Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 13 May 2020 00:26 - - {{hitsCtrl.values.hits}}

By Dr. Nicholas Ruwan Dias and Niresh Eliatamby

The world is in the grip of the most devastating pandemic in a century. Within a short time of five months, 280,000 have died and another four million have been afflicted in almost every country around the globe.

The world is in the grip of the most devastating pandemic in a century. Within a short time of five months, 280,000 have died and another four million have been afflicted in almost every country around the globe.

The rate of infection and death globally has not abated, with countries such as Brazil and Mexico now in the grip of the virus, in addition to the United States, UK and several other states. Although the numbers in several countries appear to be reducing, epidemiologists have warned that a rush to reopen economies is fraught with danger of a second wave of infections.

Until the arrival of proven medical treatments, medicines and possibly a vaccine, current strategies such as social distancing, lockdowns, curfews and closed borders will continue to be the order of the day. It is therefore of utmost importance that nations optimise their digital commerce activities, and in the face of the collapse of regular international trade, focus on domestic markets as never before.

Many of Sri Lanka’s forex earning industries are staring at a desperate future, including apparel, tourism and migrant labour, and there are dire warnings that the country is badly placed in terms of government revenue, balance of payments, and overall strength of the economy. It is all the more imperative that the country moves quickly to adopt technology, transform its businesses, and adapt to the drastic changes in its macro and micro environment.

It is in this backdrop that we have examined data with regard to the readiness or lack thereof of technology in Sri Lanka. Data for this analysis was compiled from Globalwebindex.com, Statista.com, and Datareportal.com.

Our research is based on the methodology of the World Digital Competitiveness Ranking (WDC ranking) which defines digital competitiveness into three main factors:

a. Knowledge: Determined by talent, training and education and scientific concentration.

b. Technology: Regulatory framework, capital, technological framework.

c. Future readiness: Following adaptive attitudes, business agility and IT integration.

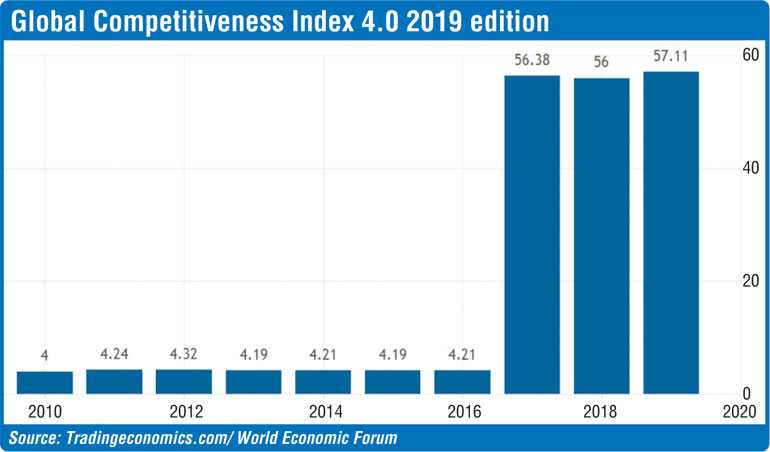

Global Competitiveness Index 4.0 2019 edition

Sri Lanka is 84th out of 140 countries ranked in the 2018 edition of the Global Competitiveness Report published by the World Economic Forum. Based on the Global Competitiveness Report, the Competitiveness Index in Sri Lanka averaged 16.21 Points from 2007 until 2019, reaching an all-time high of 57.11 Points in 2019 from a record low of 3.84 Points in 2007.

The variables for competitiveness are organised into twelve pillars, with each pillar representing an area considered as an important determinant of competitiveness.

The level of competitiveness and global ranking are vital in a world where foreign direct investment is likely to be sparse, as major investors become more cautious and focus on safe nations. Sri Lanka’s position is less than ideal.

In analysing technological readiness, we have examined the two basic sides of marketing, namely the potential buyers/consumers within the country and its institutions. While it is vital that commercial and state institutions digitally transform workplaces and work processes, it is just as important that potential buyers/consumers should possess the necessary personal infrastructure and skills required for digital commerce. In Part 1 we examine the situation with regard to Buyers/Consumers, while in Part 2 we discuss a model on which institutions could base their digital transformation.

How ready are Sri Lanka’s buyers/consumers?

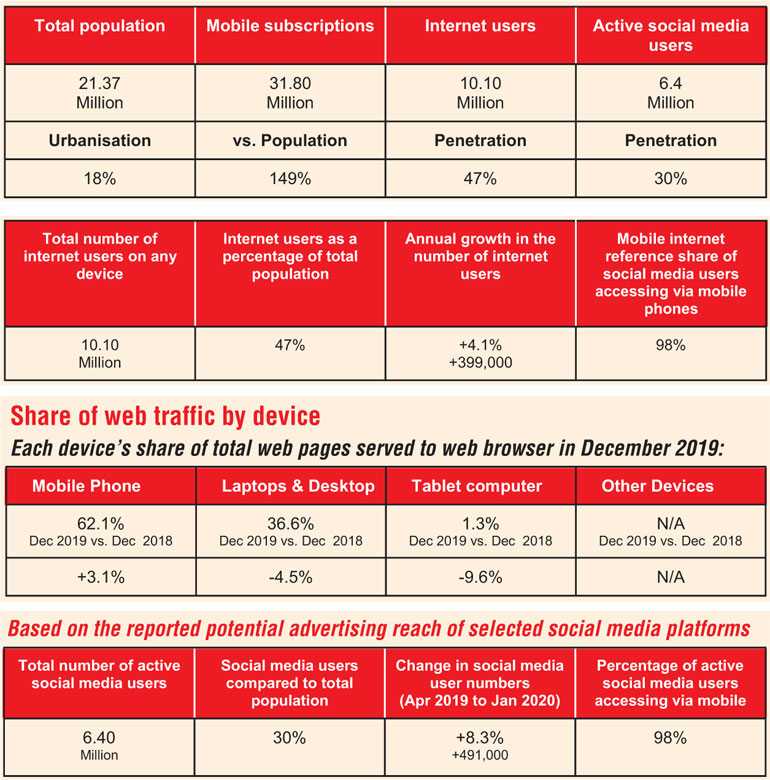

The Sri Lankan mobile ecosystem, which is based on a competitive mobile network market, is robust and well established with the development of 3G and 4G connectivity in urban and semi-urban areas. However, Sri Lanka poses significant challenges to digital marketers due to the relatively low level of ICT penetration. Although mobile usage far exceeds the population numbers, only 47% of Sri Lanka’s population is active online and 30% active on social media.

Despite an overall literacy rate of 92% in 2019, Sri Lanka’s overall computer literacy reported for 2019 was 30.1%. While the urban sector showed the highest computer literacy rate of 41.5%, the rate for Rural and Estate sectors were 28.6% and 13.7% respectively, according to an annual bulletin on Computer Literacy Statistics – 2019, by Department of Census and Statistics Sri Lanka.

Internet connectivity

A key factor that Sri Lanka’s online marketers need to keep in mind is that 98% of those who are on the Internet do so through a mobile phone. In other words, the use of laptops, desk tops and tabs is rare. Thus it is imperative that online marketing be geared towards getting messages across to mobile phones, which raises multiple challenges as opposed to larger instruments.

Reasons for the low penetration of non-mobile-phone instruments include high cost and less convenience in carrying around. Keep in mind that the vast majority of Sri Lankans travel by motorcycle, three-wheeler or public transport, rather than cars and vans. Carrying a laptop can be cumbersome. Another reason is force of habit: Sri Lankan teenagers purchase mobiles for social purposes, mainly for texting and calls. Most are on prepaid cards. Some of them may graduate to smartphones as they grow older. But once they have spent a significant sum on a smartphone, they are less likely to spend even more on a laptop or tab if their requirements are met by a smartphone or basic mobile phone.

Share of web traffic by device

Further evidence of the dominance of mobile phones can be seen from the table, with 62.1% of web pages being accessed on mobiles, with less than 38% from all other types of devices. While usage of mobiles has increased, usage of other devices has actually decreased significantly. This is not the number of users, but the number of pages accessed by each type of device, with users of laptops, desktops and tabs being more likely to access more pages on each device, possibly due to the smaller screen size of mobile phones.

Social media overview

Social media offers a rapid solution for digital marketers to reach wide audiences, through messaging and advertisements.

It is clear that the number of social media users, although relatively low in comparison to more advanced economies, is increasing at a significant pace. It is also significant that 98% of social media users utilise mobile phones, a key factor for digital marketers to bear in mind.

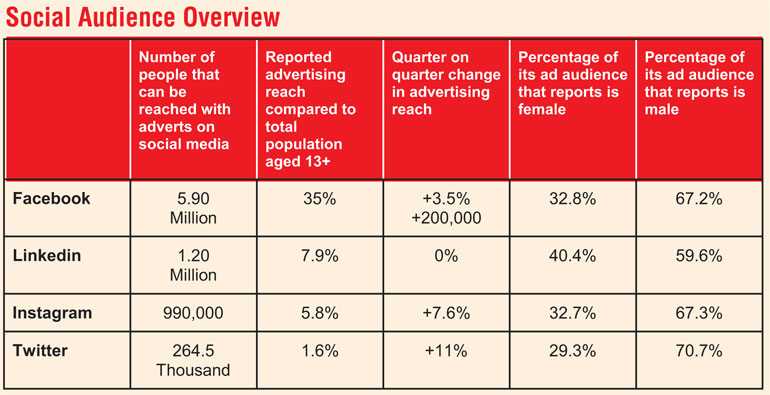

Social audience overview

It can be seen that Facebook enjoys an enormous advantage in advertising reach over other forms of social media, with LinkedIn a distant second followed by Instagram and an even less significant number on Twitter.

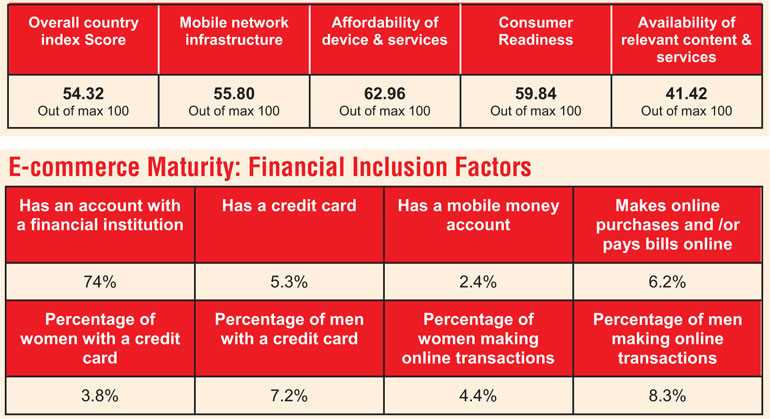

Mobile Connectivity Index

GSMA intelligence assessment of key enablers and drivers of mobile connectivity

GSMA is a global mobile communications system that serves the needs of global mobile network operators. The full membership of the GSMA is over 750 mobile operators and another 400 companies are partners of this broader telecom ecosystem.

It can be seen that Sri Lanka does not fare well in the table. A significant factor is the prevalence of basic mobile phones over smartphones. For most applications, simple and functional phones are severely limited. Clearly ordering an Uber cab or a laundry service with a smartphone is much easier, where a simple phone is unable to do it. It is important that as a nation Sri Lanka pushes forward with smartphones and tabs in place of basic tools. The government must facilitate this transition by making smartphones more affordable.

E-commerce maturity: Financial inclusion factors

Sri Lanka faces a critical challenge of the percentage of the populace with access to credit being quite low, with a mere 5.3% possessing a credit card. A further 2.4% rely on mobile money accounts. While access to debit cards is more widespread, the prerequisite is that one must have funds in one’s account and Sri Lankans do not have a high rate of savings.

This situation is likely to be exacerbated by the general slowdown in economic activity due to COVID, which has led to a significant drop in income and in some cases the loss of employment, all of which means that the average person would have less disposable cash in their bank accounts.

The overall percentage of the population that makes online purchases and/or pays bills online is just 6.8%.

Sri Lanka needs the banking industry to take concrete steps towards rapid expansion of the percentage of Sri Lankans with the capacity to purchase online through credit. In marketing terms, social distancing would lead to a distinct lack of enthusiasm to travel to crowded shops in crowded public transport. It is therefore imperative to provide a larger segment of the population with the capacity to shop online.

Conclusion

In conclusion, the technological readiness of Sri Lanka’s general population appears to have some way to go before domestic e-commerce can become a mainstay of day-to-day transactions.

[Dr. Nicholas Ruwan Dias is a Digital Architect at Aegon Asia, based in Kuala Lumpur. He holds a BSC in Computing from the University of Greenwich, Masters in Computer Software Engineering from Staffordshire University and PhD from the University of Malaya. He is completing a second doctorate (DBA) from Universiti Utara Malaysia.]

[Niresh Eliatamby is Chairman of Chaos Theory Ltd., a research based consultancy in Colombo, is an author, and a lecturer in HR/tourism/marketing. He holds an MBA from London Metropolitan University and LL.M. in International Business from Cardiff Metropolitan University.]

(Copyright Nicholas Ruwan Dias and Niresh Eliatamby.)