Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 30 May 2018 00:00 - - {{hitsCtrl.values.hits}}

By W.A Wijewardena

Detecting even minor lapses

It was 26 August, 2000. The Central Bank’s new state-of-the-art building was to be declared open by Deputy Minister of Finance Prof. G.L. Pieris. Governor A. S. Jayawardena, Deputy Governor Manik Nagahawatte and I, were standing under the foyer of the building to receive the Chief Guest. This event coincided with the Central Bank’s hosting of the South East Asia, New Zealand, and Australia or SEANZA Governors’ Symposium in Colombo and the Central Bank’s Golden Jubilee celebrations.

All the guests had already been seated in the main hall of the new building. AS was pacing up and down along the street side pavement of the building examining the final touches made for the decorations. All of a sudden, he bent down to pick up a tintack nail lying on its head. Handing it to a security officer nearby, he quoted one of Murphy’s Laws: “If anything can go wrong, it will”, implying that that little nail could do an indescribable damage to the reputation of the bank had it got stuck under the sole of the shoe of a guest. He did not want even a small tintack nail to tarnish the good name and reputation of the bank.

The perfectionist to a fault

That was A.S. Jayawardena, the perfectionist. In fact, it was his fault too. Whatever he did and whatever he wanted others to do – no matter whether it was economic policy or Central Bank building or cooking soups at the bank’s cafeteria – he wanted nothing but perfection. Those who were unable to play it according to his high benchmarks could not survive with him. He sat with young officers like me for hours and hours, correcting our drafts. In the process, he taught us where we had gone wrong. He could do so well because he was well-versed in both Sinhala and English. On top of that, his overall superior knowledge on any subject made him the most qualified to correct our writings.

Rebuilding and modernising the bank

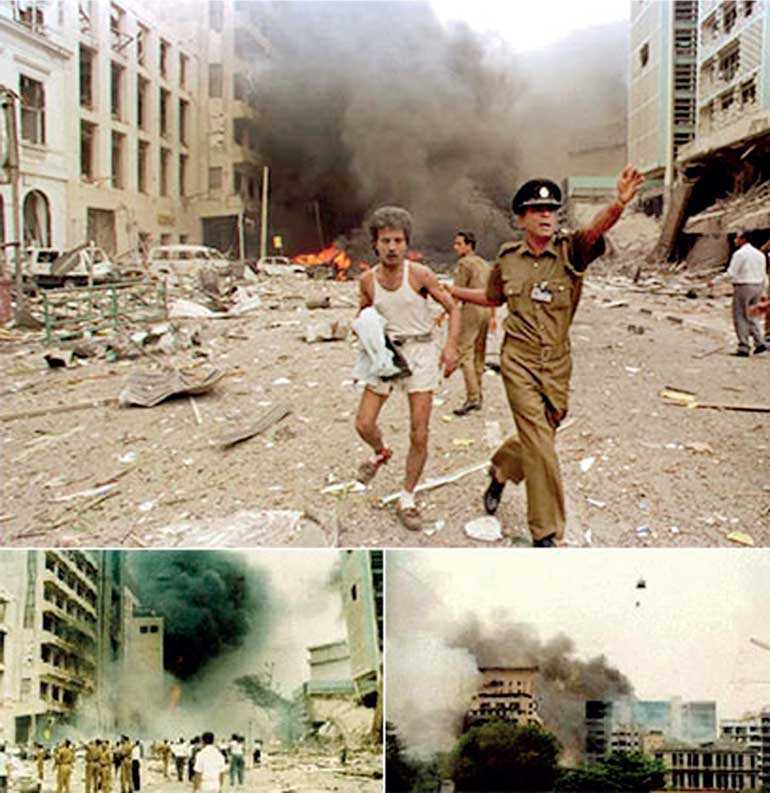

I can write volumes about AS but, I would just concentrate on one thing that stands above all other contributions he had made. That was how he rebuilt the bank after it was virtually destroyed by a bomb explosion by the LTTE in front of the bank’s main building in January, 1996 and how he used the opportunity to modernise the bank to be on par with the other modern central banks in the world.

Defeating LTTE

The objective of the LTTE was to destroy the bank and through that, destroy Sri Lanka’s economy. They were successful in destroying the physical infrastructure of the bank but they failed to destroy the morale, determination and courage of Central Bank employees. AS used this to defeat the LTTE and he was successful in doing so. In fact, he rebuilt the bank out of its adversity to gain prosperity for all.

Putting a bold face amidst adversity

AS appeared on national TV on the same night and assured the public that the bank would start its operations in an alternative location immediately. He said that terrorists could destroy the Central Bank building but not the morale of its employees. Hence, the terrorists had failed to achieve their objective. This was reassuring enough for the bank’s stakeholders who had feared that the Central Bank had completely been destroyed by the terrorist attack. True to his word, the bank started its operations on the following day at its Staff Training College at Rajagiriya.

Support pledged by commercial banks

On the same day, there was a meeting with Chief Executive Officers of all the commercial banks. Banks were instructed to issue currency to the public from their stocks to assure that there was no currency shortage. To facilitate the Central Bank to make its own payments, Bank of Ceylon, the largest and the most stable commercial bank, offered a credit line to it. This was a rare occasion in which the Central Bank, the banker to commercial banks, had to rely on a commercial bank to settle its payments but it was necessary to assure the public that the bank had not been destroyed as targeted by terrorists.

Similarly, the People’s Bank offered its services to disburse funds and receive repayments under the bank’s development credit schemes which had been funded by many donors. Thus, funding flows to development projects continued without any interruption. Both the Bank of Ceylon and the People’s Bank came forward to assist EPF to receive contributions from employers and make refunds to members. Thus, AS was able to marshal the needed support of all commercial banks to manage the financial economy without interruption.

Convincing the media with confidence

AS then met both the local and foreign press. He used the press briefing to assure everyone that the bank was not dead, it had started functioning again and it would soon restore normalcy. This was in fact a testing of AS’s maturity and experience. Answering the media was not a problem for AS who was a career central banker, a former finance secretary and an international civil servant. That was important to quell the suspicions of the media personnel. Thus, the media briefing was successful in communicating the bank’s position.

Clarity and transparency in Central Bank communications

What AS demonstrated was that the Central Bank’s communication policy was important in establishing its reputation among the stakeholders. The bank should not have any fear of coming before the media and explaining its position to the public. If it does not, the media as well as the public start suspecting that there could be some underhand dealings in the Central Bank which the bank attempts to conceal from the public. What AS did was the observance of the three basic pillars of a central bank’s communication policy: clarity, transparency, and predictability. The Central Bank should be ready to clarify not only what it has done or what it has proposed to do but also any rumour in the market damaging the bank’s reputation.

Team spirit is the key to regain reputation

One important contributor to the rebuilding of the Central Bank while preserving its reputation after the bomb explosion was the excellent teamwork displayed by all the senior officers of the bank. There was healthy competition among the senior officers to do the best for the Bank as it should be in any growing and dynamic institution. However, when it came to rebuilding and modernising the bank, all senior officers functioned as a single team demonstrating team-spirit in every move they made. Within teams, there were diverse opinions. That was encouraged because that culture led to the building of a creative workforce. However, they were debated freely at team meetings allowing the bank to choose the best path for its future development.

‘The Long Room’ operation

The Bank set up a temporary field office at its Staff Training College at Rajagiriya. AS occupied one of the lecture rooms which had a long table. Immediately, it was christened ‘the long room’. AS was at the head of the table and the two Deputy Governors S. Easparathasan and P. Amarasinghe, next to him. All executive directors were seated wherever they could sit at the table. When heads of departments visited him, he gave orders for various actions but not before writing them down in a CR register. That was to keep a record of all the orders he had issued. From that long table, AS, two Deputy Governors, and Executive Directors mapped out the plans for the restoration of the bank.

Identification of excess fat in the bank

Because of the space limitation, the bank could accommodate only about 500 employees at the Staff Training College. Out of the total staff of about 2200, about 1200 had been injured and were at hospitals or at homes. Out of the balance 1000, only about 500 were called for duty and the balance was placed on compulsory leave. With that limited staff, the bank was not only able to do all the work it had to do, but also do a better job. It revealed that the bank had been overstaffed and it was time to go for a lean and better bank. This was the birth of the modernisation project that was implemented in the bank from 2000 to 2005.

Steering Committee on Modernisation

When the bank decided to modernise itself, the enterprise was supported by IMF and the World Bank: IMF providing technical expertise and the World Bank, funding. I had the privilege to chair the steering committee that planned and executed the modernisation project under AS’s guidance. He gave me a free hand in running the affairs with the requirement that I consult him on all important matters. I was supported by the other Deputy Governor, the late P.M. Nagahawatta, all the Executive Directors and other staff. I had frequent meetings with AS and it was at those meetings that I came to know the real visionary living in AS. The project was funded jointly by the Central Bank and the World Bank as an external funding agency. AS insisted that the World Bank funding was necessary to meet the foreign exchange commitments involved in the expenditure. It was a soft loan granted to the Government and the then Treasury Secretary P.B. Jayasundera made available the loan funds as a grant to the Central Bank.

Pillar I of the Modernisation Project: Technology improvement in the bank

The modernisation project had four objectives: introduction of modern technology to the bank, updating the legal structure of the bank, creating a lean but efficient organisation and improvement of the talents and technical skills of the bank’s staff. The introduction of modern technology had three components: the establishment of a modern payments and settlement system including a real time gross settlement system, known as RTGS, the automation of the general ledger of the bank and the introduction of a scripless government securities system with the associated Central Depository System or CDS.

Pillar II of the Modernisation Project: Lean organisation

It had already been noted that the bank had been overstaffed and it could be well managed with a staff of only 800. The Steering Committee mapped out offering a voluntary retirement scheme to the excess staff. It was to be funded up to 80% out of the World Bank money, to be received by the Government as a grant. Since the bank employees at all levels were enjoying high perks, it was necessary to offer them an equally high compensation formula. Accordingly, the final formula offered was one of the best in the country but, in view of the available facilities in the bank, was not so generous as many had believed. Thus, the unions were against it and openly canvassed that the staff should not take it. This was a show of strength between AS and unions. AS explained the benefits to staff if they take up the voluntary retirement scheme in a series of long memos; though there was no interest shown by the staff for the scheme at first, toward the last few days, thanks to AS’s long memos, a renewed interest was shown by everyone. On the last day before the deadline, 1000 bank employees had applied for voluntary retirement that strangely included almost all the office bearers of the main trade union that had been fiercely against it, the Central Bank Employees Union.

Pillar III of the Modernisation Project: Creating a learning organisation

The main asset which the Central Bank has is its staff but that staff would mean nothing if they have not upgraded their knowledge to be on par with the growing talent requirements of a modern central bank.

AS wanted to convert the bank into a learning organisation. He allocated a generous budget for postgraduate studies and training. A special Management Development Centre was set up to train the staff continuously. A monthly public lecture program was introduced in order to bring the staff and the public up to date on emerging development issues. Foreign experts in the relevant fields were engaged to deliver the lectures. Staff talent mapping and performance based staff evaluation methods were introduced. Learning at all levels and at all times was the motto of the bank.

Pillar IV of the Modernisation Project: Legal changes

It was necessary to make sweeping changes to the law relating to central banking and commercial banking up to date. As a first step, the Monetary Law Act was amended, clearly focussing on two co-objectives of the bank: economic and price stability and financial system stability. Previously, the bank had multiple objectives which very often clashed with each other when the bank sought to attain them. Hence, the necessity for focussing on two main co-objectives.

However, making economic and price stability one of the co-objectives ran into trouble because no central bank in the world had this strange addendum called ‘economic’ added to price stability objective. All of us were puzzled but AS had a fine explanation. He said that if the bank focused only on price stability, it would run the risk of seeking to stabilise a price index which could be attained by artificial means.

An obvious misuse was price controls which would record a lower growth in the index today but would bring about inflation in the future. Hence, the Central Bank should not be complacent until it has stability in the whole macro economy. The events that took place subsequently fully justified AS’s foresight.

The above is only a few contributions which AS made for the long term development of the Central Bank. It suffices to say that to do full justice to this visionary, one may have to write a book. He faced a lot of adversities during his tenure as the Governor. But his remarkable quality was that he managed to convert all those adversities into prosperities.

AS has now left us. He has left behind Lalitha, Menaka, Migara, and Sonali who had been behind him through weal and woe. He is no more in physical form, but he is remembered forever. That is the wonder of this great man.

The writer is a former Deputy Governor of the Central Bank.