Sunday Feb 15, 2026

Sunday Feb 15, 2026

Saturday, 19 December 2015 00:56 - - {{hitsCtrl.values.hits}}

By Ashwin Hemmathagama – Our Lobby Correspondent

By Ashwin Hemmathagama – Our Lobby Correspondent

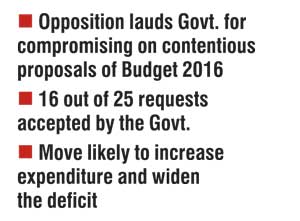

Sri Lanka Freedom Party (SLFP) lawmakers yesterday commended Prime Minister Ranil Wickremesinghe for agreeing to establish 16 out 25 post Budget requests the group presented to the Government.

Addressing the media last evening at the Parliamentary complex, the MPs listed some of the agreements with the Government.

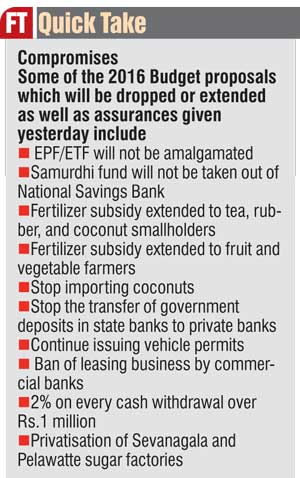

These included pledges the EPF/ETF will not be amalgamated, the Samurdhi fund will not be taken out of National Savings Bank, fertilizer subsidy extended to tea, rubber, and coconut smallholders, fertilizer subsidy extended to fruit and vegetable farmers, stop importing coconuts, stop the transfer of government deposits in state banks to private banks, continue issuing vehicle permits, letting commercial banks to continue with leasing business, cancelling the 2% on every cash withdrawal over Rs.1 million and stop the privatisation of Sevanagala and Pelawatte sugar factories.

Meanwhile, Reuters yesterday reported that the changes could raise concern over Sri Lanka’s efforts for fiscal consolidation as the government is expected to start negotiations next year for an IMF standby arrangement. The final vote on the reformist budget is scheduled for Saturday. It initially aimed to boost revenue 38% and cut the deficit to 5.9% of GDP next year, from an estimated 6% in 2015.

Since Finance Minister Ravi Karunanayake presented the budget on 20 November, the government has amended several revenue proposals, including an increase in fees on vehicle emission tests and valuations and vehicle permits for public servants. On Friday, the government extended fertiliser subsidies for plantation crops, a day after dozens of paddy farmers wearing only loincloths protested against a subsidy cut.

Karunanayake told the parliament that the revenue lost by the amendments would be only Rs. 7 billion (USD 48.80 million), less than 1% of the estimated budget deficit of Rs. 740 billion.

He told Reuters the revisions would not affect the revenue target. Many analysts say the resulting fall in revenue and increase in expenditure could swell the deficit.

“Public finances remain a key credit weakness for Sri Lanka,” Sagarika Chandra, Fitch Ratings’ associate director for Asia Pacific Sovereigns, told Reuters.

She said there was a risk of missing the 2016 fiscal deficit target, due to the trend of very low revenue in recent years but ambitious economic reforms to boost foreign investment and private participation could be positive for the economy, if Sri Lanka reduces external borrowing to finance growth.

Strong protests by trade unions have prompted the government to withdraw a proposal to revise public sector pensions.

The IMF last week warned Sri Lanka of an uncertain economic outlook, while a top IMF official raised questions about its ambitious revenue and capital expenditure goals.,

Kyran Curry, S&P’s director of sovereign ratings, said Sri Lanka’s sovereign rating could be lowered if its external liquidity deteriorated markedly or growth and fiscal consolidation prospects worsened significantly.