Sunday Mar 01, 2026

Sunday Mar 01, 2026

Tuesday, 25 June 2019 00:00 - - {{hitsCtrl.values.hits}}

It was announced that the economy has grown by 3.7% in the first quarter (January-March) of 2019. This was a surprise to me, as I was expecting growth to slow down from last year.

Economy was slowing down from mid 2018

The growth was as low as 2.9% in the third quarter (July-September) and 1.8% in the fourth quarter (October-December) last year.

Early indicators in 2019 showed that the demand for credit was sharply lower and corporate earnings for the first quarter of 2019 also showed weakness. In light of the indication of further slowdown, one would have expected growth in 2019 to be less than 3%, compared to 3.2% in 2018. This was even prior to the Easter Sunday attack. Therefore, the first quarter growth of 2019 released by the Census Department was baffling.

Digging deeper into numbers

As the numbers defy logic, one has to dig a bit deeper into the numbers.

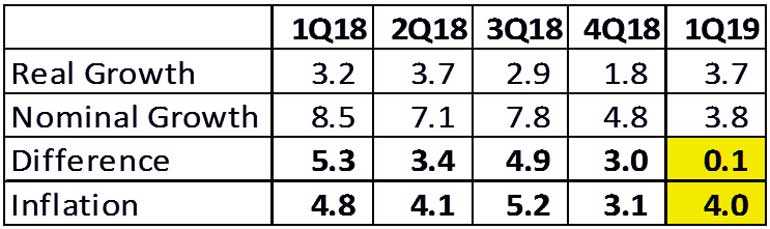

To put simply, the growth is referred to as “real growth”, which excludes the impact of inflation. The growth including inflation could be called “nominal growth”, but that’s not where the focus is. The table shows the “real growth” and “nominal growth” over the last five quarters.

Was inflation 0% in 2019Q1?

The data for 2018 clearly shows the difference between real growth and nominal growth, which is almost equal to the inflation during the period. While the real growth was around 3% in 2019, the nominal growth was around 7%. The difference of around 4% is almost equal to the inflation of 4.3% in 2018.

However the data for 2019Q1 shows that while the inflation remains at over 4%, the nominal growth and real growth is almost the same, which should be the case if inflation is close to zero! This is a significant contradiction in data, which the Department of Census would have to explain to the public. The failure to do so would seriously question the credibility of the data.

Agriculture sector grew or contracted?

Glancing at the numbers for the three main sectors, the question arises whether the Agriculture sector has grown or contracted. The real growth is given as 5.5% while nominal growth is -4.2%. Or in other words, in nominal terms the Agriculture sector has contracted by 4.2%. What that implies is a significant decline in price levels (deflationary conditions rather than inflation) in the Agriculture sector.

While real growth in Industry and Services sectors are given as 3.0% and 4.1% respectively, the nominal growth is shown as 6.8% and 5.5% respectively. That implies a measly 1.4% increase in price levels in Services sector. Only the Industry sector is implying a somewhat acceptable 3.8% increase in price levels.

Was real growth close to 0% in 2019Q1?

As the data is contradicting, one could estimate what the real growth is, if reasonable inflation numbers are considered. Inflation remained around 4% in 2019Q1. As the nominal growth was 3.8% in 2019Q1, it works out to a real growth of less than 1%!

This would actually be even lower than what one would have expected. As I mentioned at the beginning, we were anticipating a growth under 3% for 2019Q1 or possibly around 2.5%. A growth of 0-1% is sharply lower than that.

Some explanations needed by authorities

As analysts are compelled to do their own numbers and arrive at such concerning estimates, the authorities could do well to make an explanation with respect to the growth numbers published.

The absence of such explanation would possibly mean, a sharp decline in real growth numbers, much worse than one would have expected. If 2019Q1 growth was that low, the performance in 2019Q2 would be a sharp contraction with growth in negative territory. Therefore, going by the early indications, avoiding a contraction in the economy in 2019 would be a serious challenge. The last time we recorded a negative growth was in 2001, when the economy contracted by 1.5%. One could only hope that we wouldn’t have a similar 2019.

A kind action by Moody’s

In that light, the recent revision by Moody’s projecting a growth of 2.6% for Sri Lanka in 2019 is actually generous and optimistic. But one may wonder whether they have properly analysed and reviewed the most recent data and trends.

(The writers can be contacted via [email protected].)