Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 27 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Devin Jayasundera

Over 50% of the Sri Lankan start-up community feels that inadequate funding opportunities and lack of affordable workspaces are key challenges to growing their businesses, according to a recent study.

The ‘Sri Lanka Start-up Ecosystem Report’ compiled by the SLASSCOM Innovation and Entrepreneurship Forum is the first-ever comprehensive study to assess the nature and structure of the start-up economy in the country.

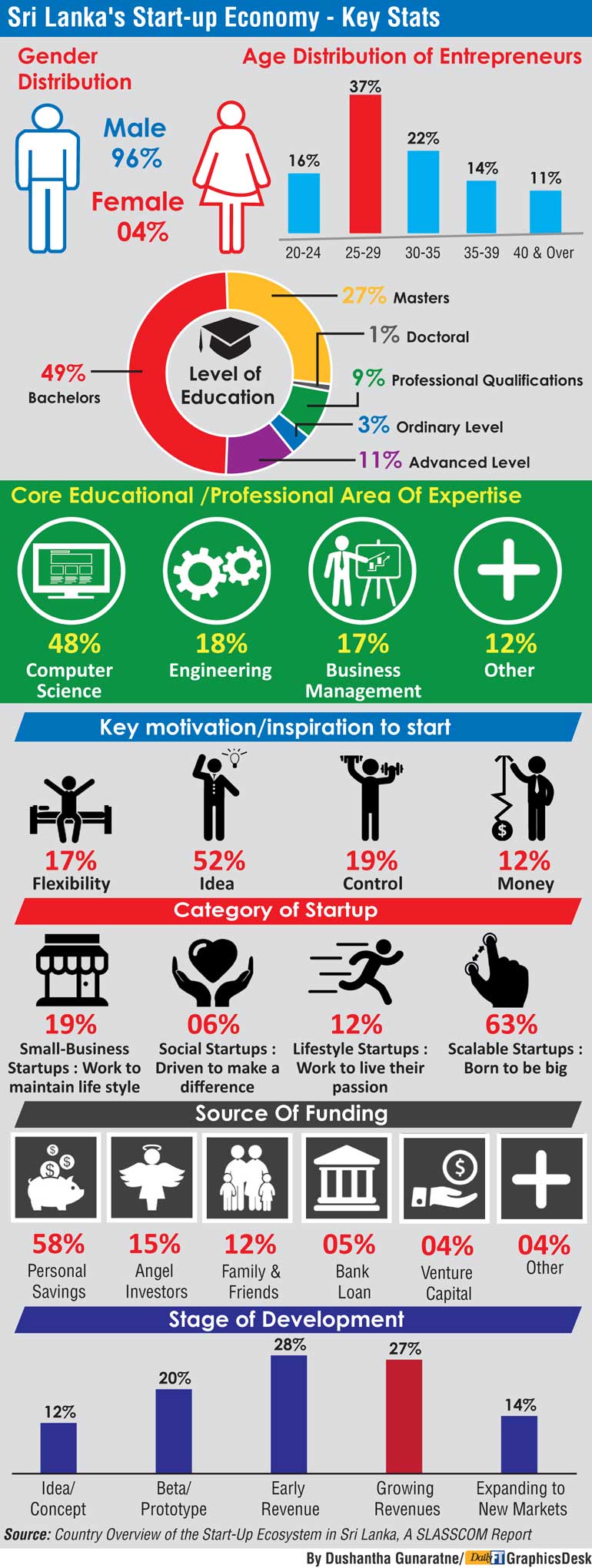

According to the study, the local start-up scene is rapidly expanding with 55% of the companies already generating early or growing revenues.

SLASSCOM projects that the local IT/BPM industry is on the way to achieve a target of $ 5 billion in export revenue by 2022. However, industry experts opine that depending purely on IT services, which is the most predominant sector, would not be sufficient to take the industry to the next level.

“IT services companies work on the basis that you charge by the hour. On average, about $150 to $200 per hour. That could scale only so much. In contrast, a company such as Uber which is valued at $46 billion has only 100 people working across the world. That is the value of a product start-up company. Start-ups are the only way to grow,” SLASSCOM’s Vice Chairman and Entrepreneurship Lead Ruwindhu Peiris told the Daily FT.

The report highlights a perception of a weak institutional support environment in investments for start-ups. The major source of acquiring capital for an overwhelming 70% of entrepreneurs is either through personal savings or funding by family or friends. Only 24% are funded externally, which is broken down to 15% by angel investors, 5% by banks and 4% via venture capital.

Peiris, who was directly involved in the study and is a venture capitalist himself, does not believe that the investor community is abnormally risk averse in investing in local start-ups.

“It is not a lack of capital. The problem is that our start-ups do not know how to attract capital. That’s the big difference,” says Peiris.

He identifies this misnomer as a deficit between the high quality technical capacity that start-ups possess and inadequacy of business savviness as the major drawback in convincing investors.

The low inclination of the banking sector in funding start-ups is a major barrier in acquiring debt capital. Even companies that are growing which have signed up contracts worth $500,000 to $600,000 have difficulty in getting working capital loans from banks, according to Pieris.

He quipped that banks are more inclined to give money for a buyback program for broilers of a chicken farm than a tech start-up. He attributes this to the common illiteracy and low exposure among the banking community on the workings of a tech start-up.

“We need to educate the banking sector on technology and intellectual property to create a layer of understanding and be more flexible in providing working capital and loans at least for a few companies,” stressed Peiris.

To increase funding opportunities, SLASSCOM has already proposed a program in the partnership with the Export Development Board (EDB) to provide non-collateral-based loans for 1,000 start-ups. The loan will feature a one to two year grace period payback with a lenient interest rate.

Start-ups are also feeling the burn of rising rental costs experienced in key metropolitan areas of the country; 57% of the companies feel that the lack of affordable work spaces coupled with high electricity prices contributes a significant portion of their business costs. According to the report, the country’s electricity costs are the highest among other comparable countries in the region.

Peiris notes that lack of affordable workspaces for start-ups also hinders them in attracting high quality talent to their work pool.

“The Sri Lankan mentality is that you need to work in a nice office in Colombo to be called professionally successful. That’s where the problem lies. Initially they start working at their houses in suburbs like Kiribathgoda and Kelaniya. When it comes to hiring the next person and expanding the business, they find it difficult in attracting talented people.”

SLASSCOM is aggressively pushing forward the setting up of ‘incubator zones’ for high-potential start-ups in the business districts of Colombo, where free rental and subsidised electricity rates would be provided.

One of the key findings of the study is that companies which have a narrower specialisation (concentrating on one to two sectors) are more successful at generating higher revenue streams than companies with higher diversification.

Companies that are generating revenue within the Rs. 12-150 million range catered to less than two sectors whilst companies that had diversified into more than two sectors were only able to record revenues less than Rs. 12 million.

“When we dug into the data, there was a very direct statistical correlation of a company’s ability to grow fast with a lot of money if it specialised in a few things. As an entrepreneur started describing his company in more than two keywords, there was a dramatic decrease in terms of how fast it took them to grow and the amount of money they made in a year,” said Peiris.

According to Peiris, start-ups tend to follow a diversified approach, especially in the early stages, to generate a consistent cash-flow stream to keep their business operations running on a day-to-day basis. He attributes this behaviour to the expensive nature of maintaining a start-up in Sri Lanka, which ultimately forces companies to venture into multiple sectors and forgo the high returns of specialisation.

On a brighter note, a significant majority of the start-up community is self-assured of the sufficiency and quality of the technical talent in the country (86% of the respondents had a Bachelor’s degree or higher compared to 82.5% in the US).

Peiris identifies the current IT workforce as Sri Lanka’s biggest asset. However, he noted that technical skills alone would not help to make a billion dollar business.

“We have brilliant and smart individuals who always hands-down could compete with any other individual in the world. What is absolutely needed is more defined thinking, the ability to come up with effective business models that could disrupt industries. We need to encourage this kind of thinking in the younger generation as a start,” asserted Peiris.