can be contacted via [email protected])