Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 15 June 2019 02:43 - - {{hitsCtrl.values.hits}}

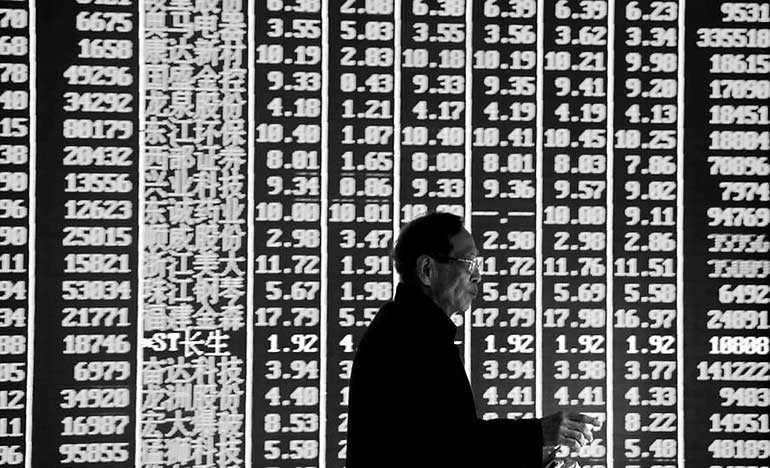

A man is seen in front of an electronic board showing stock information on the first day of trading in the Year of the Pig, following the Chinese Lunar New Year holiday, at a brokerage house in Hangzhou, Zhejiang province, China - Reuters

LONDON (Reuters): World stocks struggled and safe haven bets were back in play on Friday with German bond yields plumbing record lows as Chinese data rekindled woes about the health of the global economy and fears of a new US-Iran confrontation intensified.

Data from Beijing painted a fairly gloomy picture of the world’s second largest economy as the trade war with the United States starts to bite. May industrial output growth slowed to a more than 17-year low, well below expectations, while fixed-asset investment also fell short of forecasts.

Expectations for more stimulus in China are growing as the Sino-US trade dispute threatens to escalate into a full-blown trade war that many fear could push the global economy into recession.

The data saw yields on German 10-year Bunds — seen as one of the safest assets in the world — fall to fresh record lows. US Treasury yields were also grinding lower. Safe-haven bond yields have already fallen in recent days amid rising speculation about monetary easing by major central banks. Spain bond yields have fallen for the first time below 0.5%.

“The Chinese data was disappointing, especially the industrial output numbers,” said Chris Scicluna, head of economic research at Daiwa Capital Markets. “That’s given bond markets additional momentum.”

Equity markets across Europe chalked up hefty losses on the risk-off sentiment, with a warning by US chipmaker Broadcom Inc. of a slowdown in demand due to trade tensions and the US ban on Chinese tech and mobile phone company Huawei Technologies exacerbating the glum mood.

The pan-European STOXX 600 index fell 0.5%, with Germany’s trade-sensitive DAX falling 0.6%.

European tech shares led the indexes lower, with semiconductor companies Infineon, AMS, STMicroelectronics, Siltronic and Dialog Semiconductor all dropping between 2-3% after Broadcom outlined the impact of a total halt in sales to Huawei.

“The sales warning from Broadcom is also weighing on markets this morning as it suggests that both semiconductor and auto sectors are under pressure worldwide,” said brokerage Market Securities, Paris, Chief Strategist Christophe Barraud, adding that expectations for a rebound were now shifting from the second half of this year to 2020. “Given both these sectors are key for world trade, it’s not good news for trade.”

US stock futures indicated Wall Street was in line for a lower open, with the S&P e-mini pointing to a 0.2% fall.

Wall Street shares have had a strong run in June on hopes the Federal Reserve will ease monetary policy soon to counter pressure on the US economy from the escalating trade war. The S&P 500 index is up about 5% so far this month.

Wait for the Fed

The Fed’s 18-19 June meeting will give investors an opportunity to see if the US central bank’s monetary policy stance matches market expectations for a near-term rate cut.

A Reuters poll showed a growing number of economists expect the Fed to cut interest rates this year although the majority still expect it to stay on hold.

“There is a large degree of uncertainty going into next week’s FOMC (Federal Reserve Open Committee) meeting as market reaction will differ significantly depending on whether the Fed hints toward easing policy,” said chief Japan FX and equity strategist at Bank Of America Merrill Lynch Shusuke Yamada.

“A wait-and-see mood is likely to begin prevailing in the markets ahead of the FOMC.”

In currency markets, the dollar’s index against a basket of six major currencies was little changed at 96.957 after ending the previous day nearly flat, with caution ahead of the Fed meeting keeping the greenback in a tight range.

The euro was steady at $ 1.1282 while the greenback inched down 0.2% to JPY 108.19.

The Australian and New Zealand dollars fell on Friday as bets on interest rate cuts undermined demand and Group of 20 meeting later this month sidelined investors.