Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 4 November 2015 00:53 - - {{hitsCtrl.values.hits}}

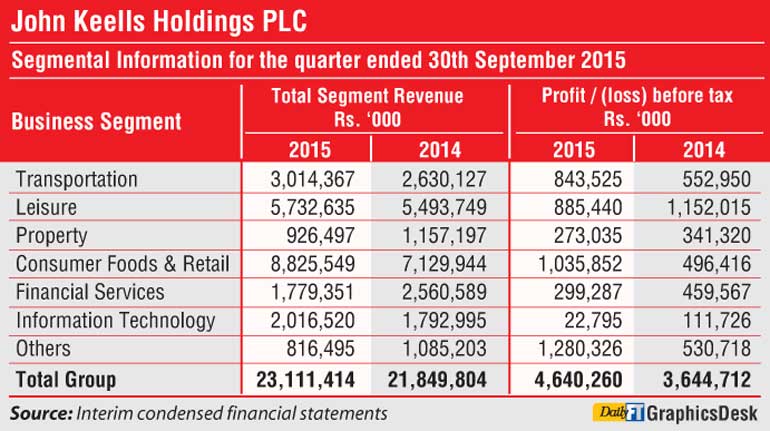

Premier blue chip John Keells Holdings PLC (JKH) yesterday reported a strong second quarter with its consolidated pre-tax profit rising by 27% to Rs. 4.64 billion.

Resilient performance in the second quarter pushed the cumulative FY16 first half pre-tax profit by 17% to Rs. 7.83 billion. Last year’s comparative figure of Rs. 6.67 billion included a capital gain of Rs.389 million.

Star performer in 2Q was JKH’s Consumer Foods and Retail industry group which saw its pre-tax profit swell by 109% to Rs. 1.04 billion. Transportation sector also saw a 53% rise in pre-tax profit to Rs. 844 million. Other sectors including Leisure, Property and Financial Services suffered dip in pre-tax profit.

The profit attributable to equity holders for the second quarter at Rs.3.47 billion reflects an increase of 31% over the previous year, while the first half performance at Rs.5.65 billion reflects an increase of 18% over the corresponding period of the previous financial year.

Group revenue at Rs. 22.68 billion for the second quarter was a 5% increase and for the first half it rose by 3% to Rs. 43.68 billion.

At Company level, PBT for the second quarter of 2015/16 at Rs. 4.93 billion is an increase of 350% over the Rs. 1.09 billion recorded in the corresponding period of 2014/15, primarily due to the capital gain of Rs.3.10 billion arising from the share repurchase of Union Assurance PLC where the Company subscribed to its entitlement. However, the capital gain is eliminated at the Group reporting level. The Company PBT for the first half of the financial year at Rs. 8.17 billion was an increase of 101% over the previous financial year.

Following is brief review by JKH Chairman Susantha Ratnayake regarding the sectoral performance as contained in the interim results statement.

Transportation

The Transportation industry group PBT of Rs.844 million in the second quarter of 2015/16 is an increase of 53% over the second quarter of the previous financial year (2014/15 Q2: Rs. 553 million). The improved performance is attributable to the Group’s Ports and Bunkering businesses. The Bunkering business witnessed an improvement in volumes on the back of an increased demand for supplies over Colombo and maintained its market leadership position. Enhanced operational efficiencies and reduced overheads, contributed positively towards the performance of South Asia Gateway Terminals (SAGT).

Leisure

The Leisure industry group PBT of Rs. 885 million in the second quarter of 2015/16 is a decrease of 23% over the second quarter of the previous financial year (2014/15 Q2: Rs. 1.15 billion). As in the previous quarter, the decline in PBT is mainly on account of the partial closure of Cinnamon Lakeside which negatively impacted overall occupancies and profitability of the City Hotels sector. Cinnamon Red performed well recording an average occupancy of 89% for the period under review. The Sri Lankan Resorts sector continued to benefit from the growth in tourist arrivals into the country and recorded an increase in occupancy. Whilst the depreciation of the Rupee will have a positive impact on the foreign currency denominated revenue streams emanating within Sri Lanka, the Sri Lankan Resorts sector had a negative impact on the translation of its foreign currency denominated debt during the quarter. The tourist arrivals in to the Maldives witnessed only a marginal increase and this coupled with the increased supply of rooms resulted in a significant increase in overall competition. However, improved operational efficiencies and the resulting cost savings helped partially mitigate the impact. The improved performance of the European and Chinese markets contributed towards a notable growth in profitability for the Destination Management business.

Property

The Property industry group PBT of Rs. 273 million in the second quarter of 2015/16 is a decrease of 20% over the second quarter of the previous financial year (2014/15 Q2: Rs.341 million). The decline in PBT is mainly on account of the lower revenue recognition of the “OnThree20” residential development project which was completed in the previous financial year. Construction of the “7th Sense” residential development was completed with all 66 units currently been sold. The handover of units has commenced and is expected to be completed within the financial year.

Pre-sales of the first residential tower and commercial space of the “Waterfront Project” is currently underway and progressing satisfactorily. The “Waterfront Project” was formally launched as “Cinnamon Life”. “Cinnamon Life”, which is positioned under the “Cinnamon” master brand, will offer a complete “vibrant lifestyle” where different aspects of life, living, working and playing blending seamlessly within one location.

During the period under review, the Group’s shareholding in Rajawella Holdings Limited (RHL) was increased from 17% to 51%. The total cost of this investment of Rs. 1.04 billion, comprising of a partial buyout from existing shareholders, an infusion into RHL and the release of an existing sublease of land held by the JKH Group in exchange for shares, will be made over three years. RHL operates an 18-hole, Donald Steel designed, Golf Course in Digana, which, coupled together with the overall development potential of the land bank, complements the Group’s leisure and property portfolios. A “Land Use” Plan has been commissioned.

Consumer Foods and Retail

The Consumer Foods and Retail industry group PBT of Rs.1.04 billion in the second quarter of 2015/16 is an increase of 109% over the second quarter of the previous financial year (2014/15 Q2: Rs.496 million). The performance of the industry group was buoyed by the sustained growth in consumer spending where volumes continued to demonstrate encouraging growth. Ceylon Cold Stores (CCS) recorded an improved performance on account of the Frozen Confectionary and Beverage businesses recording a notable growth in volumes and improved margins. Keells Food Products (KFP) continued to witness a growth in profitability aided by improved operational efficiencies and an encouraging growth in volumes.

The Retail sector continued its strong performance with a steady growth in footfall contributing positively towards a year-on-year growth in same store sales.

Financial Services

The Financial Services industry group recorded a PBT of Rs. 299 million in the second quarter of 2015/16, this being a decrease of 35% over the second quarter of the previous financial year (2014/15 Q2: Rs. 460 million). The decline in PBT is mainly attributable to the performance of Nations Trust Bank as a result of mark to market losses on its bond portfolio due to an increase in the long end of the yield curve and lower than anticipated growth in its loan book.

Whilst the Life Insurance business recorded an encouraging growth in gross written premiums, the lower PBT from Union Assurance PLC (UA) is due to the divestment of its General Insurance business during the fourth quarter of the financial year 2014/15 which is now accounted for as an associate company. During the quarter under review, the share repurchase at UA was fully subscribed with 24.66 million shares held by JKH being repurchased at a value of Rs. 4.14 billion.

Information Technology

The Information Technology industry group PBT of Rs. 23 million in the second quarter of 2015/16 is a decrease over the second quarter of the previous financial year [2014/15 Q2: Rs.112 million]. Whilst the Office Automation business witnessed a steady growth in demand for smart phones, the lower PBT is mainly attributable to the Software Services business due to the profit reversal of the sale of ‘Zhara HS’, a web based hotel management software.

The Holding Company and the Plantation Services sector recorded a PBT of Rs.1.28 billion in the second quarter of 2015/16, which is an increase of 141% over the second quarter of the previous financial year [2014/15 Q2: Rs.531 million]. The increase is mainly on account of exchange gains recorded at the Company on its foreign currency denominated cash holdings. Revenue and profitability in the Plantations Services sector were negatively impacted as tea prices continued to remain at low levels.