Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 6 September 2016 00:06 - - {{hitsCtrl.values.hits}}

The manner in which intangible assets are valued may be difficult to understand in a world where assets are commonly considered as tangible items with a value based on the price at which it can be expected to be exchanged with another party.

The reality however, is that the world we live is now driven increasingly by intangible assets rather than tangible assets. Apple,  which is the world’s most valuable brand, marketing computers, phones, iPods and watches amongst other items, does not own a single factory. Their business model involves outsource manufacturing to third parties, predominantly in China. Yet, because they own all the intellectual properties, they are able to extract value without tying up significant capital on expensive buildings and machinery. Another example is Uber which has raised venture capital based on a valuation of over $ 62 billion for its business without owning a single vehicle. The intellectual property that drives its value is the technology platform which matches cars to passengers.

which is the world’s most valuable brand, marketing computers, phones, iPods and watches amongst other items, does not own a single factory. Their business model involves outsource manufacturing to third parties, predominantly in China. Yet, because they own all the intellectual properties, they are able to extract value without tying up significant capital on expensive buildings and machinery. Another example is Uber which has raised venture capital based on a valuation of over $ 62 billion for its business without owning a single vehicle. The intellectual property that drives its value is the technology platform which matches cars to passengers.

Not all Sri Lankan businesses have original intellectual property that can be deployed for creating such immense business value. But most companies have brands that can do just that. Brands are a powerful source of intangible assets that can create enormous value not just for consumer goods companies but for business to business companies as well, which can develop their corporate brand into a powerful asset.

It has long been acknowledged that powerful brands drive consumer or customer choice, improving business performance and ultimately increasing shareholder value. However, for the first time the extent of this effect has been quantified.

Brand Finance has taken a retrospective look at the share price of the brands it has assessed over a 10 year period, revealing a compelling link between strong brands and market performance.

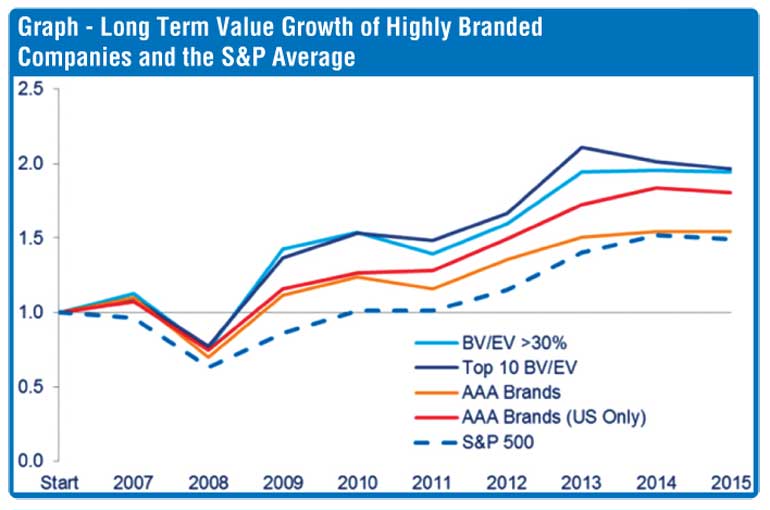

The most striking finding is that an investment strategy based on the most highly branded companies (those where brand value makes up a particularly high proportion of overall enterprise value) would have led to a return almost double that of the average for the S&P 500 as a whole.

Between 2007 and 2015, the average return across the S&P was 49%. However by using Brand Finance’s data, an active investor could have generated a return of up to 97%. Investing in companies with a brand value to enterprise value (BV/EV) ratio of greater than 30% would have generated a return of 94%. Investing exclusively in the 10 companies with the highest BV/EV ratios would have resulted in a 96% return.

There was a similar, though lesser, effect for brands rated as AAA or AAA+ according to Brand Finance’s Brand Strength Index (BSI). This is the system Brand Finance uses to determine the royalty rate to be applied to a brand’s revenue information as part of a brand value calculation. A letter grade or ‘brand rating’, analogous to a credit rating, is awarded to each brand based on the results of its BSI assessment. A strategy based on investment in all AAA and AAA+ rated brands would have led to a return of 54% over the eight years from 2007. However if only top-rated US brands were targeted, the return would have been 87%.

So, the challenge is to be able to build strong brands, and this requires an extensive and in-depth understanding of the category in which the brand operates. Searching out and identifying the key drivers of revenue in that category in which the brand operates provides early clues around which the brand could possibly be aligned. However, it requires a competitive scan as well, leading to focusing on areas that are untapped and enabling elements of differentiation to be added to the brand.

This establishes the unique positioning for the brand based on the identified business opportunities and leads to clearly articulating the brand in a manner that on the one hand will motivate employees and fulfil customer aspirations on the other. It is this powerful combination of employees and customers that creates a strong brand leading to creating significant brand value. Better the understanding that employees have on what they need to deliver as a customer experience, greater the likelihood that the customer will experience this with resultant satisfaction and hence build loyalty with that brand.

This resulting brand strength drives business and brand value, maximising the brand as a value creating asset.

Taken holistically, the brand helps to shape the entire customer experience through the product, services and space that they interact within, whilst for employees, the brand helps to shape the culture they work in and the values that guide their behaviour. This creates strong relationships with the two most important stakeholders.

It is this dual force which senior management of companies need to drive. And getting that right, results in the ability to unleash significant value, with the brand playing the central role in the process.

This is what is driving performance of the brands listed on the Brand Finance index above, and which has out-performed the S&P index. Therefore brand value as a long term measure of business performance is an indicator that companies must embrace and adopt as soon as possible.