Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 7 August 2020 00:00 - - {{hitsCtrl.values.hits}}

The total value of Sri Lanka’s most valuable brands fell by 4% in the Brand Finance 100 published earlier this year. External forces beyond the control of business primarily led this decline, attributable to the Easter bombings and a weakening economy. Now, with the economic impact of COVID-19, Brand Finance expects a further 10% decline in our next review in 2021.

As businesses struggle to cope with shrinking markets, Brand Managers need to consider all the factors that could be used to withstand the vagaries of these uncertain times by minimising investments and saving costs. The most valuable brands on the Sri Lanka 100 are also among the strongest in the Brand Finance valuation model. The stronger the brand, greater the impact on brand value.

Brand managers should therefore focus on brand strength – a controllable factor – to offset external shocks which impact their category and is beyond control.

What is brand strength?

Strong brands are better placed to work hard for the business by providing price or volume premium, improving margins, increasing revenue through loyal and new customers and saving on scarce marketing investments.

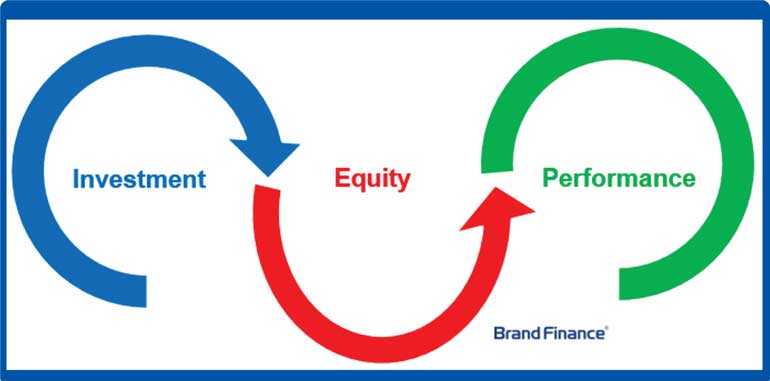

The Brand Strength Index (BSI) used by Brand Finance is a comprehensive dashboard that calculates this brand strength. It is made up of three pillars – investment, equity and performance. Each component in this chain has a logical link to the other. Brand investment is expected to result in creating brand equity with customers, employees and other stakeholders, which in turn is expected to convert to better business results in the form of revenue, higher margin, volume, etc.

The first pillar of investment looks at all the tools and mechanisms that are used to promote the brand. These include the amount of investments and marketing spend for the brand, level of social media engagement, market share and the reach or distribution it is building to access consumers. Separately, the brand management processes itself should also provide a good framework for strategy and developing the plan.

The second pillar, brand equity, focuses on what stakeholders think and feel about the brand. The level of empathy, engagement, trust and belief is key to establishing loyalty, repeat purchase and building customer advocates who recommend the brand to others.

And finally, performance captures how that equity is driving marketing and financial outcomes which include growth of customers, revenue and margins.

A brand that invests in effective strategies should drive better brand equity, and as perception of the brand amongst stakeholders improve, it will translate into stronger financial performance. Such is the benefit of a strong brand.

How to build brand strength?

It is possible to analyse the rate at which brand investments are converting into brand equity, and the rate at which that equity is converting to financial performance, which could then be benchmarked with competitor performance providing the financial data publicly available or listed on the Stock Exchange. This sets out areas of strength and weaknesses to focus on.

Apart from such analysis, there are three important elements that are required to build a strong brand: processes used for brand management, brand positioning and performance tracking.

In Brand Finance’s annual review of the Most Loved Brands, every year we find a disproportionately high number of multinational brands. Unilever brands dominate the top of the table with around 12-16% being listed. This year for example, Sunlight is the most loved brand. Our analysis has established the single most important factor for this is the standardised brand management system leading to consistent long-term investment. Whilst global brand management templates are used by multinationals, many local companies do not have one.

In using positioning to build brand strength, the Brand Manager must begin with first understanding what he or she sees as an opportunity for the brand to represent and establish a consumer value proposition that flows seamlessly across the organisation. For example, Dialog’s “The Future.Today.” is a promise to deliver the latest in technology to their customers and is driven by ongoing investments, long term marketing initiatives, employee engagement around creating new products and services. A more recent example is Keells “freshness” proposition. It is no coincidence that both these brands are doing exceedingly well on the Brand Finance 100.

For performance, there needs to be continuous monitoring in terms of both marketing and financial indicators. This goes beyond market research, to evaluating how competitors are performing against the three pillars of investment, equity and performance and building a brand matrix which tracks the main KPI’s driving brand value.

Four step holistic approach

Companies should start with optimising its brand management system and strengthening the processes that it uses.

Adopt a fact-based approach to establish a differentiated positioning and value proposition

Understand the pillars and conversion across the chain whilst benchmarking performance with competitors, developing strategies to increase customer engagement.

Continuous performance tracking that includes marketing and financial measures to bridge the gap between marketing and finance.