Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 3 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Tyler Jewell

By Tyler Jewell

I joined WSO2 because of Open Source Software (OSS)’ potential.

Open source enables a transparent innovation and business model. Intellectual property published with an open source license can be consumed with freedoms not available with commercial licenses. Customers buy WSO2 subscriptions with clarity that our business goal is their successful deployment of open source to address their digital challenges.

We align WSO2’s interests with customers by IP transparency through open source and the Apache-way.

In public markets, a company discloses business and financial information regularly to the public with disclosures to protect investor, facilitate capital formation, and to maintain fair, orderly and efficient markets. Additionally, our customers, by purchasing our subscriptions, are making a dependency upon us. Their awareness and confidence in our business and financial health is necessary to establish an equitable engagement.

To further the alignment we have with customers, WSO2 will now annually report key business and financial results.

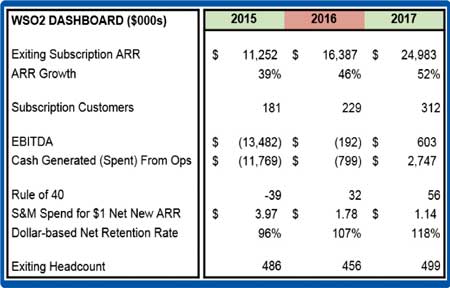

We are pleased to share that WSO2 is financially sound. (See box)

WSO2 is comprised of two businesses: OSS subscriptions and professional services. Subscriptions are renewable and we use SaaS metrics for tracking KPIs in pro forma financials. The ARR and customer metrics reflect our subscription business and our EBITDA is for the company.

In 2017, we will exit our Annualised Recurring Revenue (ARR) between $24.5 – $25.5M, a growth of 52%, up from 46% growth the previous year. Our gross margin for the recurring business is 88% and will increase in coming years. In 2017, we will turn our first profit with $603K EBITDA and generate $2.7M cash from operations.

We acquired 150 new customers in 2017 and more than 80 new subscription customers. Our new customers start with professional services during their technology evaluation and either continue consuming WSO2 open source or transition to a WSO2 subscription for access to patches, security updates and incident support.

We use dollar-based net retention rate to measure our ability to retain customers and expand their use of our subscriptions. Historically, customers have expanded their use of our IP and subscriptions over time as they realise the benefits of speed and innovation that come with engaging WSO2.

To support growth, we began significantly hiring in support, sales and marketing in Q3 finishing the year with a 482 headcount.

2017, by all accounts, is a successful year for WSO2.

We attribute the results to:

The passion and commitment of the employees and partners that put customer needs ahead of their own. We track our NPS at 25. We are striving for a 50 NPS, which is rare for enterprise software given the spectrum of customer needs.

Product and intellectual property expansion to service cloud-native architectures, which are, along with microservices, dominating customers’ future deployment expectations. This advanced architecture lets us process 5 trillion transactions, 40 million identities, and 200,000 APIs across our customers. We estimate that 25% of our customers are cloud deployments across our public cloud or within megaclouds.

The continued rotation within IT from proprietary to open source software. We have seen a dramatic rise in the number of organisations which have open source mandates, especially in emerging market territories, public sector, and system integrators.

Maturity and continuity of operations. We have 69 employees with >5 years service and 23 with >10 years. More than 2/3 of employees with us five years ago are with us today. Our employee mix is 33:67 for female:male creating a vibrant culture of diversity. Also, other than myself, the WSO2 management team has not changed since 2013. This has allowed a long-term open source vision to nurture in equal measures across the company.

WSO2 is the 8th largest OSS company and largest integration OSS company. An OSS company derives more than 50% of its revenues from OSS support subscriptions. The top OSS companies are:

RedHat

Pivotal

Mozilla

Canonical

Hortonworks

Suse

MongoDB

WSO2

Acquia, MuleSoft, Cloudera, Alfresco, Actian, Sophos, Forgerock, and Datastax were not included due to their open core model and dependency upon proprietary licensing.

We expect the coming year to continue playing to our strengths. Trends tied to growth in programmable endpoints across devices, identities, apps, APIs, and data will increase. Integration is now central to digitisation. Every program is an integration and every developer an integration specialist. This compounds the challenges to creating and governing integration endpoints that is the emphasis of our business.

Our 2018 operating plans include

Continue investing into Ballerina, and relaunch it with a developer GTM that focuses on solving integration problems for the next 20 years.

Expand sales and marketing by opening offices in new territories, establish our first resellers and distributors, and growing our sales, marketing and channel organisations.

Continue our investment in cloud-native architectures with the generational release of API Manager 3 and Enterprise Integrator 7 along with investing into cloud infrastructure installers.

Invest into broadening the value of our subscriptions: launching a Technical Account Manager program, expanding our Long Term Support policies, bundling cloud-native operations tools within our subscriptions, broadening the scope of our managed cloud services, expand test grid coverage to incorporate ecosystem technologies, and exploring the inclusion of a security scanning service.

Launch research initiatives into open source blockchain, AI, machine learning, and General Data Protection Regulation.

Formalise the CTO office. Our co-founder, Paul Fremantle, will return full time as our CTO January 1st after completing his PhD in Computer Science. The CTO office will receive investment to formalise the production of our Corporate Reference Architecture, Corporate Reference Methodology, Global Technology Outlook, and Global Market Outlook.

More than doubling our investments into marketing, enablement, and market education programs.

Renewed focus on open source governance to better engage the community and their involvement in the evolution of our projects.

Expanding our sales territories from 4 to 9 and separating our OEM ISV business.

We expect our ARR growth rate, EBITDA, and cash generation to increase in 2018. We’ll exit the year with approximately 560 employees.

All this means we can – and will – create a lot more open source that helps IT digitise assets.

We will be working to turn WSO2 into an IT-household brand, bringing our form of integration into every application and service you are building. If you are new to WSO2 or open source, 2018 will be a great year for you to learn more about how we can help you solve your digitisation challenges. Get in touch with me directly: [email protected].

Since this blog post includes future operating plans, predictions, estimates, and forecasts, this is a good time to point out that we have lawyers, and that our lawyers want you to know that this information represents our current judgment on what the future holds and it is subject to risks, uncertainties, and other nightmares. In other words, don’t be crazy by drawing conclusions that have undue reliance on this blog post and understand that we may revise anything.

(Source: https://wso2.com/blogs/thesource/2017/12/wso2-the-8th-largest-oss-company-2017-results-and-2018-plan/)