Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 15 October 2015 00:09 - - {{hitsCtrl.values.hits}}

WASHINGTON (Reuters): The 500 largest American companies hold more than $2.1 trillion in accumulated profits offshore to avoid US taxes and would collectively owe an estimated $620 billion in US taxes if they repatriated the funds, according to a study released last week.

The study, by two left-leaning non-profit groups, found that nearly three-quarters of the firms on the Fortune 500 list of biggest American companies by gross revenue operate tax haven subsidiaries in countries like Bermuda, Ireland, Luxembourg and the Netherlands.Citizens for Tax Justice and the US Public Interest Research Group Education Fund used the companies’ own financial filings with the Securities and Exchange Commission to reach their conclusions.

Technology firm Apple was holding $181.1 billion offshore, more than any other US company, and would owe an estimated $59.2 billion in US taxes if it tried to bring the money back to the United States from its three overseas tax havens, the study said.

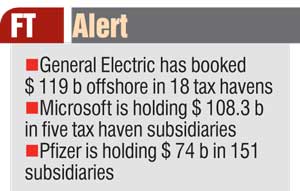

The conglomerate General Electric has booked $119 billion offshore in 18 tax havens, software firm Microsoft is holding $108.3 billion in five tax haven subsidiaries and drug company Pfizer is holding $74 billion in 151 subsidiaries, the study said.

“At least 358 companies, nearly 72% of the Fortune 500, operate subsidiaries in tax haven jurisdictions as of the end of 2014,” the study said. “All told these 358 companies maintain at least 7,622 tax haven subsidiaries.”

Fortune 500 companies hold more than $2.1 trillion in accumulated profits offshore to avoid taxes, with just 30 of the firms accounting for $1.4 trillion of that amount, or 65%, the study found.

Fifty-seven of the companies disclosed that they would expect to pay a combined $184.4 billion in additional US taxes if their profits were not held offshore. Their filings indicated they were paying about 6% in taxes overseas, compared to a 35% US corporate tax rate, it said.

“Congress can and should take strong action to prevent corporations from using offshore tax havens, which in turn would restore basic fairness to the tax system, reduce the deficit and improve the functioning of markets,” the study concluded.