Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 22 September 2017 00:00 - - {{hitsCtrl.values.hits}}

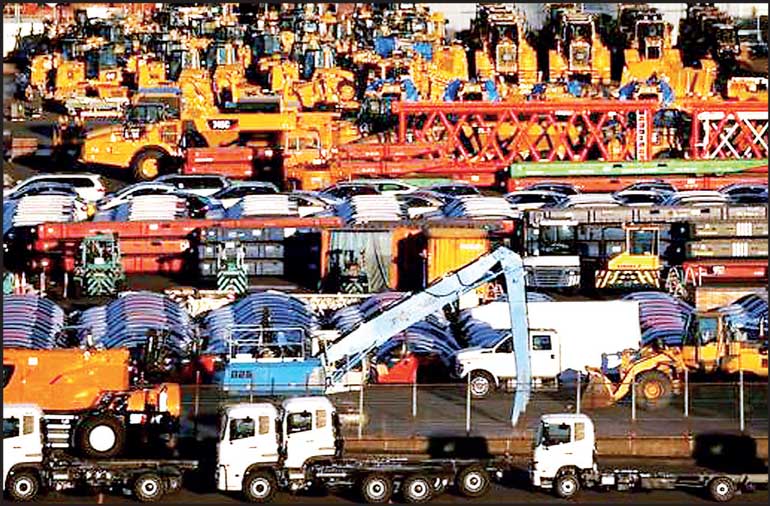

TOKYO (Reuters): Booming shipments of cars and electronics in August drove up Japan’s exports at the fastest pace in nearly four years, further evidence that overseas demand is strong enough to support healthy economic growth.

TOKYO (Reuters): Booming shipments of cars and electronics in August drove up Japan’s exports at the fastest pace in nearly four years, further evidence that overseas demand is strong enough to support healthy economic growth.

The 18.1% annual increase in exports was the fastest since November 2013 and handily beat the median estimate for a 14.7% annual rise seen in a Reuters poll.

August’s export result was well up on July’s 13.4%, and marked a ninth straight month of expansion.

Export growth is seen likely to continue as the global economy remains on a solid footing, which should underpin policymakers’ confidence in Japan’s economic outlook.

The Bank of Japan is expected to keep monetary policy on hold at a meeting ending on Thursday as inflation remains confusingly low despite data pointing to solid economic growth.

“This data suggests that overseas demand will drive Japan’s growth in July-September and make up for slight weakness in consumer spending,” said Hiroaki Muto, economist at Tokai Tokyo Research Center.

“The global economy is healthy, so expect Japan’s exports to accelerate even further.”

Japan’s exports rose 10.4% by volume in August from a year ago, following a 2.6% annual increase in July.

Export volumes rose the most since 2010 in August, suggesting that net trade should have started to support growth in the third quarter, Marcel Thieliant, Japan economist at Capital Economics, said in a research note.

A pickup in shipments of cars, car parts, and semiconductor manufacturing equipment increased Japan’s year-on-year exports to the United States in August by 21.8% versus an 11.5% annual increase in the previous month.

The rise in Japan’s exports to the United States in August was the fastest since December 2014, finance ministry data showed.

China-bound exports rose 25.8% year-on-year in August, faster than a 17.6% annual increase in July as Japan shipped more electronic screens panels and plastics.

Imports rose 15.2% in the year to August, versus the median estimate of an 11.8% increase.

The trade balance came to a surplus of 113.6 billion yen ($1.02 billion), versus the median estimate of a 93.9 billion yen surplus.

Capital Economics’ Thieliant noted, however that: “The surge in the annual growth rates was driven by base effects. In seasonally-adjusted terms, both export and import values rose by a modest 1.2% month-on-month.”