-

Commodities pulled down by tumbling Asian stocks

-

Oil, coal, copper at 2009 peak financial crisis levels

-

Solar stocks tumble along with China’s share rout

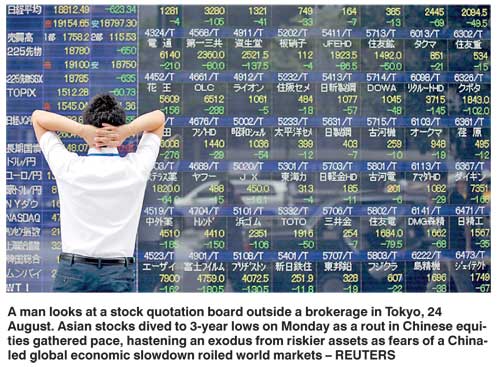

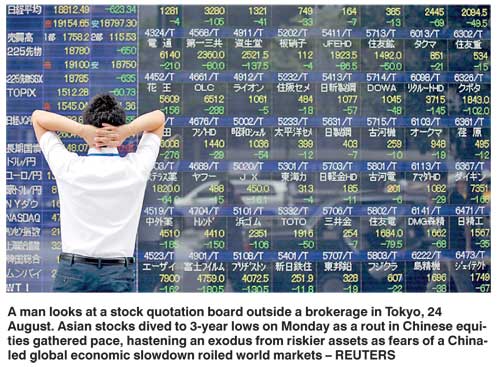

SINGAPORE (Reuters): Commodities markets tumbled on Monday as fears spread that a more severe slowdown in China would pull down other economies in the region, denting energy and raw material consumption.

Chinese stocks dived more than 8% on Monday morning, with the Shanghai index giving up all its gains for the year, prompting a broader sell-off in riskier assets, including oil and metals.

“Stock markets are often said to be leading indicators of the global economy. Given how equity markets have slumped in the past  couple of weeks and months, it may be an ominous foreboding of things to come,” Singapore-based Phillip Futures said.

couple of weeks and months, it may be an ominous foreboding of things to come,” Singapore-based Phillip Futures said.

In oil markets, the US West Texas Intermediate (WTI) and Brent marked fresh six-year lows, falling to levels last seen during the peak credit crunch of 2009.

WTI traded well below $ 40 a barrel and Brent fell under $ 45 per barrel by 0500 GMT. With prices down 60% from 2014 highs, revenues for oil exporting countries are being hammered.

“The continued fall in oil prices and uncertainty about China’s growth prospects have added further downside risks to Saudi Arabia’s macroeconomic outlook,” Barclays said about the world’s top crude exporter, which has been forced to issue bonds and eat into its foreign reserves to cover a huge budget deficit.

In coal, the most common source for electricity generation, API2 2016 futures already hit 12-year lows last week, and physical prices for cargoes from Australia’s Newcastle or South Africa’s Richards Bay terminals are back to levels last seen before the 2008/2009 boom and bust.

Analysts said further downward price adjustment might come.

“Global investor sentiment dipped in August to the lowest level since we started the survey,” Morgan Stanley said, adding that an adjustment process would be long and painful.

In metals, copper and aluminium futures hit 2009 lows on Monday, while iron ore and steel futures in China slid sharply to reach their downside limit.

Australia’s Fortescue Metals Group said its annual profit slumped 90%, the latest iron ore miner to report sharply lower earnings on weak prices for the steelmaking ingredient as China’s economy slows.

The rout has also spread to sectors that have so far been performing well. The MAC global solar index, which soared in early 2015, has almost halved in value since April, pulled down by the tumbling Chinese stock markets.

India tries to calm jittery investors as markets tumble

India’s policymakers tried to soothe jittery investors on Monday after domestic shares slid nearly 6% and the rupee sank to its lowest since late 2013 following a China-led sell-off across Asia.

Central bank governor Raghuram Rajan told a banking conference Asia’s third-largest economy was in a good position relative to other countries to withstand the current global markets volatility.

“India is better placed compared to other countries with low current account deficit, and fiscal deficit discipline, moderate inflation, low short-term foreign currency liabilities, very sizeable base of forex reserves,” he said.

“We will have no hesitation in using our reserves when appropriate to reduce volatility in the rupee.”

The rupee fell to as low as 66.74 per dollar on Monday, its lowest since September 2013, as Asian markets reeled under fears of a China-led global economic slowdown.

The 30-share Sensex dropped 5.94%, its biggest daily percentage fall since 7 January 2009. The index fell to as low as 25,624.72 points at one point, its lowest intraday level since 11 August 2014.

Finance Minister Arun Jaitley also downplayed the sell-off, calling it “transient and temporary in nature”.

“The factors responsible for this are entirely external,” he said in New Delhi. “There is not a single domestic factor in India which has either contributed to it or added to it.”

Analysts believe India’s markets will remain relatively more insulated than other countries.

India has steadily built up its FX reserves to a record high of more than $355 billion since Rajan took the helm of the RBI in September 2013, when the rupee was in the midst of its worst crisis in more than two decades.

Jaitley emphasised the need to strengthen the domestic economy so that even amid a global slowdown, India will be among one of the fastest-growing economies in the world.

Deficient summer rainfall as well as listless corporate earnings have raised worries that growth could come in below Jaitley’s 8 to 8.5% for the year to March. Moody’s last week lowered its growth forecast to 7%, from 7.5%.

A record cooling in retail inflation in July as well as China’s decision to devalue the yuan have bolstered calls for the RBI to cut rates further to juice up growth.

But on Monday, Rajan reiterated his focus on bringing down inflation, saying any rate cuts would be carried out in response to inflation and not to “public pleading.”

“Rate cuts should not be seen as goodies that the RBI gives out stingily after much public pleading,” Rajan said.

|

China gives pension funds access to stock market

China on Sunday allowed pension funds managed by local governments to invest in the stock market for the first time, potentially channelling hundreds of billions of yuan into the country’s struggling equity market.

China published a draft rule on the move for public consultation on 30 June, at the height of a recent stock market rout.

Despite a series of official measures aimed at supporting the market, investor sentiment has remained fragile amid continued signs of slowing economy.

The State Council, or cabinet, published the finalised rules on Sunday after shares slumped nearly 12% last week, the worst weekly performance since June.

Pension funds will be able to invest up to 30% of their net assets in the country’s stocks, equity funds and balanced funds, according to rules published on the State Council’s website.

Previously, the pension funds could only invest in bank deposits and treasuries.

Together the funds have assets of more than 2 trillion yuan ($ 322 billion) that can be invested, meaning about 600 billion yuan ($ 97 billion) could theoretically go into the stock market, state media has estimated.

According to the new rules, pension funds can also invest in convertible bonds, money-market instruments, asset-backed securities, index futures and bond futures in China, as well as the country’s major infrastructure projects.

Local governments can mandate institutions authorised by the central government to manage the pension funds.

|

couple of weeks and months, it may be an ominous foreboding of things to come,” Singapore-based Phillip Futures said.

couple of weeks and months, it may be an ominous foreboding of things to come,” Singapore-based Phillip Futures said.