Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 6 April 2018 00:00 - - {{hitsCtrl.values.hits}}

Beijing (Reuters): China has never surrendered to external pressure and it will win any trade war with the United States, the nation’s state media stressed in a series of editorials and columns in the hours after the world’s two top economies targeted each other with steep tariffs.

Beijing (Reuters): China has never surrendered to external pressure and it will win any trade war with the United States, the nation’s state media stressed in a series of editorials and columns in the hours after the world’s two top economies targeted each other with steep tariffs.

While China’a Ambassador to the United States Cui Tiankai stressed in comments to reporters in Washington that Beijing’s preference was to resolve the trade dispute through negotiations, Beijing’s official mouthpieces were taking a more belligerent line.

The ruling Communist Party’s People’s Daily newspaper said Beijing’s quick counter-move had caught the Americans off guard.

“Within 24 hours of the U.S. publishing its list, China drew its sword, and with the same strength and to the same scale, counterattacked quickly, fiercely and with determination,” the paper said in a commentary on Thursday.

“The confidence to know that [China] will win the trade war comes from the scale of [China’s] consumer market,” the paper said, noting that China’s market potential is incomparable to other economies.

Many American consumer product and industrial companies see the Chinese market as a big source for future growth given the continued rise in the number of people joining both the middle class and the wealthier levels of Chinese society.

The United States’ proposed list of $50 billion in duties on Chinese goods is aimed at forcing Beijing to address what Washington says is deeply entrenched theft of U.S. intellectual property and forced technology transfer from U.S. companies.

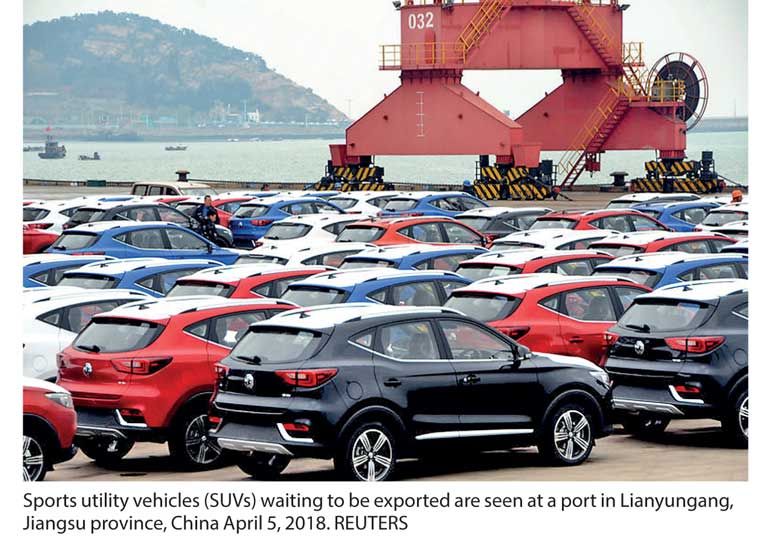

China hit back within hours with its own threatened tariffs on U.S. imports including soybeans, planes, cars, whiskey and chemicals. The official Xinhua news agency said late on Wednesday that the U.S. tariffs proposal would cost the United States “dearly”.

“China will not be afraid or back down if a trade war is unavoidable. The country has never surrendered to external pressure, and it will not surrender this time either,” Xinhua said.

The apparent determination not to retreat is at the polar opposite of comments by White House National Economic Council Director Larry Kudlow, who told Fox News Channel on Wednesday: “I believe that the Chinese will back down and will play ball.” Shortly after U.S. President Donald Trump’s administration issued its list, China’s ambassador to the World Trade Organization urged all of the trade body’s members to join with China to counter U.S. trade abuses. “China’s counter tariffs are a spectacular way of standing up to America’s bullying tactics, not only for itself, but for other countries threatened by the United States’ new trade policies,” the nationalist Global Times said in an editorial on Thursday.

While Beijing’s claims that Washington is the aggressor and spurring global protectionism, China’s trading partners for years have complained that it abuses WTO rules, and practices unfair industrial policies at home that lock foreign companies out of crucial sectors with the intent of creating domestic champions.

China has repeatedly pledged that it would open up sectors such as financial services, including promises to the Trump administration last year that it would give “full and prompt market access” to U.S. payment network operators.

But despite a 2012 WTO ruling that China was discriminating against foreign payment card companies, no U.S. firm has yet been granted a license.

Trump has said in speeches that the United States will no longer let China take advantage of it on trade, and bipartisan support has been steadily building in Washington to address what are seen as Chinese abuses.

Washington’s some 1,300-product long list was focused on Chinese industrial technology, transport and medical products and tailored to do the least damage to U.S. consumers.

China appeared to be angling to inflict political costs on Trump by striking at signature U.S. exports, including soybeans, frozen beef, cotton and other agricultural commodities produced in states from Iowa to Texas that voted for him in the 2016 presidential election.

Neither lists have gone into effect. Washington will hold public comment period expected to last around two months, and Chinese officials have said its implementation will depend on U.S. action.

Cui met with Acting U.S. Secretary of State John Sullivan in Washington on Wednesday, and later told reporters that the two countries should avoid a trade war. “Negotiation would still be our preference, but it takes two to tango,” Cui said.

New York (Reuters): It took China just 11 hours to retaliate against the United States for proposing tariffs on some 1,300 Chinese products, but Chinese officials are holding back on taking aim at their largest American import: government debt.

In a tit-for-tat response to the Trump administration’s plan for 25% duties on $50 billion of Chinese imports, China hit back with its own list of similar duties on key American imports including soybeans, planes, cars, beef and chemicals. But officials signaled no interest for now in bringing their vast holdings of U.S. Treasuries to the fight.

China held around $1.17 trillion of Treasuries as of the end of January, making it the largest of America’s foreign creditors and the No. 2 overall owner of U.S. government bonds after the Federal Reserve. Any move by China to chop its Treasury portfolio could inflict significant harm on U.S. finances and global investors, driving bond yields higher and making it more costly to finance the federal government.

Jeffrey Gundlach, the chief executive of DoubleLine Capital LP, said China can use its Treasury holdings as leverage, but only if they keep holding them.

“It is more effective as a threat. If they sell, they have no threat,” said Gundlach, known as Wall Street’s Bond King. “It would only escalate the situation and eliminate their leverage.”

Prices on benchmark 10-year U.S. Treasury notes slipped on Wednesday, giving back earlier gains on the trade news. Their yield edged up to about 2.81% Wednesday afternoon.

China’s Treasury holdings have dipped in recent months, declining by about $30 billion from $1.20 trillion last August, and they are down about 11% from their record high above $1.3 trillion in late 2013, according to U.S government data. In all, foreign governments own $4 trillion, or more than a quarter, of the $14.7 trillion in Treasury securities outstanding.

Asked by a reporter on Wednesday if China would reduce its U.S. Treasury holdings in retaliation, Vice Finance Minister Zhu Guangyao reiterated China’s long-standing policy regarding its foreign exchange reserves, saying it is a responsible investor and that it will safeguard their value.

China’s foreign exchange reserves, the world’s largest, stood at about $3.13 trillion at the end of February, with roughly a third of it held in Treasuries.

“If they wanted to pull the nuclear switch, if they committed to dumping Treasuries, it would have an immediate and temporary impact on money markets in the United States,” said Jeff Klingelhofer, a portfolio manager who oversees more than $6 billion at Thornburg Investment Management Inc. “But I think it is a bigger hit to the sustainability of what they’re trying to accomplish.”

Brad Setser, senior fellow for international economics at the Council on Foreign Relations in New York, said China can sell Treasuries and buy lower-yielding European or Japanese debt.

But the effect would likely be to strengthen the yuan against the dollar, weakening the relative desirability of its exports, analysts said. The sale could also tank the value of the Treasuries China retains, with nothing to show for the aggression.

More likely, if China wanted to turn up the heat it would let the yuan depreciate against the U.S. dollar, according to CFR’s Setser, a move that could kneecap the Trump administration’s goal of jump-starting U.S. manufacturing. The yuan weakened by about 0.25% on Wednesday but remains near its strongest in two and a half years.

Even if the likelihood of a change in Chinese policy regarding its Treasuries portfolio remains low, investors are sensitive to the risk any big shift would pose to world financial markets, where Treasuries are a global benchmark asset. A January report that China might halt its purchases of Treasuries forced yields higher, but China disputed the news and said it was only diversifying its foreign exchange reserves to safeguard their value.