Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 28 October 2019 00:00 - - {{hitsCtrl.values.hits}}

Lead:

Overseas Realty Ceylon PLC CEO Pravir Samarasinghe

Members of the working group: International Finance Corporation Principal Investment Officer Kamal Dorabawila, Ministry of Finance National Agency for PPP Chairman Thilan Wijesinghe, Access Engineering PLC Managing Director Christopher Joshua, Western Region Megapolis Master Plan Project Director, Team Leader Lakshman Jayasekara, Tudawe Brothers Ltd. Chairman Rohan Tudawe.

1.Prioritisation of Infrastructure Projects

a) Implementing the Public Investment Committee (PIC) or an equivalent high-powered committee to take over the role of selecting, prioritising and creating a pipeline of infrastructure projects drawn from varied line ministries based on economic and/or financial feasibility.

b) The PIC should decide on mode of funding for project (e.g. consolidated fund, external resources/multilateral donor funding, FDI/PPP and variants thereof)

c) Ensuring consistency and continuity of the priority project pipeline is important to ensure the required economic and social objectives are met.

lDraw up a robust project pipeline through the Public Investment Committee (PIC) or equivalent institution.

lPIC or the equivalent should have the secretary to the Treasury acting as the chairman of the committee; as the planning, allocation and management of public finances are under its purview. The related line ministries should also be represented in this committee.

lBroadly functions of a PIC or the equivalent institution should include:

- To evaluate projects with clearly defined parameters based on the merits of economic, financial and social factors, so that there will be a prioritised permanent list of projects over a three to five year horizon with their identified funding mechanisms (public, private and PPP).

- To examine whether projects are being managed in accordance with sound business principles and prudent commercial practices throughout the projects lifespan.

2.Infrastructure Financing Policy

The lack of fiscal space owing to high debt repayment (82.9% of GDP) has led to significantly low levels of Government capital expenditure on Infrastructure.

Policies to attract private funding should be encouraged and the newly formed National Agency for Public-Private Partnership (NAPPP) should be facilitated with sufficient authority and guidelines to implement PPPs.

The NAPPP can play the role of an intermediary who structures the private public funding mechanism and looks at the long-term agreement with the parties concerned where project quality and delivery targets are established. The NAPPP can also tap into a variety of innovative sources of project financing.

In other countries PPPs have been successfully executed in providing physical infrastructure and non-specialist services for education and health.

3.Funding mechanism for feasibility and assessment studies

lFeasibility studies or viability assessments should be done prior to commencement of projects in order to identify projects based on economic impact, social impact and financial viability. By doing this, it will also identify the most appropriate funding mechanism.

lThe costs of the study must be commensurate with the costs of the planned investment.

lA long-term arrangement should be in place, to fund and facilitate viability assessments or feasibility studies.

lIdentification of specific risks associated with projects using a technical framework. When considering PPPs, risk allocation must be carried out via a formal mechanism provisioning optimum levels of risk to both private and public sector. If appropriate risks are not addressed in the formulation stage projects would end up being costly for society.

4.Improving the procurement process

Enabling the procurement process to be competitive and transparent without placing further pressure on fiscal consolidation

Fast-Tracking the PPP procurement guidelines which is currently under review by the National Procurement Commission.

Fine-tuning the general procurement guidelines and ensuring all ministries follow these guidelines when procuring without giving rise to prolonged delays.

Reduce time committed to obtaining multiple ministry and stakeholder approval and need to manage logistical and practical issues in convening and decision making in procurement committees; and strengthen technical capability within procurement committees to evaluate large-scale projects.

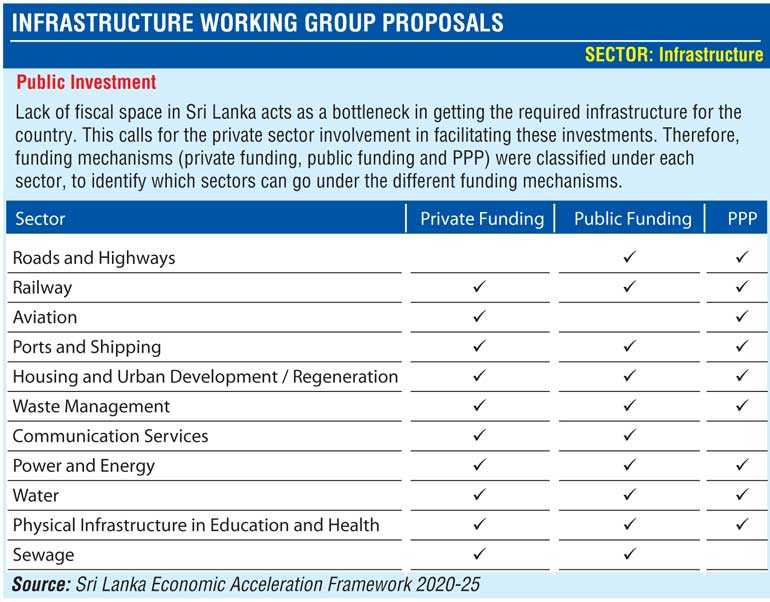

Public investment

Lack of fiscal space in Sri Lanka acts as a bottleneck in getting the required infrastructure for the country. This calls for the private sector involvement in facilitating these investments. Therefore, funding mechanisms (private funding, public funding and PPP) were classified under each sector, to identify which sectors can go under the different funding mechanisms.