Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 19 October 2016 00:01 - - {{hitsCtrl.values.hits}}

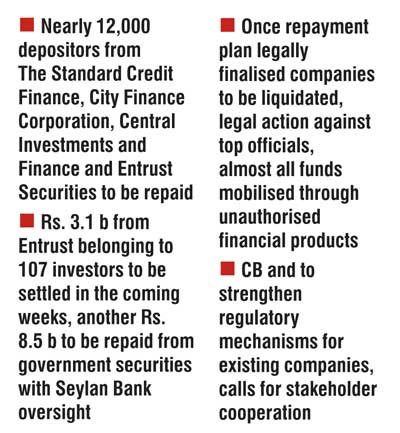

The Central Bank yesterday announced hard-edged plans to repay Rs. 16.5 billion owed to nearly 12,000 depositors of four insolvent financial institutions before liquidating them, including the establishment of a new Enforcement Division to institute legal action against top officials responsible for fraud as well as to increase regulatory oversight by the monetary authority.

The Central Bank yesterday announced hard-edged plans to repay Rs. 16.5 billion owed to nearly 12,000 depositors of four insolvent financial institutions before liquidating them, including the establishment of a new Enforcement Division to institute legal action against top officials responsible for fraud as well as to increase regulatory oversight by the monetary authority.

Three of the four finance companies are The Standard Credit Finance Ltd., City Finance Corporation Ltd. and Central Investments and Finance Plc. All three companies got into a chronic financial position in 2008 and 2009 due to fraud and mismanagement of funds and therefore did not have assets to pay off deposits.

The fourth, Entrust Securities Plc, a company with a primary dealer license to trade government securities and close links to the family of former President Mahinda Rajapaksa, got into a chronic liquidity and insolvency crisis during the latter part of 2015 as a result of the fraudulent use of funds placed by customers for investment in government securities.

The Central Bank on 4 January 2016 suspended Entrust’s Board of Directors and vested its operations in the National Saving Bank to protect the investors.

“The Monetary Board reviewed the lack of progress so far and took cognisance of the fact that there was no further room to revive these companies to enable them to repay depositors and investors in the foreseeable future. Given the long delay involved so far, the Monetary Board approved the company resolution plans submitted by the Department of Supervision of Non-banking Financial Institutions to repay deposits and investments annually commencing from 2017 over a reasonable period of time with a fair interest rate during this repayment period,” the Central Bank said in a statement.

In the case of the three finance companies, repayment will cover Rs. 4,868 million of nearly 11,878 depositors. In the case of the Entrust, investments secured with government securities amounting to Rs. 3,100 million belonging to 107 investors will be settled in the coming weeks. In respect of unsecured investments in the Entrust amounting to Rs. 8,508 million belonging to 24 individuals and entities, government securities will be allocated and be repaid under the repayment plan to be implemented with the managing support of Seylan Bank Plc, the Central Bank said.

“All restructuring efforts made by the Central Bank, from time to time, could not produce the envisaged results as those who managed these companies failed to arrange an infusion of new capital. As a result, these Department of Supervision of Non-Bank Financial Institutions companies became insolvent and were out of business since then.

“The Central Bank will complete the required administrative procedures and communicate details to all those depositors and investors. Once the repayment plan is legally finalised those companies will be dealt with through applicable laws for liquidation. The Monetary Board is of the view that this is the only option that now remains as there are no assets in these companies and no investors have been willing to revive these companies and repay the above depositors and investors.”

As part of the resolution plans, the Central Bank will set up a new Enforcement Division in the Department of Supervision of Non-bank Financial Institutions to institute legal action against directors and managers who have been responsible for fraud and the misappropriation of funds and to make every effort to recover such funds from them.

In the case of Entrust, law enforcement authorities, in association with the Central Bank, have already initiated legal action. The Enforcement Division will also introduce a routine procedure to take legal action against parties that have committed similar fraudulent practices in existing companies, in the event such instances are detected by the examination staff.

Further, action will be taken to address lapses in the Central Bank and to strengthen regulatory and supervisory mechanisms on a priority basis to ensure the safety and soundness of existing institutions, the statement said.

The Central Bank went on to say that it was important to stress that the regulation and supervision do not mean a guarantee for each and every deposit and investment made by the public in banks and financial institutions. Those who make such deposits and investments and those who undertook businesses based on these funds were primarily responsible for their business decisions regarding the prudent management of their funds. In fact, almost all funds placed in the above distressed companies had been mobilised through unauthorised financial products.

“Even large depositors and investors have been negligent in not undertaking the normal due diligence on risks and return, despite being sufficiently knowledgeable and skillful to do so. The responsibility of the Central Bank is only to provide an external safeguard through regulation and supervision to the extent permitted in law while facilitating institutions to carry on their businesses essential for the economy and general public in a safe and sound manner in a stable financial system.

“Therefore, all those who are stakeholders to these resolution plans are kindly requested to cooperate with the Central Bank in order to end this longstanding issue in the public interest. In the event of non-cooperation, the Central Bank will have no option but to reluctantly permit these companies to be wound up under the law.”