Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 5 August 2015 00:00 - - {{hitsCtrl.values.hits}}

Reuters: The Reserve Bank of India (RBI) kept its policy rate on hold at 7.25% on Tuesday, as widely expected, while leaving the door open to ease further depending on the inflation outlook and how swiftly banks lower their lending rates.

Read what experts are saying about the RBI’s decision to hold rates, click here

The RBI also said government economic reforms and the timing of any increase in US interest rates would be key factors that will determine whether the central bank cuts rates for a fourth time this year.

“It is prudent to keep the policy rate unchanged at the current juncture while maintaining the accommodative stance of the monetary policy,” the RBI said in its statement.

“As the Reserve Bank awaits greater transmission of its front-loaded past actions, it will monitor developments for emerging room for accommodation.”

The next policy review is set for Sept. 29. Any increase in US rates decided at a Federal Reserve meeting earlier that month is expected to suck money out of emerging markets.

The RBI has reduced its policy rate by three-quarters of a percentage point since embarking on an easing cycle in January. The last cut lowered the repo rate to 7.25% on 2 June.

But, to the central bank’s chagrin, the benefits for the broader economy have been limited because of commercial banks’ reluctance to lower their lending rates.

Whereas the decision to leave rates unchanged this time was widely expected, economists polled by Reuters before the review were evenly split over chances for reduction by the end of the year.

“Unlike the last policy, where they sounded very hawkish and the market construed it as the end of the cutting cycle, this was clear affirmation they are not at the end and they would look for an opportunity to give growth a boost,” said Abheek Barua, chief economist of HDFC Bank in New Delhi.

India’s benchmark 10-year bond yield was largely unchanged after the RBI decision. The broader Nifty index was down 0.5%.

India is overhauling its monetary policy-making and during coming months, the RBI and the government will discuss the formation of a seven-member committee that will decide interest rates, and how much power the RBI governor would retain.

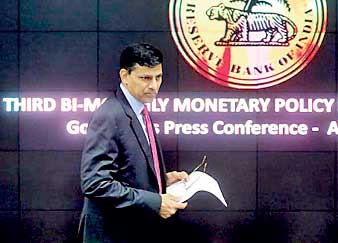

The RBI governor currently has wide discretion in deciding interest rates. Governor Raghuram Rajan said there was “broad consensus” on the structure of the committee and the powers of the governor.

“Currently the situation is that the governor has a veto. All advice is only advice, ultimately the decision is the governor’s, so if we continue to retain a veto it doesn’t change the current situation, it maintains the status quo,” Rajan told a news conference.