Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 7 February 2018 00:00 - - {{hitsCtrl.values.hits}}

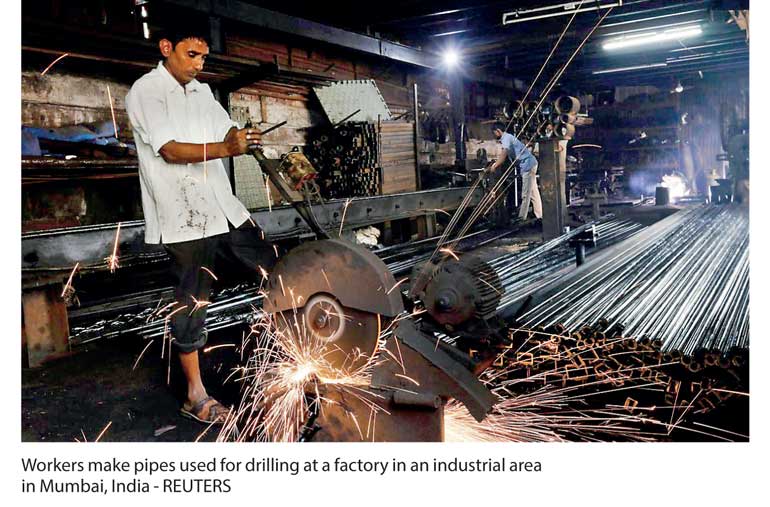

New Delhi(Reuters): India has forecast its economic growth would accelerate to 7 to 7.5% in the 2018/19 fiscal year, to once again become the world’s fastest-growing major economy.

The Government’s economic survey, presented to Parliament went on to say that though the plan has been to reduce the fiscal deficit from an estimated 3.2% this year to 3.0% in 2018/19, a pause in the move toward a lower deficit could be merited in order to give the economy momentum.

“Reflecting largely fiscal developments at the centre, a pause in general Government fiscal consolidation relative to 2016-17 cannot be ruled out,” the survey, written by the Finance Ministry’s Chief Economic Adviser Arvind Subramanian, said.

The survey, an annual report the health of the economy, was released ahead of the Government’s budget statement, presented by Finance Minister Arun Jaitley on Thursday.

“A series of major reforms undertaken over the past year will allow real GDP growth to reach 6.75% this fiscal (year) and will rise to 7.0 to 7.5% in 2018/19, thereby reinstating India as the world’s fastest growing major economy,” the survey said.

A senior official at China’s National Development and Reform Commission (NDRC) wrote in the Beijing daily on Monday that China’s economic growth was likely to slow to 6.5-6.8% this year. Fuelled by stronger private investment and exports, the recovery forecast for India’s growth rate comes after the country posted its slowest growth in three years in 2017/18.

The slowdown was partly a consequence of the chaotic rollout of a nationwide goods and service tax (GST) last year and a shock move to take high value currency notes out of circulation in late 2016.

The budget is expected to step up funding of rural development programmes and help small businesses as Prime Minister Narendra Modi’s nationalist government heads into a national election in 2019.

“GDP growth might be at the lower end of the range, but broadly the estimates are in line with our expectations,” said Suvodeep Rakshit, Senior Economist at Kotak Institutional Equities in Mumbai.

“The Government will likely focus on rural and urban infrastructure, housing, agriculture as well as bit on the capital expenditure front with a judicious mix of budgetary and extra budgetary expenditure,” Rakshit added.

The survey cautioned that persistently high oil prices remained a key risk for a country that relies on imports for much of its fuel needs.

The benchmark 10-year bond fell, with the yield up 5 basis points at 7.53% after the report indicated fiscal deficit targets could be loosened, albeit modestly.

The rupee was slightly stronger, trading at 63.51 from its 63.5475 close.

But, India’s share markets held onto gains after the release of the survey, with the broader NSE share index up 0.7% from the previous close.