Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 16 November 2017 00:09 - - {{hitsCtrl.values.hits}}

By Son of the Soil

We are not only amused but perplexed to read the article in the Daily FT of 15 November which is not only misleading but maliciously written by a mercenary of interested parties with no national interest.

The shipping industry is already liberalised - Analyst misconstruing facts

The Ministry of Finance appears to have been grossly misled by the so-called experts who have no practical experience in the shipping and logistics industries.

Current regulations permit 100% foreign ownership in all key areas of the shipping and logistics industry such as Warehousing, Multi-Country Consolidation, Entre-pot Trading, Bunkering, Supply of Marine Lubricants, Chandelling Services, Waste Disposal, Offshore/Marine Services, Ship Repair, Container Depot, Container Freight Stations, Trucking and Distribution, Shipbuilding, Salvage and Towage, Marine Security, Ship ownership/Management, Ship Brokering/Insurance, etc. all aspects of which constitute a maritime and logistics hub. Hence it is totally incorrect to say that the shipping and logistics industry is not liberalised.

The only exception is in the shipping agency and freight forwarding which is restricted by law up to 40%, which is asset-light and non-capital intensive.

The Government’s policy of liberalisation is well-accepted by the shipping industry. In fact the industry is liberalised in that any shipping line can call at Sri Lankan ports to load, discharge and transship cargo without any limitations.

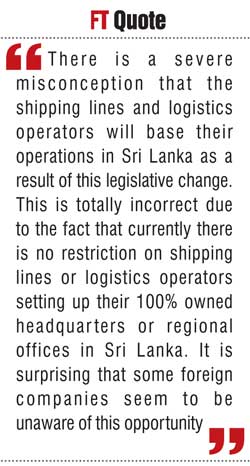

There is a severe misconception that the shipping lines and logistics operators will base their operations in Sri Lanka as a result of this legislative change. This is totally incorrect due to the fact that currently there is no restriction on shipping lines or logistics operators setting up their 100% owned headquarters or regional offices in Sri Lanka. It is surprising that some foreign companies seem to be unaware of this opportunity.

Further, as the activities mentioned in the paragraphs above are permitted for shipping lines or freight forwarding companies to have 100% ownership, why haven’t they invested in these sectors?

Conversely, 40% of some shipping agencies have been held by foreign ownership and we are yet to see any substantial investment in the country’s shipping and logistics industry from these foreign owners over the past 20 years. We therefore fail to understand how permitting 100% ownership in a shipping agency, which does not require heavy capital investment, would persuade them to invest locally.

Any opening up of the agency business needs to be linked to very substantial Foreign Direct Investment (FDI) which will be sustained in the country for several years, boosting our economy and providing employment to the people of Sri Lanka, in which case the benefits would be clear.

Minister of Ports and Shipping not consulted

The Budget proposals lifting the restriction on foreign shareholding in shipping agencies and freight forwarding companies without having consultations with the industry stakeholders or even the line ministry comes as a surprise.

The Minister of Ports and Shipping, in a televised interview, spelt out the contribution the local shipping agency and freight forwarding community makes to the national economy. More importantly, he also highlighted the foreign exchange earnings and tax revenue that the Government receives through these local companies that have also reinvested over the years in related and diverse businesses. These local entrepreneurs have shown continuous faith in the economy by investing and promoting Sri Lankan ports even during the height of the 30-year civil war.

Statements made by Analyst in the 15 November Daily FT article clearly show that its author is not from the industry and has no knowledge of the industry and is displaying his ignorance – e.g. disputing the income generated by the shipping and logistics industries and confusing this as freight revenue.

It is rather disappointing to note that a respected Minister of this stature has been criticised on the position he has taken when in fact two previous independent presidential commissions on maritime matters have upheld that the 40% foreign ownership threshold in shipping agencies should be maintained.

The restriction in foreign ownership of shipping agencies or freight forwarding has not inhibited shipping lines’ interests in investing in port terminal capacity in Sri Lanka as displayed in the expression of interest for ECT where all major shipping lines such as MAERSK, MSC, CMA CGM, NYK and PIL have expressed interest in investing in the East Container Terminal. Another example would be the case of SAGT where there have been investments from major international shipping lines.

Maritime hub

The Government’s vision of making Sri Lanka a maritime hub is fully supported by the whole industry. But what does a maritime hub entail? A maritime hub constitutes world-class facilities for air and seaports, which caters to the container, bulk, tanker, offshore and LNG markets. A maritime hub should also offer both technical and maritime commercial services such as finance, brokering, insurance, surveying, legal and arbitration.

A maritime hub also provides ancillary services such as ship husbanding, transshipment of cargo, multi-country consolidation, bonding and warehousing, sea air cargo movement, entre-pot trading, bunkering, marine lubricants and fresh water supplies, offshore supplies and ship chandelling, ship layup, services to cruise ships and yachts, maritime security, ship repair and shipbuilding, salvage and towage, waste disposal facilities, seafarer training and recruitment.

At a macro level, the policies should also entail a transparent legal framework, strong rule of law, Ease of Doing Business, modernised Customs laws and strong FTA agreement to facilitate business, all of which are provided in a competitive and cost-effective business environment.

With the Government’s vision of becoming a true maritime and logistics hub, we need to address all the above aspects concurrently.

We wish to draw the example of Dubai, UAE which does not permit 100% foreign ownership in their shipping agency business but they are one of the largest maritime and logistics hubs in the region. Despite the limitation in foreign shareholding in agencies, foreign shipping lines have set up regional offices, headquarters operations, regional logistics and distribution centers, marine and offshore activities as well as other related services. As such it is evident that diluting local shareholding in the shipping agency business is not the criteria for attracting shipping lines to invest in the country and thereby become a maritime hub.

We wish to draw the example of Dubai, UAE which does not permit 100% foreign ownership in their shipping agency business but they are one of the largest maritime and logistics hubs in the region. Despite the limitation in foreign shareholding in agencies, foreign shipping lines have set up regional offices, headquarters operations, regional logistics and distribution centers, marine and offshore activities as well as other related services. As such it is evident that diluting local shareholding in the shipping agency business is not the criteria for attracting shipping lines to invest in the country and thereby become a maritime hub.

The shipping agent takes on the responsibility of handling shipments and cargo and the general interest of its customers, at ports and harbors worldwide on behalf of ship-owners, managers and charterers. The agency business requires low investment; it is asset-light, low capital intensive and a service-oriented organisation with local expertise and knowhow. There is no evidence of significant FDIs brought into a country purely for establishing a shipping agency.

The role of shipping agents is very much alive and needed in all countries. The role played by the shipping agents is an important one as they are the ones who market the ports in Sri Lanka, lobby the lines and attract them to call at Colombo or other ports in Sri Lanka. The shipping agents use their own resources to secure agencies, attract lines to call at Colombo, push for transshipment cargo to be routed via Colombo and also bring in foreign exchange. It’s the “local” agent who has expertise in local procedures, etc. and hence the need for local representation for the international shipping line.

No benefit

The argument in offering 100% ownership of shipping agency business to foreigners, anticipating them to bring in investments, create more jobs and generate more cargo volume, is an absolute myth. What will happen is the reverse. The foreign shareholders will bring in expatriates from overseas to run the office depriving locals of job opportunities, will push all the service providers to reduce rates, etc., thereby depriving the service providers of earnings in foreign exchange, will make the Colombo office a cost centre showing no profits at all because the foreign investor will bill all expenses to the local office, thereby depriving the country of foreign exchange and taxes and also deprive the country of investments in other sectors.

The Port of Colombo is already operating at almost full capacity and hence the need of the hour is to enhance port capacity which will attract more volume as displayed in the past.

In Sri Lanka, the shipping agents service over 8,000 casual caller vessels (non-container vessels) per annum. The number of containers vessel calling at Sri Lanka ports is around 3,500 per annum. Most of this business of casual caller vessels is canvassed and promoted by the local shipping agents who are mainly SMEs. The easing of the foreign ownership restrictions will adversely affect the SME agents.

National Interest

The Minister of Ports and Shipping has highlighted the fact that to open up an industry that is generating valuable foreign exchange to the country and also contributing to the national coffers by way of taxes, there has to be a justifiable reason.

The Minister has categorically stated that what the country needs is FDI and that in the shipping agency business there is no requirement of sizeable FDI.

If shipping lines are willing to bring in investment of a sizeable sum, then there is benefit to the country and that will justify lifting the restriction of foreign ownership in the shipping agency business.

Without any FDI what is the justification in permitting 100% foreign ownership when it is very evident that the country is going to lose $ 800 million in foreign exchange and over 500 local companies, most of which are SMEs, and the livelihoods of over 100,000 people will be affected.

The maritime industry stakeholders wholeheartedly support the Finance Minister’s vision of developing Sri Lanka into a maritime hub and are actively engaged, along with the Ministry of Ports and Shipping, in developing a maritime policy document with the vision of making Sri Lanka a leading maritime nation and addressing the various impediments to the ease of doing business, bureaucracy and bottlenecks in the supply chain.