Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Saturday, 30 January 2016 00:00 - - {{hitsCtrl.values.hits}}

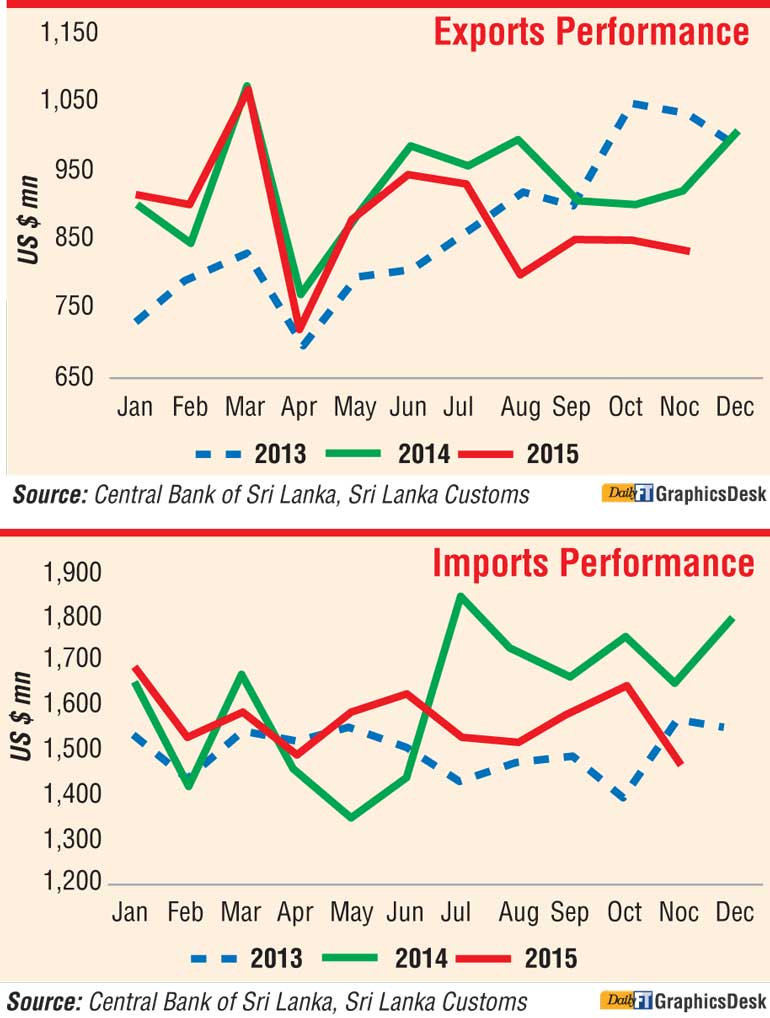

Declining exports as well as imports have helped narrow the country’s trade deficit in November in addition to checking growth during the first 11 months of 2015.

The Central Bank said the trade deficit in November 2015 contracted significantly by 13.2% to $630 million in comparison to $726 million in November 2014. However, the trade deficit for the first eleven months of 2015 marginally increased by 1.0% to $7,566 million.

“The trade deficit contracted in November 2015 compared to the corresponding month of 2014 due to the decline in import expenditure at a higher rate than the reduction in export earnings,” the Central Bank said.

Earnings from exports declined by 9.3%, year on year, to $835 million in November 2015.

On a cumulative basis, earnings from exports declined by 4.4% to $9,679 million during the first eleven months of 2015, reflecting the significant decline in earnings from tea, rubber products and sea food exports.

Expenditure on imports in November 2015 continued to decline by 11.0%, year on year, to $1,465 million, the lowest monthly import expenditure in 2015. On a cumulative basis, expenditure on imports declined by 2.1% to $17,244 million during the first eleven months of 2015.

Following is the full text of Central Bank statement on external trade in November.

Earnings from exports declined by 9.3%, year-on-year, to $835 million in November 2015. This was mainly due to declines recorded in tea, rubber products, petroleum products and garments exports. The currency depreciation and geo-political development, particularly in Middle-Eastern countries caused continued decline in demand for tea. Accordingly, export earnings from tea declined significantly by 21.1%, year on year, in November 2015.

However, the average export price of tea remained unchanged from the previous month at $ 4.11 per kilogramme though down from $4.75 per kilogramme recorded in November 2014. Earnings from rubber product exports continued to weaken and recorded a 19.5% decline, year on year, in November. Adding to that, petroleum products exports recorded a 40.5% decline as a result of the lower prices for bunkering and aviation fuel, despite bunkering quantity being increased by 32.9%, year on year, in November 2015.

Export earnings from garments, which contribute nearly 46% to the total exports, declined by 2.7% in November 2015, reflecting low exports to EU markets. However, garment exports to the USA and non-traditional markets increased by 9.3% and 7.5%, year on year, respectively, in November 2015.

Further, lower export earnings from machinery and mechanical appliances, coconut products and sea food also contributed considerably to the overall decline in exports. However, earnings from spice exports continuously recorded a growth so far this year. Adding to that, sub categories of gems and edible nuts showed growth in the month of November 2015.

On a cumulative basis, earnings from exports declined by 4.4% to $9,679 million during the first eleven months of 2015, reflecting the significant decline in earnings from tea, rubber products and sea food exports.

The leading markets for merchandise exports of Sri Lanka during the first eleven months of 2015 were the USA, UK, India, Germany, Italy and China, accounting for about 54% of the total exports.

In line with the substantial decline in international oil prices, expenditure on imports in November 2015 continued to decline by 11.0%, year on year, to $1,465 million, the lowest monthly import expenditure in 2015.

Despite the increase in import expenditures on consumer goods and investment goods, a substantial reduction in import expenditure on intermediate goods led to this decline.

The drop in international oil prices in November 2015 resulted in a 27.9% decline in the fuel import bill despite the increases in import volumes of both crude oil and refined petroleum. The average import price of crude oil declined to $45.46 per barrel in November 2015 compared to $76.82 per barrel recorded in November 2014.

In addition, import expenditure on textiles and textile articles, fertiliser and diamonds and precious stones and metals also declined by 22.3%, 61.6% and 80.7%, respectively, on a year-on-year basis, contributing more than 55% of the overall decline in import expenditure in November 2015. Import expenditure on rice declined significantly in November 2015, for the seventh consecutive month, mainly due to the availability of rice in the local market and higher imports recorded the previous year. Import expenditure on transport equipment declined by 41.4%, year on year, mainly due to the higher imports in November 2014 largely reflecting the impact of the import of a cruise ship and three light vessels. Even though, expenditure on vehicle imports recorded a lower value in November 2015, compared to the previous month, it increased by 25.0% on a year-on-year basis mainly due to the increase of importation of motor cars. Further, imports of building materials and machinery and equipment, increased during the month.

On a cumulative basis, expenditure on imports declined by 2.1% to $17,244 million during the first eleven months of 2015.

The main import origins were India, China, Japan, UAE and Singapore accounting for about 61% of the total imports by November 2015.

The trade deficit in November 2015 contracted significantly by 13.2% to $630 million in comparison to $726 million in November 2014. However, the trade deficit for the first eleven months of 2015 marginally increased by 1.0% to $7,566 million.

Thanks to plunging prices, the country’s import bill of oil has declined by 44% or $ 1.981 billion in the first 11 months of 2015.

In November the oil import bill was lower by 28% to $ 194 million.

“The drop in international oil prices in November 2015 resulted in a 27.9% decline in the fuel import bill despite the increases in import volumes of both crude oil and refined petroleum. The average import price of crude oil declined to $45.46 per barrel in November 2015 compared to $76.82 per barrel recorded in November 2014,” the Central Bank said.