Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 8 February 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: US employment gains slowed more than expected in January as the boost to hiring from unseasonably mild weather faded, but rising wages and an unemployment rate at an eight-year low suggested the labor market recovery remains firm.

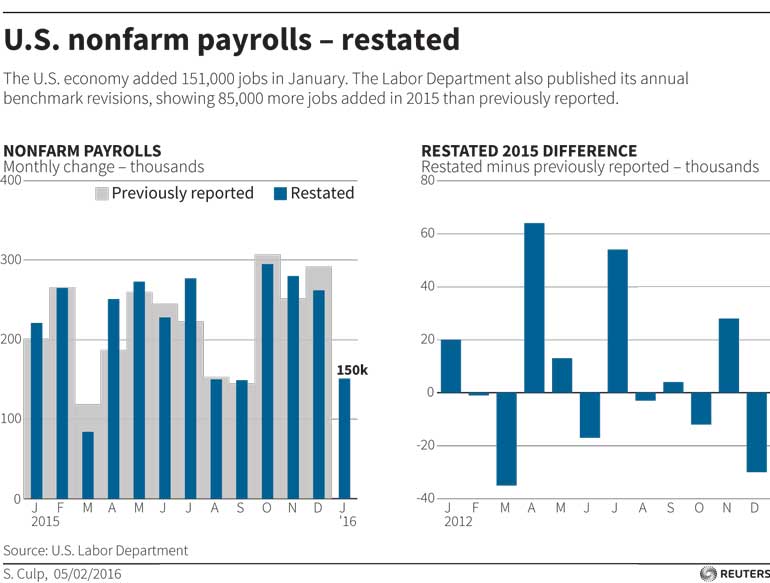

Non-farm payrolls increased by 151,000 jobs and the unemployment rate slipped one-tenth of a percentage point to 4.9%, the lowest since February 2008, the Labor Department said on Friday. The payrolls gain was a sharp step-down from the average 231,000 jobs per month during the fourth quarter.

“The fact that payroll gains fell back to earth is not necessarily a bad sign. Most indications are that the job market in the US is on solid footing and improving,” said Nariman Behravesh, chief economist at IHS in Lexington, Massachusetts.

Economists had forecast employment increasing by 190,000 in January and the jobless rate steady at 5%. The economy added 2,000 fewer jobs in November and December than previously reported.

On top of a 0.5% jump in average hourly earnings, which was the biggest gain in a year, employers increased hours for workers. Manufacturing, which has been undermined by a strong dollar and weak global demand, added the most jobs since August 2013.

Economists said the combination of strong wage growth and falling unemployment suggested a March interest rate increase from the Federal Reserve could not be completely ruled out.

The dollar rose against a basket of six major currencies on the data after hitting a roughly 15-week low on Thursday. Prices for US government debt initially fell, but pared losses as stocks on Wall Street extended their decline.

“The lower unemployment rate and rising wages further support the view that the labor market is doing nothing but tightening,” said Joel Naroff, chief economist at Naroff Economic Advisors in Holland, Pennsylvania. “Clearly, there are more uncertainties today than when the Fed raised rates in December and hinted that there could be four increases this year. But the labor market is absolutely not one of them.”

Tightening financial market conditions and signs that both the domestic and global economies were slowing had undercut the case for a Fed rate hike next month and lowered the probability of monetary policy tightening this year.

The US central bank raised its short-term interest rate in December for the first time in nearly a decade.

Federal Reserve Chair Janet Yellen has said the economy needs to create just under 100,000 jobs a month to keep up with growth in the working-age population.

The economy, especially voters’ perceptions of their job prospects, will likely be an issue in the November elections. President Barack Obama lauded the labor market progress.