Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 17 November 2015 01:21 - - {{hitsCtrl.values.hits}}

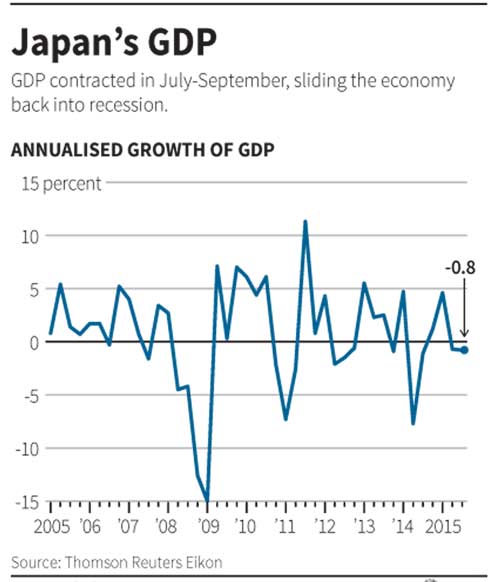

Reuters: Japan’s economy slid back into recession in July-September as uncertainty over the overseas outlook hurt business investment, keeping policymakers under pressure to deploy new stimulus measures to support a fragile recovery.

A rebound in private consumption and exports offered some hope the world’s third-largest economy is emerging from the doldrums, despite slowing Chinese demand and the pain households are feeling from rising imported food prices.

Still, many analysts expect the economy to grow only moderately in the current quarter as companies remain hesitant to use their record profits for wage hikes, underscoring the challenges premier Shinzo Abe faces in pulling Japan sustainably out of stagnation with his “Abenomics” stimulus policies.

“A big drop in inventory was the largest factor behind a third-quarter contraction. Weak capital spending was a concern, but excluding these factors, the GDP figures were not so bad,” said Takeshi Minami, chief economist at Norinchukin Research Institute.

The world’s third-largest economy shrank an annualised 0.8% in July-September, more than a median market forecast for a 0.2% contraction, government data showed on Monday.

That followed a revised 0.7% contraction in April-June, which was the first decline in three quarters.

Japan thus slipped back into technical recession, which is defined as two consecutive quarters of contraction, after suffering one last year due to the hit on consumer spending from a sales tax hike in April 2014.

The data may affect debate among policymakers on how much fiscal spending should be earmarked in a supplementary budget that is expected to be compiled this fiscal year.

The government maintained a cautiously upbeat view, saying that despite some weaknesses, the economy continues to recover moderately on improvements in job and income conditions.

“While there are risks such as overseas developments, we expect the economy to head toward a moderate recovery thanks to the effect of various (stimulus) steps taken so far,” Economics Minister Akira Amari said in a statement after the data was released.

Capital expenditure fell 1.3%, more than a median market forecast of a 0.4% decrease to mark a second straight quarter of declines, on sluggish investment by automakers and machinery manufacturers.

But private consumption, which accounts for about 60% of gross domestic product (GDP), rose 0.5% from the previous quarter, roughly in line with a median market forecast.

While domestic demand shaved 0.3 percentage point off GDP, external demand added 0.1 point to growth, the data showed.

The weak data would be of little surprise to many Bank of Japan officials, who had largely factored in the recession and expect growth to rebound in coming quarters as consumption and factory output show signs of a pick-up.