Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 3 May 2016 00:03 - - {{hitsCtrl.values.hits}}

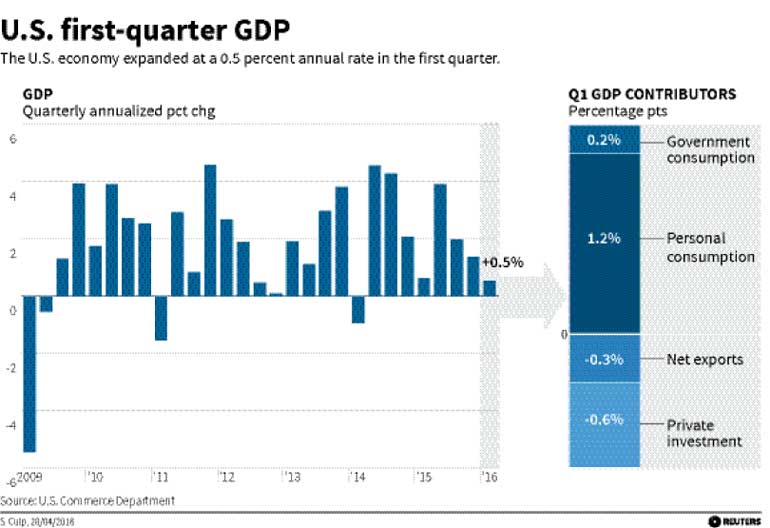

AFP (Washington): The US economy sputtered in the first quarter of 2016 to the weakest growth in two years as consumers and businesses cut back spending.

The economy grew at a slower-than-expected annual rate of just 0.5% in the quarter, the Commerce Department said on Thursday (28). It was the weakest pace since the first quarter of 2014, and was well below analysts’ 0.9% consensus estimate.

The paltry expansion in gross domestic product, a broad measure of economic output, followed a modest 1.4% pace in the fourth quarter and 2.0% in the third quarter.

“The US economy went through a rough patch at the turn of the year, with GDP growth averaging less than 1.0% during the past two quarters,” said Harm Bandholz of UniCredit Economics.

Analysts saw the recent rise in crude oil prices as potentially easing the pain of the long price rout that has battered the energy industry, forcing huge cutbacks in investment in the sector.

“Another weak first quarter is likely to be followed by stronger growth in the rest of the year - as has occurred in the past couple of years,”said Nariman Behravesh, chief economist at IHS Global Insight, predicting a rebound to at least 2.0% growth in the second quarter.

The Commerce Department’s first estimate of GDP, to be followed by two more, should also be taken with a grain of salt because of persistent problems in adjusting data for seasonal effects in the first quarter, analysts said.

“Looks grim, but the second quarter will be much better,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Business, consumer spending slower

A key brake on first-quarter growth was business investment, which fell at the sharpest pace, 5.9%, since 2009 amid the Great Recession. Spending on structures fell for a third straight quarter.

Consumer spending, which typically accounts for two-thirds of US economic activity, rose only 1.9% in the first quarter, the weakest growth since a year ago.

Consumer spending on goods was flat, up a bare 0.1%. Purchases of durable goods fell 1.6%, dragged down in part by slowing auto purchases.

Exports fell under pressure from a strong dollar and weak demand in the cooling global economy. Federal government spending also fell, including a hefty drop in defense spending.

The housing market remained a bright spot in the economy. Spending on home purchases jumped nearly 15% in the first quarter, the biggest advance since late 2102.

Inflation, based on the Federal Reserve’s preferred measure of core consumer prices excluding food and energy, jumped to an annual rate of 1.9%, near its 2.0% target.

Analysts said the data reinforces the Fed’s cautious approach to raising interest rates. The Fed kept key interest rates unchanged on Wednesday, citing slower growth.

But the Fed, noting the strong jobs market, also forecast that economic activity “will expand at a moderate pace” over the rest of the year.

Chris Low of FTN Financial said the Fed “is right to be cautious.”

“So far, companies are still investing in human capital, but ongoing employment growth cannot be a sure thing given the extent of the weakness in business investment,” he said. “There is not yet anything in the data to suggest the rebound will be anywhere near as strong as last spring’s.”