Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 10 July 2017 00:55 - - {{hitsCtrl.values.hits}}

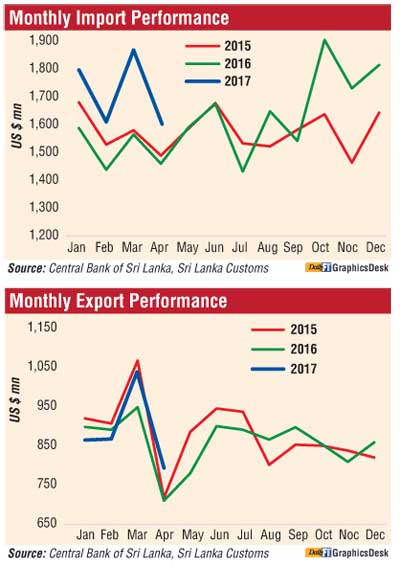

Exports earnings rose 11.9% to $ 795 million in April 2017, mainly driven by a low base effect the year before, the Central Bank said in its latest external performance data but outlined the trade deficit widened on strong import demands resulting in a mixed  performance.

performance.

April 2017 high growth was mainly driven by the low base effect which registered $710 million in April 2016, the lowest monthly export value since April 2013.

Expenditure on imports increased by 9.8% to $1,604 million in April 2017 from the year before while the trade deficit expanded to $809 million in April from $751 million the previous year. The cumulative trade deficit increased substantially during the first four months of 2017 to $3,314 million from $2,606 million during the same period in 2016.

“Despite the increase in tourist earnings in April 2017, the decline in workers’ remittances together with the expanded trade deficit moderated the performance of the external current account.”

“However, the financial account of the Balance of Payments (BOP) was supported by continued foreign inflows to the Colombo Stock Exchange (CSE) and the government securities market in April 2017,” it said.

Earnings from industrial exports, which represent about 75 per cent of total exports, grew by 8.6% (year-on-year) to $ 595 million in April 2017 mainly due to higher exports of transport equipment, petroleum products and textiles and garments. Earnings from transport equipment increased by nearly fivefold to $27 million during the month, as a result of the export of a general cargo vessel worth $23 million.

Earnings from exports of petroleum products increased by 62.5% (year-on-year) in April 2017 reflecting greater volumes and higher prices for bunker and aviation fuel. Textile and garment exports at $351 million in April 2017 registered a moderate increase of 3.0% (year-on-year), although in comparison to the previous month, earnings from textile and garment exports reduced reflecting seasonal patterns.

Earnings from machinery and mechanical appliances, printing industry products and wood and paper product exports also showed an improved performance in comparison to April 2016. However, export earnings from gems, diamonds and jewellery, leather, travel goods and footwear and base metals and articles declined in April 2017 on a year-on-year basis.

Earnings from agricultural exports grew by 22.7% (year-on-year) to $196 million in April 2017 led by tea, spices and seafood exports. Earnings from tea exports increased by 17.1% (year-on-year) to $ 109 million due to higher average prices, despite the decline in volume exported. The average export price of tea increased to $5.42 per kg in April 2017 in comparison to $4.20 per kg in April 2016, reflecting the increasing trend seen in tea prices from September 2016.

Earnings from spices showed a significant growth of 78.4% (year-on-year) in April 2017 mainly due to increased volumes of cinnamon and cloves exports. In addition, earnings from seafood exports increased by 59.7% (year-on-year) in April 2017 due to a 251% growth recorded in seafood exports to the EU, following the removal of the ban on fisheries products. However, earnings from coconut and rubber exports declined in April 2017.

On a cumulative basis, exports earnings during the first four months of 2017 at $3,569 million, grew by 3.5% (year-on-year) with higher earnings from tea, spices, machinery and mechanical appliances, petroleum products and seafood exports. However, export earnings from textiles and garments, gems, diamonds and jewellery and food, beverages and tobacco declined during the period under consideration.

The leading markets for merchandise exports of Sri Lanka during the first four months of 2017 were the USA, the UK, India, Germany and Italy accounting for about 51% of total exports.

Expenditure on imports increased by 9.8% (year-on-year) to $1,604 million in April 2017. The largest contribution to overall growth caused from intermediate goods (74.7%), followed by consumer goods (20.2%) and investment goods (5.7%).

Expenditure on import of intermediate goods increased by 13.7% (year-on-year) to $886 million in April 2017, largely due to higher expenditure on fuel and base metal imports. Expenditure on fuel increased by 62.1% (year-on-year) during the month, reflecting higher import volumes of oil and coal for power generation and elevated import prices in the global market. The import price of crude oil increased to $56.48 per barrel in April 2017 from $44.05 per barrel in April 2016.

In addition, expenditure on the importation of base metals led by iron and steel as well as diamonds, precious stones and metals, particularly gold, also contributed significantly to the high growth in intermediate goods imports. However, import of wheat and maize, fertiliser, chemical products and textiles and textile articles declined in April 2017 relative to April 2016.

Expenditure on consumer goods imports increased by 9.1% (year-on-year) to $345 million in April 2017 driven by higher imports of non-food consumer goods such as clothing and accessories, household furniture items and home appliances amidst a decline in imports of vehicles and telecommunication devices. Expenditure on food and beverages also increased owing to the substantial increase in import of rice, dairy products and vegetables.

Rice imports increased to $10 million in April 2017 from $1 million in April 2016 due to measures taken by the government to encourage rice imports to meet the shortage in the domestic market. However, import expenditure on sugar, spices and rubber products declined on a year-on-year basis.

Expenditure on investment goods imports grew in April 2017 by 2.3% to $372 million (year-on-year) led by higher imports of building materials and transport equipment. Import expenditure on building materials increased owing to iron and steel and cement imports in April 2017 while imports of transport equipment increased mainly due to higher imports of commercial vehicles. However, machinery and equipment imports declined during the same period, owing to lower imports of electric motors and generators and machinery imports for the textile industry.

On a cumulative basis, import expenditure at $ 6,883 million during the first four months of 2017 increased by 13.7% (year-on-year), largely due to increased imports of fuel, gold and rice. Import expenditure on fuel and gold increased by 76% and 158.2% (year-on-year), respectively. Expenditure on rice imports increased by more than 28-fold due to increased volumes of rice. However, import expenditure on machinery and equipment, personal vehicles and textiles and textile articles declined during the month.

India, China, the UAE, Singapore and Japan were the main import origins during the first four months of 2017, accounting for about 59% of total imports.

Foreign investments in the CSE during the first four months of the year recorded a net inflow of $154.5 million, including a net inflow of $106.3 million to the secondary market and an inflow of $48.2 million to the primary market.

Continuing the reversal of the trend observed in the previous month, foreign investments in the government securities market recorded a net inflow of $45 million during April 2017. However, on a cumulative basis, the Government securities market experienced a net outflow of $360.4 million during the first four months of 2017. Long term loans to the Government recorded a net inflow of $60.3 million during the first four months of 2017, compared to a net inflow of $7.6 million during the corresponding period of 2016.

Further, Foreign Direct Investments including foreign loans to BOI companies, which are reported on a quarterly basis, remained moderate with a net inflow of $146.5 million during the first quarter of 2017. This included disinvestments as a consequence of share buybacks initiated by several companies listed in the CSE.

During the first four months of 2017, the overall BOP is estimated to have recorded a deficit of $344.4 million in comparison to a deficit of $958.1 million recorded during the corresponding period of 2016.

Remittances drop 15.6%

The Qatar crisis along with a general economic downturn in the Middle East continued to sap Sri Lanka’s remittances in April, recording a sharp drop of 15.6% to 487.9 m.

Adverse economic and geopolitical conditions prevailing in the Middle Eastern region continued to have a negative impact on workers’ remittances, the Central Bank said.

Workers’ remittances declined by 15.6% to $487.9 million in April 2017 from $578.0 million in April 2016. Furthermore, the cumulative inflow from workers’ remittances also declined by 6.3% to $ 2,221.7 million during the first four months of 2017, relative to the corresponding period of 2016.

On Sunday Britain’s Foreign Secretary Boris Johnson called for “dialogue” to resolve the current dispute between Qatar and four other Arab states and reiterated London’s support for Kuwait’s mediation efforts to end the rift during a visit to Doha.

Johnson made the call during a meeting with Kuwait’s Foreign Minister in the Kuwaiti capital on Saturday, as part of his visit to the region. The two disputing sides have not met yet but after a month-long standoff the UK is hoping progress can be made.

Tourism earnings grow 6.1% in first 4 months

Tourist arrivals at 160,249 in April 2017 increased by 17.5% year-on-year, following a decline in arrivals for two consecutive months.

As a result, tourist arrivals during the first four months of 2017 recorded an increase of 6.1% to 765,202, in comparison to 721,185 recorded in the corresponding period of 2016.

The top five sources of tourist arrivals during the first four months of 2017 were India, China, the UK, Germany and France, accounting for 50.3% of total tourist arrivals during this period.

Accordingly, earnings from tourism increased to $274.9 million during April 2017 in comparison to $234.0 million in April 2016. Meanwhile, cumulative earnings from tourism increased by 6.1% to $1,312.8 million during the first four months of 2017.