Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 30 July 2015 00:00 - - {{hitsCtrl.values.hits}}

SYDNEY (Reuters): Asian shares were mostly higher on Wednesday on hopes that Beijing could stem the rout in its markets without damage to the economy, though caution was the watchword ahead of a policy decision from the US Federal Reserve.

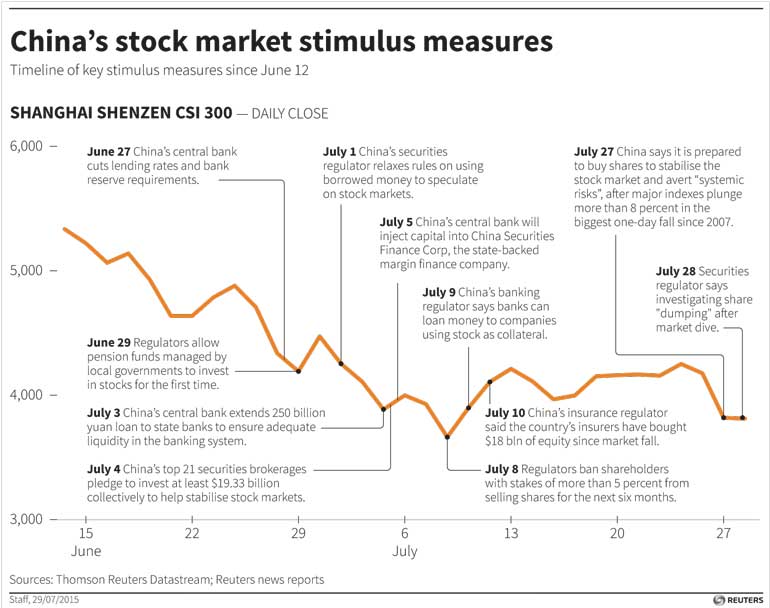

The CSI300 index of the largest listed companies in Shanghai and Shenzhen gained 0.6% in choppy morning trade, while the Shanghai Composite rose 0.7%.

Sentiment has been soothed a little by pledges from Chinese regulators to buy shares to stabilise stocks if needed and hints of more policy easing from the central bank.

Yet investors remain understandably wary of a market that, without warning, fell more than 8% on Monday.

The steadier tone was enough to lift Australia’s main index 1%, while MSCI’s broadest index of Asia-Pacific shares outside Japan bounced 0.7%.

Japan’s Nikkei was one of the few markets in the red with a loss of 0.4%.

On Wall Street, the Dow had ended on Tuesday with gains of 1.09%, while the S&P 500 rose 1.24% and the Nasdaq 0.98%.

Not faring so well was Twitter, which sank 11% in extended trade after the microblogging company said its monthly average users grew at the slowest pace since it went public in 2013.

The Fed ends a two-day policy meeting later on Wednesday with markets divided on whether it will take a hawkish or dovish stance, while some suspect it might chose to do neither. No move on rates is expected this week.

In recent congressional testimony, Fed Chair Janet Yellen neither ruled out a September hike nor guided the market toward thinking it was a done deal.

“We think the upcoming FOMC statement will reflect this non-committal approach,” said Tom Porcelli, chief US economist at RBC Capital Markets.

“In other words, there will be no explicit tweak to the guidance signaling a hike is imminent.”

At most, the Fed might sound a little more positive on the economy and describe risks to the outlook as balanced rather than “nearly” balanced, Porcelli added.

In currency markets, investors seemed to decide it was safer not to be short of the U.S. dollar ahead of the policy statement at 1800 GMT.

The dollar was holding at 123.45 yen, from a low of 123.04 on Tuesday, while the euro stood at $1.1082.

Against a basket of currencies, the dollar was off 0.2% at 96.505.

In energy markets, oil prices were subdued ahead of official data on U.S. stockpiles.

Brent futures were down eight cents at $53.21 a barrel and near their lowest since February. U.S. crude futures slipped 6 cents to $47.92 a barrel.