Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 20 July 2018 00:00 - - {{hitsCtrl.values.hits}}

It’s been a turbulent and challenging couple of decades in developed markets with the physical act of shopping being under threat from online shopping across many categories from grocery to fashion. However, in Sri Lanka the brick and mortar business is at a point of take-off as Fitch rating expects Sri Lanka’s grocery retail to grow in the middle teens over the midterm due to urbanisation and increasing per capita income.

Four brands are positioning themselves with an eye on dominating this massive modern trade or grocery supermarket business, with possible plans for an ambitious new entrant as well. With potential multibillion rupee revenue up for grabs, these brands are racing towards redefining, positioning and fine-tuning their operations to better serve the Sri Lankan shopper.

The brands

The brands include Cargills Food City with 315 stores, Keells with 80 stores, Arpico with 58 stores and Laugfs with 34 stores. With the exception of Arpico they have all coincidentally recently rebranded themselves with each one staking out its own distinctive positioning (and uniquely associated colour), making them easy to identity on the busy streets of Colombo and other cities. Rumour has it that Softlogic also has ambitions to aggressively enter this market in the very near future.

The revised brand identities are being used to stake out what they stand for. Cargills Food City in red is the everyday low price brand, Keells in green stands for freshness, Arpico in blue offers the widest choice of products and Laugfs in yellow is yet to make a distinguishable offer apart from its claim to being the first supermarket to offer a 24-hour service.

Of the four main players, Keells, has opted to make the most change from its dominant red and smiley faced brand identity. They have opted for a dramatic makeover in green. They have also transitioned their name to simply ‘Keells’ by dropping the ‘Super’ descriptor. This was to be expected following the name-change of Keells meat products to Krest, which has freed up the reputed corporate brand for exclusive use in the supermarket business.

Cargills Food City has refined its branding as well by prominently featuring ‘Cargills’ whilst ‘Food City’ is being less conspicuous on its signage and promotions which may be a strategic move. The plan could be to phase out ‘Food City’ completely and be simply known as ‘Cargills’, similar to that of Keells, leveraging the corporate name for supermarkets.

Laugfs Super has also changed its brand identity through a more contemporary design in line with the corporate, but has taken on board the ‘Super’ name, which Keells has dropped so as to differentiate itself from Laugfs Gas which is the primary business for this corporate.

These changes are key to establishing a clear consumer proposition for each brand, in a rapidly growing market with each entity hungry to achieve the first milestone of hitting the Rs. 100 billion revenue mark, before accelerating on to the next of becoming a billion-dollar revenue business.

Performance

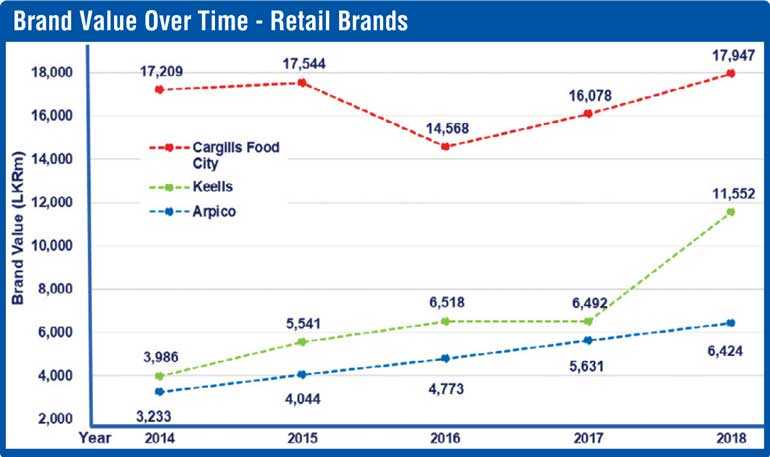

Brand Finance Lanka has been tracking the brand value performance of three of the brands (Cargills, Keells and Arpico) which disclose their revenue through annual reports for several years (see chart).

Whilst the long established Cargills Food City has been the market leader, we find that Keells has made dramatic strides in catching up to them.

For years Keells was underperforming but has recently found the formula to accelerate its performance. What they are doing is clearly working well for them. If they are able to maintain the momentum it is likely that they will catch up to Cargills Food City in the foreseeable future based on our brand value forecast. This is of course dependent on what Cargills Food City will do in response. It would seem that Arpico is happy to continue its relatively slow and steady growth year-on-year but is clearly in danger of being left behind as the third player.

Our research shows that whilst Keells and Arpico have found and settled on their store formats, Cargills Food City has not. Keells has midsized stores, standardised to a warehouse style with sufficient parking, and Arpico has its mega store formats in order to accommodate the variety of products across many categories which is their core strength. Cargills Food City on the other hand has many legacy stores, which do not have a consistent format, with different configurations and sizes that make standardisation much more challenging.

Customer experience

It’s now apparent that for all brands, the in-store experience is where focus has devolved. With statistics demonstrating that getting shoppers into stores will result in increased basket sizes and a more loyal customer base, the emphasis in 2018 and beyond will be squarely on enhancing the customer experience.

Studies in developed markets have shown that if retailers can combine online shopping with the widespread appeal of the in-store experience then their customer base will grow, shopping frequency will increase and basket sizes will get exponentially bigger.

The importance of having a well-defined customer offering which delivers on the brand through standardised and consistent formats as well as service offerings is critically important to build a successful retail business.

By defining their brand and what they provide, we are seeing a shift in going beyond advertising to offer a holistic customer experience. As the market gets more competitive and shoppers more sophisticated, focusing on the key brand drivers of price, convenience, product availability and service begins to play a crucial role.

The future king of retail will be the one who better understands customers and is able to deliver on those expectations.