Friday Mar 06, 2026

Friday Mar 06, 2026

Tuesday, 2 March 2021 03:38 - - {{hitsCtrl.values.hits}}

|

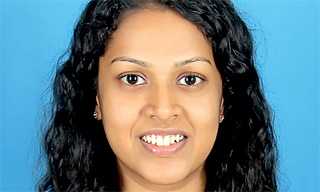

| Rifka Ziyard |

|

| Sachithra Chandrasena

|

The KPMG Academy will be enlightening decision makers on ‘Employment Benefits – Tax Considerations’ at the Friday mid-afternoon chat on 5 March from 3 p.m. onwards.

This is an interactive session on the tax on employment benefits such as salary, allowances, over time, bonus and non-cash benefits.

There were several changes introduced during the past few years on recognition of employment benefits as well as the valuation of the non-cash benefits given to employees.

Under Inland Revenue Act No. 24 of 2017 the employment income is computed on a gross basis including all cash and non-cash benefits identified under the Act.

Additionally CGIR has issued a circular providing the basis for valuing the non-cash benefits such as motor vehicle, fuel, accommodation, shares, medical insurance, etc.

The benefits would not only cover the value of any benefits to the employee but also includes benefits provided to the employee’s spouse, child, or parent; and payments to third parties for the benefit of the employee, spouse, child, or parent.

The session will cover the tax on both cash and non-cash employment benefits including corporate gifts, service awards, health benefits, COVID-19 vaccine funded by employer, medical insurance, provisions of food etc. Further key tax points in relation to terminal benefits such as recognition of retirement gratuities, monies accumulated to the credit of the employee in any funds and compensation for loss of employment will be discussed.

The session will be conducted by KPMG Director – Tax and Regulatory Rifka Ziyard and KPMG Senior Manager Director – Tax and Regulatory Sachithra Chandrasena. For registrations please contact Seneli on [email protected] or 074 061 0783.