Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 19 April 2017 00:00 - - {{hitsCtrl.values.hits}}

Reuters: Global automakers face fresh threats to their profits in China from domestic automakers SAIC and Geely, which are launching new models and marketing strategies to challenge better-known foreign brands in the world’s largest car market.

Reuters: Global automakers face fresh threats to their profits in China from domestic automakers SAIC and Geely, which are launching new models and marketing strategies to challenge better-known foreign brands in the world’s largest car market.

The country’s biggest automaker, Shanghai Automotive Industry Corp (SAIC), wants to double sales of its fully owned domestic brands this year – albeit from a low base – executives told a group of reporters on Monday.

“China success is the base of overseas market success,” said Zhang Liang, product portfolio planning director for SAIC Motor’s passenger vehicles operation.

Zhang said SAIC’s MG and Roewe – brands based on technology acquired from bankrupt British car maker MG Rover – plan a total of five car models and nine sport utility vehicles, and would aim to offer quality comparable to global brands such as Nissan, but at a lower price.

A concept shown to reporters for an MG sports coupe it will exhibit at this week’s Shanghai auto show could pass for a Jaguar.

“I worry for them,” Zhang said of the global brands. “You see local technology getting stronger and stronger.”

SAIC, controlled by Shanghai’s municipal government, has toiled for years in the shadow of its foreign partners, Volkswagen AG and General Motors Co, who are obliged by Beijing to form joint ventures with a local automaker for their China operations.

Those two joint ventures accounted for about 16.5% of the Chinese passenger car market last year, compared with just 1.3% share for SAIC’s own brands.

However, those 50-50 alliances with GM and VW have generated floods of cash that SAIC has ploughed into hiring European designers to give its future MG vehicles more flair.

It has spent 2.25 billion yuan ($327 million) on new research and engineering facilities in Shanghai, where company engineers are working with the same suppliers as their foreign rivals to improve the safety, quality and reliability of MG and Roewe models.

In one lab, Roewe and MG vehicles are shaken on machines that simulate rough roads. In another lab, cars are frozen, then subjected to broiling simulated desert heat, while engineers evaluate the performance of engines and climate control systems.

With the help of suppliers such as Mobileye NV, an Israeli autonomous vehicle firm Intel is buying for $15 billion, SAIC plans to offer advanced safety systems such as automatic emergency braking, as established rivals do.

European styling, Chinese costs

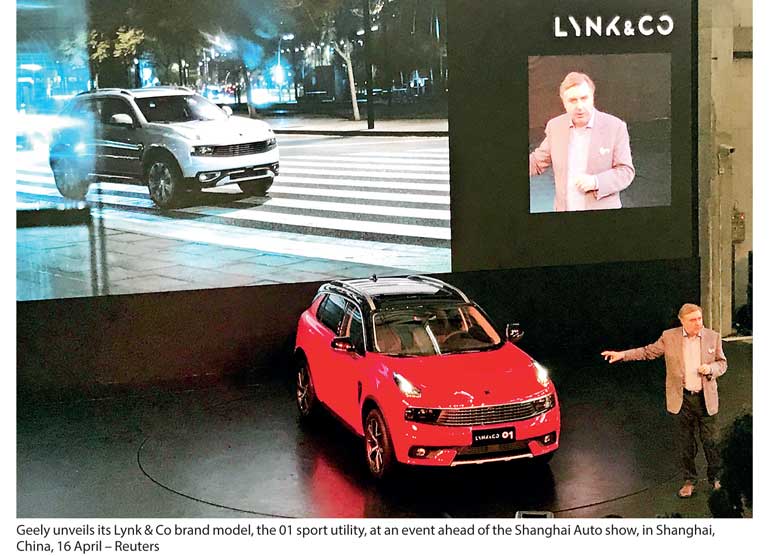

Rival Zhejiang Geely Holding Group, through its ownership of Swedish luxury automaker Volvo Cars, is pursuing a similar strategy of marrying European styling and developed market safety and quality engineering to Chinese production costs, primarily through its new Lynk & Co brand, company executives told Reuters.

Geely on Sunday evening staged an elaborate party at Shanghai’s West Bund Art Center to debut the production version of its forthcoming sport utility vehicle and a prototype for its “03” model, a sedan to go with a planned sporty coupe.

Geely president An Conghui told Reuters in an interview that Lynk & Co would allow Geely to compete head-on with global automakers both in China and overseas. Lynk & Co has said it plans to sell vehicles in the United States and Europe after launching in China.

Geely brand models currently are priced up to about 150,000 yuan ($22,000). Lynk & Co cars should sell for up to 250,000 yuan – in the heart of the mainstream segment that accounts for about 45% of Chinese passenger vehicle sales and that is now dominated by foreign brands such as Volkswagen, GM, Ford Motor Co, Toyota Motor Corp and Honda Motor Co Ltd. The brand could move higher in price, or lower, depending on how consumers respond, he said.

“It is not easy for Chinese makers to break into this segment in the past,” An said. “But now with Lynk & Co in place we want to really go into this segment and compete with foreign brands.”

SAIC, Geely and other rising Chinese automakers such a Great Wall and Chery Automobile Co Ltd. have a long way to go to achieve the sales levels of the US, European, Japanese and Korean brands in China.

Chinese consumers are wary of the quality and safety of domestic brand vehicles, and dispelling those fears would take time and money, SAIC and Geely executives said.

Lynk & Co will offer what executives called a “lifetime” warranty, and also plan to allow consumers to pay for access to a vehicle on a subscription basis – by the month or mile – instead of committing to a purchase. ($1 = 6.8830 Chinese yuan renminbi)