Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 4 April 2016 00:00 - - {{hitsCtrl.values.hits}}

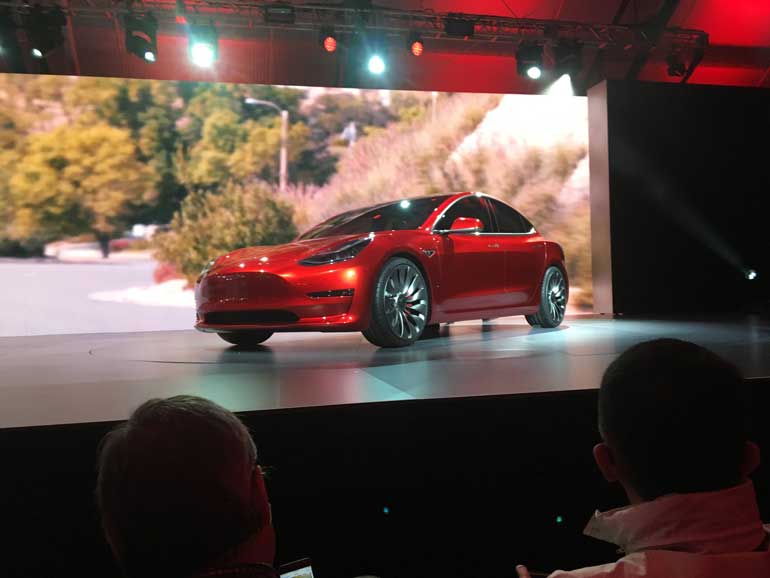

Tesla Motors’ mass-market Model 3 electric cars – REUTERS

A Tesla Model 3 sedan, its first car aimed at the mass market, is displayed during its launch in Hawthorne, California, March 31, 2016. Picture taken March 31, 2016. REUTERS

Reuters: Tesla Motors gave a sneak preview Thursday of its Model 3 sedan, saying more than 130,000 people had ordered the car, even though it is more than a year away from production.

Tesla Chief Executive Elon Musk unveiled a prototype of the Model 3 in Hawthorne, California outside Los Angeles to hundreds of Tesla owners and the media, saying the vehicle will go into production in 2017 at a starting price of $ 35,000.

The Model 3 is critical to the Silicon Valley automaker’s growth plans and to sustaining its lofty stock price. Tesla shares have jumped in recent days in anticipation of the Model 3 launch.

The Model 3 will enter a crowded field of luxury and electric cars that includes gasoline-fuelled models such as the Audi A4 and BMW 3-Series, and electric models such as the forthcoming Chevrolet Bolt EV from General Motors Co.

“Do you want to see the car?” teased Musk, to screams from the audience in the hangar-sized facility inside a Tesla design centre. “We don’t have it for you tonight – just kidding!”

Three Model 3s were driven onstage. The compact sleek four-door car with no grille features a roof that is a panoramic pane of glass from front to back.

Musk said that 115,000 pre-orders had already been taken on Thursday alone for the car. Within a half hour, that number reached 137,600 in a rolling scroll projected onto a screen.

Fans had camped out overnight, queuing outside Tesla stores across California to put down deposits on the car in scenes reminiscent of the launch of Apple Inc products.

The Model 3 is crucial for Tesla to reach its goal of selling 500,000 cars per year by 2020. The success of Tesla’s Gigafactory, its battery factory near completion in Nevada, is also contingent on the Model 3.

Tesla says scale from the massive facility will cut the cost of its battery pack by 30% to enable the lower-priced vehicle.

High expectations ahead of the unveiling have restored Tesla’s shares to around the $ 230-mark, recovering from a year low of $ 141.05 in February after analysts cut price targets and revenue expectations.

“It is important to the industry because it will signal whether or not Tesla Motors is a major threat to the status quo or just another wannabe car company with a fleeting chance for long-term success,” said Kelley Blue Book’s Jack Nerad.

GM is on track to beat Tesla to the market with its Chevrolet Bolt electric car, which GM says will launch late this year, offering about 200 miles of electric driving range and a starting price of around $ 35,000.

A new generation of Nissan Motor Co’s Leaf electric car is also expected to offer more driving range at a similar price.

The Model 3 and others in the new generation of electric vehicles face challenges from low gasoline prices, high battery costs and uncertain investment in recharging infrastructure.

Through the first two months of this year, sales of all-electric and hybrid vehicles are down nearly 9% to 60,384 vehicles, data from trade group the Electric Drive Transportation Association shows.

That’s fewer hybrid and battery electric vehicles sold in two months than Ford sold of its F-series large pickup trucks in February alone.

Several short-term concerns, such as that Model 3 production will be delayed, and the slow ramp of the Model X will continue, go hand-in-hand with sceptics’ longer-term worries that the unprofitable company will continue to bleed cash.

In February, Tesla said it would start generating positive cash flow this month.