Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 8 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Sanjana Fernando

The cancellation of the four Airbus A350-900 leases, executed under the current management led by the pilot CEO, was one of the most controversial decisions ever taken in the history of the airline. It also turned out to be the decision that finally broke the airline.

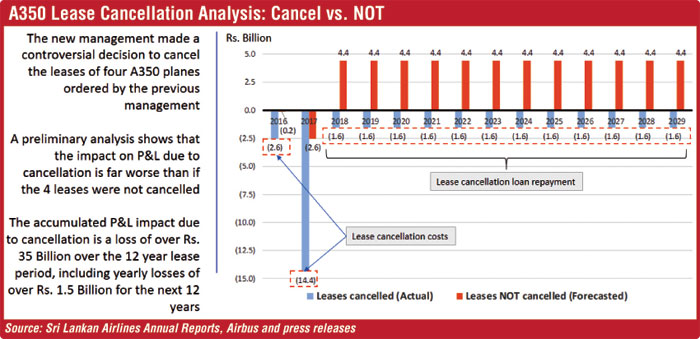

The politically motivated decision is costing the airline accumulated P&L losses of over Rs. 35 billion, including lease cancellation costs (phase 1) and lease cancellation loan payments (phase 2). Although the penalty fee to the lessor (AerCap) is now paid in full, the bank loan that was taken to pay the penalty still sits in the Balance Sheet of the company and will need to be paid out at a cost of around Rs. 1.5 billion every year for the next 12 years.

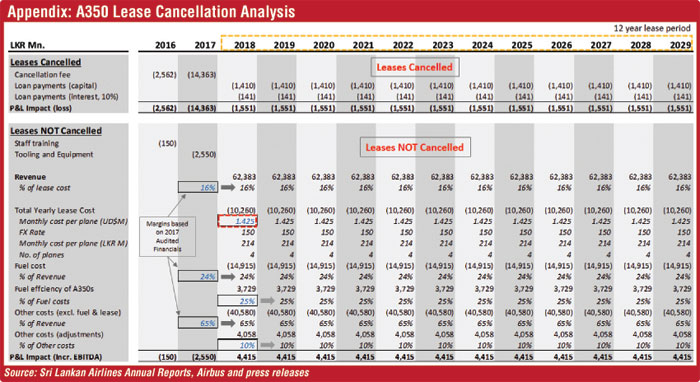

A breakdown of the Lease Cancellation Costs (phase 1), are as follows:

The story begins in June 2013when the previous management made a strategic rational business decision to replenish the ageing fleet with new assets including 8 new A350 widebody aircrafts. These aircrafts are the future of medium-to long-haul airline operations and its fuel efficiency provided a natural hedge against the challenges of volatile fuel prices at a time when fuel prices were at record levels and when over 50% of the Revenues earned was spent on fuel costs in that year. With 25% lower fuel consumption it is fast becoming the plane of choice for airlines around the world fighting against the common enemy, the fuel prices. The A350s are so popular that over 500 planes were ordered by various airlines around the world and only around 20% have been delivered so far. Such was the demand that it took AerCap (the lessor) only 3 weeks to find another home for the orphaned SriLankan aircrafts, placing them in the hands of Sichuan Airlines in China. Although it remains a mystery as to why Sri Lankan Government’s own efforts to sub-lease them to Turkish Airlines and Iran Airlines failed.

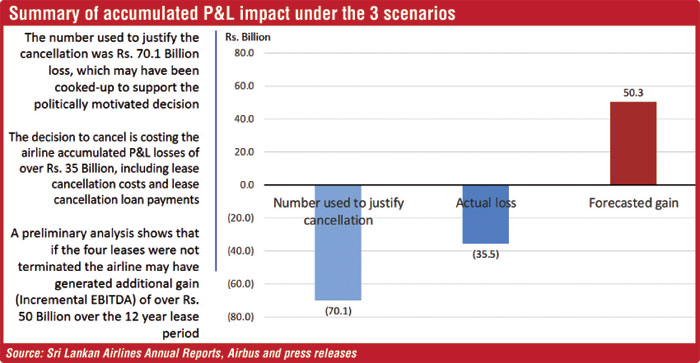

A preliminary analysis shows that if the four leases were not terminated the airline may have generated additional gain (Incremental EBITDA) of over Rs. 50 billion over the 12 year lease period. The number used to justify the cancellation was Rs. 70.1 billion loss, which may have been cooked-up to support the politically motivated decision. Apart from the initial staff training costs and the tooling and equipment costs, the 4 planes could have had a positive impact to the P&L, generated additional income of over Rs. 4 billion per year, as seen below:

P&L Impact – Leases Cancelled (Actual)

P&L Impact – Leases NOT Cancelled (Forecasted)

Summary of accumulated P&L impact under the 3 scenarios:

1.R s. 70 billion loss – this was the number used by the “government” to justify the cancellation

2. Rs. 35 billion loss – actual loss impacting the P&L

3. Rs. 50 billion gain – forecasted gain based on above analysis

The above preliminary analysis is based on the Lease Cost of the A350 and then applying revenue margins from the 2017 Audited Financials. I have also used manufacturers efficiency margins including fuel cost savings. Although lease costs are marginally higher, compared to the A330-300s which are currently used by the airline, it is more than off-set by the benefits brought about by costs savings from fuel & maintenance efficiencies and enhanced revenues due to more seating (ASK) and cargo space. While this is not a detailed analysis it highlights that the airline may have been able to make money with the A350s in use.

In fact the use of the A350s in the high yield European routes may have even turned the routes profitable. Germany is the largest outbound tourist market in the world and has been a strong high value inbound market for Sri Lanka for decades. Terminating the key European routes resulted in a Revenue drop of Rs. 6 billion in 2017 for the airline and the loss of a highly sought after exclusive routes. The routes form part of the intangible assets of the business and the terminations of these valuable routes is equivalent to an asset destruction exercise. The impact and the damage by this decision to the Tourism and Hospitality industry of the island is unmeasurable.

If not for the politically motivated destructive decisions by a corrupt few, SriLankan airlines would be proudly flying these brand-new beauties today.

(The writer is a former Investment Banker from London with Mergers & Acquisition and Corporate Strategy experience. He has worked for a number of International companies in London including HSBC Bank and Goldman Sachs. As an Investment Banker in London he was also involved in the team that advised Emirates when they were looking to sell their stake in SriLankan Airlines at the time. He holds an MSc in Engineering from Imperial College London)

RELATED ARTICLES:

Why SriLankan cancelled the A350s, SriLankan has its say

Response to SriLankan Airlines management on the A350 lease cancellations