Thursday Mar 12, 2026

Thursday Mar 12, 2026

Monday, 10 May 2021 00:03 - - {{hitsCtrl.values.hits}}

COVID-19 brought in opportunities for the manufacture and supply of personal protective equipment. Panic buying was also observed, which led to a rise in retail sales – Pic by Shehan Gunasekara

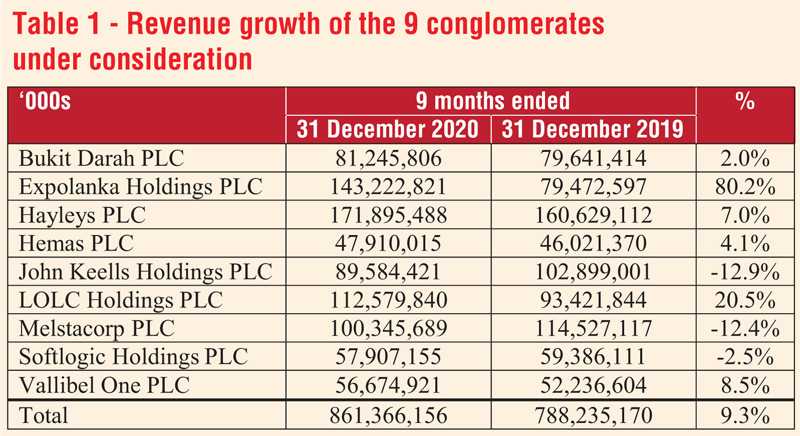

On 1 March, Daily FT published an article titled ‘9 conglomerates’ 9-month topline improves to Rs. 861 billion’ (http://www.ft.lk/front-page/9-conglomerates-9-month-topline-improves-to-Rs-861-b/44-713953). This article compared the nine-month cumulative performance in terms of revenue for nine of the top-listed conglomerates in Sri Lanka for the periods ended 31 December 2020 and 31 December 2019.

The nine conglomerates under consideration are Bukit Darah PLC, Expolanka Holdings PLC, Hayleys PLC, Hemas PLC, John Keells Holdings PLC, LOLC Holdings PLC, Melstacorp PLC, Softlogic Holdings PLC and Vallibel One PLC.

Six out of these nine conglomerates posted growth in their topline leading to a combined turnover of Rs. 861 billion. JKH, Mesltacorp and Softlogic posted a drop in their nine-month year-over-year revenue which partially offset the combined performance of the nine conglomerates.

This report analyses the underlying reasons for the increase in the performance of these nine conglomerates. The analysis is based on the published financial statements of the conglomerates. The analysis using financial statements helps point the real reasons for the improvement in performance. Identification of financial statement line items which have shown the highest growth year-over-year will be a good starting point to pinpoint the real reasons for growth.

The analysis is further extended to the management’s comments on their purview as to their corporate performance. A macro level analysis is also conducted to investigate the favourable conditions which led to the better corporate performance.

Introduction

Introduction

Six of the nine conglomerates, namely Bukit Darah PLC, Expolanka Holdings PLC, Hayleys PLC, Hemas PLC, LOLC Holdings PLC and Vallibel One PLC, posted positive growth in the revenue. It is worthwhile analysing the underlying reasons behind such an increase given that such growth comes in the midst of a pandemic.

Table 1 lists the nine conglomerates along with their nine-month cumulative revenue figures for the periods ended 31 December 2020 and 31 December 2019.

The combined revenue of the nine conglomerates rose to Rs. 861 billion for the nine months ended 31 December 2020 from only Rs. 788 billion for the nine months ended 31 December 2019. This is a 9.3% rise year-over-year. Given the challenging times that the corporates had to endure throughout the past months, this increase is quite impressive. Ranging from pandemic-driven demand to the recovery of palm oil prices, there were several macroeconomic factors that contributed to this increase.

Expolanka Holdings PLC showed the highest increase among the conglomerates, reporting a revenue increase of over 80%. Behind Expolanka was LOLC Holdings PLC recording a revenue growth of 20.5%. Bukit Darah, Hayleys, Hemas and Vallibel One were all able to report positive single digit revenue growth figures. John Keells Holdings PLC posted the highest drop in percentage revenue with a drop of 12.9%. Melstacorp PLC was not far behind reporting a drop of 12.4%. Softlogic Holdings too saw a marginal drop in its revenue reporting a drop of 2.5%.

LOLC was among the top conglomerates to show a huge increase in profits. LOLC’s profit before tax rose by a staggering 1,206%. However, this was due to the results of the divestment of a 70% stake of Cambodia’s largest microfinance company, PRASAC. It sold its stake to Korea’s largest bank, Kookmin for Rs. 120 billion. This gave LOLC a massive profit of Rs. 43 billion during the nine months ended 31 December 2020.

Factors contributing to the growth of revenue

Pandemic-driven demand

The conglomerates which saw an increase in their top line saw the higher demand stemming from the prevailing COVID-19 pandemic. COVID-19 was at its peak during the nine months ended 31 December 2020. During December global daily new cases were over a staggering 850,000. It suggests that COVID-19 rose to its peak during the nine months ended 31 December 2020. The demand for protective equipment was one of the major sources of demand which helped the conglomerates grow their top line.

Expolanka Holdings PLC started supplying personal protective equipment (PPE) which led to above 86% growth in its logistics segment. Hayleys PLC also reported above 57% growth in its hand protection segment due to the sudden spike in demand for PPE. The purification products segment too saw over 7% growth in its top line.

The demand for healthcare spiked during COVID-19. Hemas PLC reported 21% growth in its healthcare segment driven by PCR testing, tele health, home care visits and e-pharmacy.

The pandemic induced panic buying also led to a significant growth in the retail segments of the conglomerates. The consumer and retail segment of Hayleys PLC reported over 10% growth while John Keells Holdings’ retail segment too reported positive growth.

Vallibel one recorded a successful nine months posting a growth in its revenue by 8.5%. This growth was led primarily by its lifestyle segment. Revenue gains were also posted by the plantation and consumer segments. The lifestyle segment consists of the Rocell and Lanka Tiles, which benefitted from the import ban on floor tiles. The increase in demand for tiles leads the growth in group revenue.

Increase in commodity prices

Increase in commodity prices such as palm oil, tea and rubber, which saw drastic declines during the fourth quarter of the year ended 31 March 2020 recovered and reached record heights during the latter months of the nine months ended 31 December 2020.

Rubber prices which dipped during the initial months of the period under consideration, recovered steeply during the third quarter of the financial year ended 31 March 2021. This helped the conglomerates to recover the drop in volumes sold.

Tea prices in the global market did not rise as much as rubber prices but exhibited a volatile run. It also recovered by the end of the nine months ended 31 December 2020 and helped sustain revenues of the conglomerates.

Palm oil which was trading at extremely low levels rose during the latter months of 2019. It then collapsed during the fourth quarter of the financial year ended 31 December 2019. It then recovered quite quickly and rose to record highs. This enabled the companies to rake in massive profits and overturn the negative impacts of the drop in volumes sold. Bukit Darah’s oil palm plantations segment and oils and fats segment in Indonesia and Malaysia, which are predominantly based on the sale of palm oil grew by 33% and 21% respectively, which helped drive growth in the whole group. LOLC’s plantation and power segment rose by a massive 73%.

Vallibel One’s plantation segment, which is predominantly based on tea and rubber plantations, rose by 21%. Hayleys reported 18% growth in its plantation segment, which also consists of tea and rubber. Melstacorp, whose growth revenue declined year-over-year, also reported growth in its plantation segment by over 37%.

Low interest rate environment and the recovery of the equity market

Conglomerates engaging in financial services (ex: stock brokering and investment advisory) saw improved performance during the latter stages of the nine months ended 31 December 2020. During this time, there was a low interest rate environment prevailing around the world. In Sri Lanka too this environment prevailed. The Central Bank of Sri Lanka continued to reduce the interest rates to stimulate economic activity during COVID-19. The Standing Deposit Facility Rate (SDFR), which was 7% at the beginning of the year was gradually reduced and brought down to 4.5% by the end of the year.

With the reduction of interest rates, the public were reluctant to hold onto their deposits yielding fixed incomes (ex: fixed deposits) and brought their investments into the equity market. This sudden uptick in demand led to the Sri Lanka’s biggest stock market rally, which later led to the All Share Price Index of the Colombo Stock Exchange recording an all-time high of 7,922 points in January 2021. During this time, trade volumes were also on the higher end, which resulted to massive gains for the brokering companies involved. LOLC’s financial services segment, which is the highest contributor to group revenue, rose by over 17%. John Keells Holdings’ financial services segment too rose by over 17%. Softlogic’s financial services segment too reported an 8% growth.

Impact of cost cutting, cost management and lean accounting

This was another strategy used by many companies which helped the bottom line.

For Expolanka there was a reduction of administrative expenses by Rs. 420 million and also a reduction in finance costs.

Hemas PLC’s profit before tax rose by over 190%. The management credits such an increase in the profit to the working capital efficiencies and the cost rationalisation measures adopted by the company. The company has been able to reduce its selling and distribution and administration expenses by 15.6% and 23% respectively. A drop of a total of Rs 2.5 billion was observed in its main cost line items of administrative and selling and distribution expenses possibly due to the cost saving measures by most of its segments.

Hayleys PLC’s profit before tax increased by almost 200%, which was primarily driven by reduction in the finance cost. Finance cost reduced by Rs. 1.8 billion owing to the prevailing low interest rate environment.

JKH has seemed to struggle with its operational performance during the pandemic. It has gone from earning a profit before tax of Rs. 7 billion to a loss of Rs. 275 million for the cumulative nine-month period showing a drop of 103.9%. A primary reason for this change is the increase of Rs. 1.5 billion (60%) in its finance cost. This remains questionable given the low interest rate environment that prevailed both globally and locally. The group has not been able to reduce its costs along with the drop in its revenue. While administrative expenses have increased by 2.3%, it has been able to reduce its selling expenses by 8.2%.

For Melstacorp while the gross profit of the group dropped by over Rs. 7 billion, the cost reduction initiatives of the group materialised and it was able to contain the impact that it had on the bottom line of the group. The group was able to reduce its main cost items of selling and administrative expenses by Rs. 4.3 billion and finance costs by Rs. 360 million thus minimising the damage.

For Softlogic profit before tax dropped by Rs. 2.7 billion or 6,444%. The reason for this was that although the revenue dropped, the group was unable to reduce its costs along with the drop in revenue. Although revenue dropped, the cost of sales increased by 3.8%, which overtook the marginal reduction in the main cost items.

For Vallibel One the growth in profit before tax was further fuelled due to the drop in the finance costs of Rs 2.0 billion possibly due to the low interest rate environment that prevailed in the country.

Sectors impacted by the pandemic

In the case of Bukit Darah, the beverage sector consists primarily of the ‘Lion’ brand. The lockdown declared in the country and the closure of tourist arrivals impacted heavily on the drop of revenue in this segment although exports to African and Middle Eastern markets helped in the partial recovery of this. The leisure sector took a massive hit with the lockdown and saw a drop of 74.8% of revenue.

For Expolanka, a strong growth of 86% in the logistics sector was partially offset by the decline in the leisure and investment sectors due to the pandemic related disruptions.

In the case of Hemas the second largest segment, consumer, showed a drop of 2.6% year-over-year largely due to the drop in sales from the stationery segment, Atlas. The company could not materialise on the peak season of stationery sales due to the lockdowns imposed and the shift to online learning. The mobility segment too experienced difficulty during these trying times and saw a drop in revenue of 33.5% due to port congestion following the lockdown.

John Keells Holdings PLC was among the only three conglomerates to report a drop in its revenue. It showed the largest drop among the conglomerates with its revenue dropping by as much as 13% year-over-year. The largest hit to revenue was from the leisure segment. Although contributing only 3% to its overall revenue, the leisure segment reported a Rs. 8.8 billion drop in its revenue. While the obvious reasons being the lockdown and travel restrictions imposed by most of the countries around the world, JKH still could not capitalise on the gradual return to normalcy due to several bookings cancelled from European countries including the United Kingdom due to the variants discovered. The Maldivian segment showed an increase in its occupancy levels in the third quarter allowing for the mitigation of the negative consequences from the Sri Lankan segment. The transportation segment reported a drop in revenue of Rs. 5.1 billion. While the obvious reasons being the halt in operations was due to the COVID-19 pandemic, the corresponding nine-month period for the period ended 31 December 2019, saw elevated revenues due to the higher demand for low Sulphur fuel oil under the International Maritime Organisation regulations. The confectionery business also reported a drop in its revenue by 10.5% due to low demand for beverage and frozen confectionaries.

The diversified segment Aitken Spence caused the most harm to Melstacorp’s revenue posting a drop in revenue of Rs. 17 billion (- 45.7%). With the lockdowns imposed and the closing of borders in Sri Lanka and around the world, Aitken Spence, predominantly based on tourism, took a hard turn. The logistics sector, also falling under the umbrella of the diversified segment, experienced difficult times due to its operations coming to a halt with the pandemic.

The financial services and telecommunications sectors also, posted negative revenue growths of 11.0% and 12.0% respectively. The large drop in revenue stemming from the diversified segment was partially offset by the increase in the revenue from the beverages and plantations segments. The beverages segment largely consists of DCSL.

Softlogic’s revenue fell 2.5% year-over-year amidst the coronavirus pandemic. The largest impact on the group’s revenue was due to the drop of sales in the leisure and property segment. This segment lost Rs. 1.6 billion (88.7%) in revenue compared to the year ended 31 December 2021. This drop is due to the closure of the airports in Sri Lanka, which led to a halt in the tourist arrivals to Sri Lanka. The healthcare segment witnessed a drop in its revenue due to the halt in surgeries and treatments due to the patients having to postpone with no choice.

This drop was partially offset from the additional revenue from PCR testing and mobile healthcare units. The information technology segment too saw a drop in its revenue by over Rs. 500 million due to the closure of stores amidst the pandemic. However, this segment has been recovering over the past two quarters due to the surge in demand for laptops and other devices. The drop in group revenue was partially offset due to the increase in the revenue from the financial services segment due to the above-industry performance of Softlogic Life Ltd.

Conclusion

Nine of the top conglomerates in Sri Lanka reported revenue of Rs. 861.3 billion for the nine months ended 31 December 2020. This was an impressive 9.3% growth compared to the nine months ended 31 December 2019 especially due to current pandemic situation.

The growth in revenue was attributed to pandemic-driven demand, increase in commodity prices and the low interest rate environment, which led to the recovery of the equity market.

It was also noted that the import restrictions had tremendously contributed to the increase in the turnover and profitability of the floor tile industry.

COVID-19 brought in opportunities for the manufacture and supply of personal protective equipment. Panic buying was also observed, which led to a rise in retail sales.

Healthcare industry too saw novel opportunities with PCR testing. Commodity prices such as rubber, tea and palm oil rose to record levels, which enabled the companies involved in these cultivations to overrun the negative impacts of lower sales volumes.

The lower interest rate environment led to a rally in the equity market which in turn boosted the revenue of companies in the investment and wealth management industry.

However, the leisure and travel industry took a major turn and reported drastic drops in revenues. Conglomerates overly dependent on leisure saw drops in their revenues.