Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 8 October 2019 00:00 - - {{hitsCtrl.values.hits}}

By Mangala Samaraweera

On 9 January 2015, as the Rajapaksa family took off to Medamulana, they flew past many of their white elephants. In Colombo, it was the Lotus Tower. As they landed, the empty and unused Mattala Airport, Hambantota Port, Cricket Stadium, IT Park, Cinema Park and Conference Hall must have come into view.

The Treasury Building – the nerve centre of Sri Lanka’s economy – probably went unnoticed. That is no surprise. For inside its books and coffers contained a rather inconvenient truth. And a tragic one. The Rajapaksas left Sri Lanka in a debt trap. The Rajapaksas borrowed more foreign debt – at higher interest rates – than any previous government. That would not have been such a complete disaster if the debt was invested in high-return projects. Instead these expensive funds were spent on white elephant construction and consumer imports.

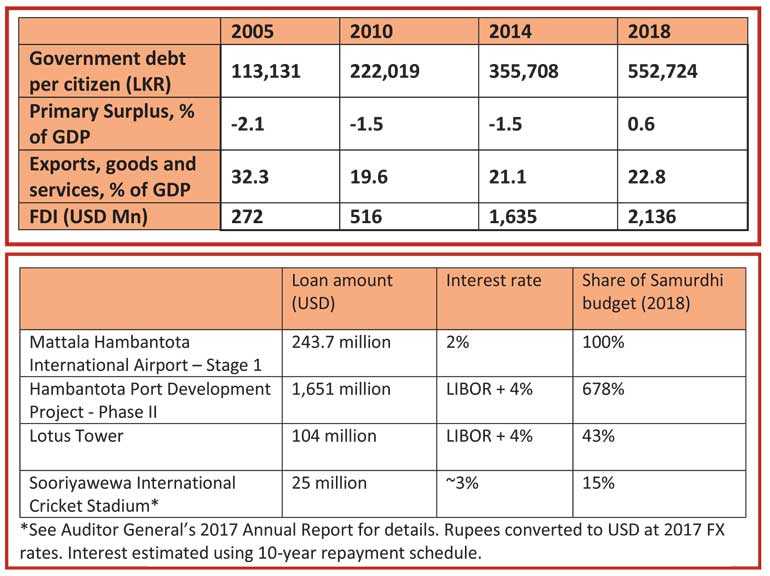

When the Rajapaksas assumed office in 2005, Government debt per citizen was Rs. 113,131. When they left it was Rs. 355,708. The real picture is even worse. Until 2007, virtually all of Sri Lanka’s foreign debt was on concessional terms. But from 2007 onward, Sri Lanka started to commit the ‘original sin’ of borrowing in a foreign currency loans on expensive commercial terms.

In fact, in 2013, the Rajapaksa Government directed the National Savings Bank to obtain $750 million from international markets at the highest ever interest rate of 8.9%. This is at a time when the global benchmark rate for that type of loan was 1.3%. The Chairman of NSB at the time, a respected civil servant, was removed and replaced with a batch-mate of the then Treasury Secretary on the instruction of the then Finance Minister, Mahinda Rajapaksa.

The irresponsibility and mismanagement does not end there. While the Government went on a borrowing spree on international capital markets, government revenue plummeted. In 2005 Sri Lanka’s tax-to-GDP ratio was 13.7%. By 2014, it was 10.1%, one of the lowest in the world. As a result, expenditure necessary for long-run growth such as health and education suffered. And Sri Lanka needed to borrow more just to repay the Rajapaksa loans.

In 2014 interest payments amounted to Rs. 436 billion, 24% of Government expenditure. But because of all the Rajapaksa debt, especially expensive foreign debt, today interest payments are 31% share of Government spending. In order to pay salaries, keep the lights on in hospitals and run the country we have had to borrow just to pay back our old loans. The whole country should know that since 2016, all the money we have borrowed has been to pay back old loans.

Perhaps worst of all, the much-anticipated post-war boom never materialised. Sri Lanka lost GSP+ and a fish export ban to the EU was imposed. We were on the verge of targeted sanctions. The words “human rights abuse”, “war crimes” and “dictatorship” were the words associated with Sri Lanka in the international media at that time.

The illegal ouster of the Chief Justice, expropriation of private property, stock market pump-and-dump and culture of bribery and impunity forced foreign and local businesses to invest elsewhere. Vietnam, Bangladesh and Ethiopia prospered. We stagnated.

There is no better example of the Rajapaksa’s mismanagement than airlines and airports. They took a profitable, well-managed and rapidly expanding airline and ran it to the ground. After they nationalised Sri Lankan because the CEO did his job and followed the rules, it made consistent losses.

The lease agreements they entered into are so draconian that the airline will post losses for some years to come. And the less said of Mihin Lanka the better. Mattala Airport was built using 209 million dollars of foreign loans. Loans we still pay interest on. Yet the airport has been empty for years.

What right does a President responsible for the hedging scandal, Greek investments scandal and the most corrupt and wasteful administration since Independence have to talk about handling State finance?

Despite this legacy, we have stabilised the economy. Last year, Sri Lanka had its first non-trivial primary surplus in 63 years. This means that, leaving aside interest payments, Sri Lanka’s revenue was greater than its expenditure for the first time in over six decades. No other government has succeeded in achieving this target. This also means that, since 2016, all Government borrowings have been used to settle debt. Not for any other expenditure.

Despite the coup and the Easter bombing the economy has held-up. We have put some key fundamentals in place. Government revenue, measured as a percentage of GDP, is up by 16% from end-2014. Exports, again as a share of GDP, rose from 21% in 2014 to 23% today. Capital expenditure on health doubled and no government increased education spending as quickly and as substantially as we have.

There have been countless infrastructure projects: the Moragahakanda and Kalu Ganga Dams and irrigation schemes, and Uma Oya multi-purpose development project. Under the Gampereliya scheme, more than 105,000 projects were implemented across 160 electorates. To date, nearly 40,000 roads and bridges have been built to facilitate rural and urban transportation. Nearly 1,500 projects have been implemented across the island to renovate or construct sanitary facilities in schools.

Enterprise Sri Lanka has disbursed nearly Rs. 65 billion in the form of concessional loans to entrepreneurs in the country, with capital flowing into sectors including agriculture, services, and manufacturing for the domestic and export markets. The LRT and Colombo Elevated Highway will go a long way to solving traffic problems in the city.

As you all know, Government salaries have more than doubled, in addition to the 2500 rupee allowance. From 1 January, the Presidential Commission Report on salary anomalies will be implemented. And perhaps the greatest benefit of all is the control of inflation – the cost of many essential goods including food items and fuel have fallen.